Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

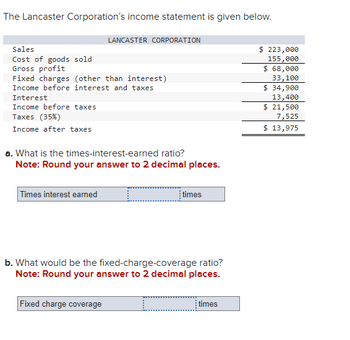

Transcribed Image Text:The Lancaster Corporation's income statement is given below.

Sales

Cost of goods sold

Gross profit

Fixed charges (other than interest)

Income before interest and taxes

Interest

Income before taxes

Taxes (35%)

Income after taxes

LANCASTER CORPORATION

a. What is the times-interest-earned ratio?

Note: Round your answer to 2 decimal places.

Times interest earned

Fixed charge coverage

times

b. What would be the fixed-charge-coverage ratio?

Note: Round your answer to 2 decimal places.

times

$ 223,000

155,000

$ 68,000

33,100

$ 34,900

13,400

$ 21,500

7,525

$ 13,975

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- please dont provide answer in image format thank youarrow_forwardsaarrow_forwardPresented below are certain account balances of Splish Products Co. Rent revenue $6,810 Sales discounts $8,080 Interest expense 13,280 Selling expenses 99,900 Beginning retained earnings 114,710 Sales revenue 404,200 Ending retained earnings 134,920 Income tax expense 26,028 Dividend revenue 71,170 Cost of goods sold 200,378 Sales returns and allowances 12,960 Administrative expenses 79,380 Allocation to noncontrolling interest 20,680 From the foregoing, compute the following: (a) total net revenue, (b) net income, (c) income attributable to controlling stockholders, if Splish has allocation to noncontrolling interest of $20,680. (a) Total net revenue $enter total net revenue in dollars (b) Net income $enter net income in dollars (c) Income attributable to controlling stockholders $enter income attributable to controlling stockholders in dollarsarrow_forward

- A firm's income statement included the following data. The firm's average tax rate was 30%. (Round each step to the nearest dollar.) Cost of goods sold Income taxes paid Administrative expenses Interest expense Depreciation a. What was the firm's net income? Net income b. What must have been the firm's revenues? Revenues c. What was EBIT? EBIT tA $ 7,600.00 11,271.00 1,900.00 2,600.00 3,200.00 LAarrow_forwardUsing the income statement for Times Mirror and Glass Co., compute the following ratios: TIMES MIRROR AND GLASS Co. Income Statement Sales Cost of goods sold Gross profit Selling and administrative expense Lease expense Operating profit* Interest expense Earnings before taxes Taxes (30%) Earnings after taxes *Equals income before interest and taxes. a.Compute the interest Interest coverage ge ratio. (Round yo times $ 223,000 130,000 $ 93,000 44,000 19,100 $ 29,900 10,600 times $ 19,300 7,720 $ 11,580 answer to 2 decimal places.) b.Compute the fixed charge coverage ratio. (Round your answer to 2 decimal places.) Fixed charge coveragearrow_forwardPlease do not give salutations in image formatarrow_forward

- Refer to the following selected financial information from Gomez Electronics. Compute the company's profit margin for Year 2. Net sales Cost of goods sold Interest expense Net income before tax Net income after tax Total assets Total liabilities Total equity Year 2 Year 1 $485,000 $427,550 277,600 251,420 11,000 12,000 68,550 53,980 47,350 41, 200 319,700 295,800 174,900 144, 800 168, 600 127, 200arrow_forwardThe Lancaster Corporation’s income statement is given below. LANCASTER CORPORATION Sales $ 265,000 Cost of goods sold 137,000 Gross profit $ 128,000 Fixed charges (other than interest) 25,100 Income before interest and taxes $ 102,900 Interest 19,100 Income before taxes $ 83,800 Taxes (35%) 29,330 Income after taxes $ 54,470 a. What is the times-interest-earned ratio? (Round your answer to 2 decimal places.)arrow_forwardWebby Corporation reported the following amounts on its income statement: service revenues, S32,500; utilities expense, $300; net income, $1,600; and income tax expense, $900. If the only other amount reported on the income statement was for selling expenses, what amount would it be? a. $2,200 c. $30,000 b. $29,700 d. $30,900arrow_forward

- Please help. Thanksarrow_forwardIncome statements for Fanning Company for Year 3 and Year 4 follow. FANNING COMPANY Income Statements. Sales Cost of goods sold. Selling expenses Administrative expenses. Interest expense Total expenses Income before taxes Income taxes expense Net income Year 4 $200,200 143,800 20,500 12,500 3,500 $180, 300 19,900 5,900 $14,000 Year 3 $180, 200 121,800 18,500 14,500 5,500 $160,300 19,900 3,100 $16,800 Required a. Perform a horizontal analysis, showing the percentage change in each income statement component between Year 3 and Year 4. b. Perform a vertical analysis, showing each income statement component as a percentage of sales for each year.arrow_forwardcompute net sales, gross profit, and the gross profit ratio for each of the four seperate companies. Round gross margin ratio to one decimal place. carrier lennox trane york sales 150000 550000 38700 255700 sales discounts 5000 17500 600 4800 sales returns and allowances 20000 6000 5100 900 cost of goods sold 79750 329589 24453 126500arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education