Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

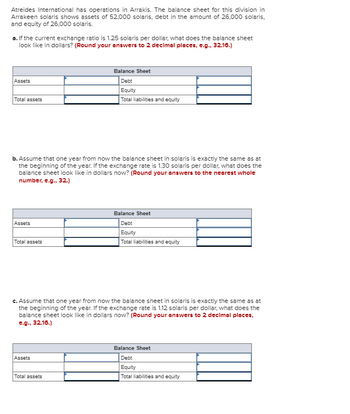

Transcribed Image Text:Atreides International has operations in Arrakis. The balance sheet for this division in

Arrakeen solaris shows assets of 52,000 solaris, debt in the amount of 26,000 solaris.

and equity of 26,000 solaris.

a. If the current exchange ratio is 1.25 solaris per dollar, what does the balance sheet

look like in dollars? (Round your answers to 2 decimal places, e.g., 32.16.)

Assets

Total assets

b. Assume that one year from now the balance sheet in solaris is exactly the same as at

the beginning of the year. If the exchange rate is 1.30 solaris per dollar, what does the

balance sheet look like in dollars now? (Round your answers to the nearest whole

number, e.g., 32.)

Assets

Total assets

Balance Sheet

Debt

Equity

Total liabilities and equity

Assets

c. Assume that one year from now the balance sheet in solaris is exactly the same as at

the beginning of the year. If the exchange rate is 1.12 solaris per dollar, what does the

balance sheet look like in dollars now? (Round your answers to 2 decimal places,

e.g., 32.16.)

Total assets

Balance Sheet

Debt

Equity

Total liabilities and equity

Balance Sheet

Debt

Equity

Total liabilities and equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 6. 131 3) Northern Industries accepted a credit card sale for $14,000. The credit card company charges 2%. a. What is the entry for this transaction on the horizontal equation? b. What is the impact of collecting the payment from the credit card company? (Show the individual accounts impacted in the asset section) Assets Liabilities Stockholders' Equity Revenues Expenses Net Income Cash %3D Flow a. b. 4) Here are the inventory purchases and sales for Fraser Company: Inventory Layers Available for Sale: October 1 Beginning Inventory 14 @ $16 $224 9. Study guide - Chapter 5 (with solutions).docx 19 f12 Oly prt sc 114arrow_forwardWant to give you a correct answerarrow_forwardHere is some financial statement data for Nestlé (in millions of Swiss francs): After reviewing the information, calculate the following ratios for Nestlé for 2021:1) Inventory turnover2) Profit margin3) Return on assets4) Free cash flowRound all answers to two decimal places. Do not include dollar signs because Nestlé's accounting information is in Swiss francs. Show the calculations for each answer.arrow_forward

- These are the quotes from the spot market. Citigroup Credit Suisse Deutsche Bank ¥122/€ ¥126/$ $0.99/€ If you have $1,000,000 to arbitrage, your profit is $_____________ (Please keep at least two decimal places.)arrow_forward1. A company, extends credit to its customers. Total Sales is 2 Million, credit Sales is 850,000, Sales Return is 305,000, with percent of uncollectibility set at 4% What is the journal entry under percentage of net credit sales?arrow_forwardAce Industries has current assets equal to $4 million. The company's current ratio is 2.0, and its quick ratio is 1.7. What is the firm's level of current liabilities? What is the firm's level of inventories? Do not round intermediate calculations. Round your answers to the nearest dollar. Current Liabilities $ Inventory $arrow_forward

- Rhea Company has P9,000 in cash, P11,000 in marketable securities, P26,000 in current receivables, P34,000 in inventories, and P40,000 in current liabilities. The Rhea's quick ratio is closest to * Choices: 1.35. 1.15. 1.73. 2.00.arrow_forwardA company has current assets of $92,000 (of which $37,000 is inventory and prepaid items) and current liabilities of $37,000. What is the current ratio? What is the acid-test ratio? If the company borrows $17,000 cash from a bank on a 120-day loan, what will its current ratio be? What will the acid-test ratio be? Current Ratio enter the ratio rounded to 2 decimal places :1 Acid Test Ratio enter the ratio rounded to 2 decimal places :1 New Current Ratio enter the ratio rounded to 2 decimal places :1 New Acid Test Ratio enter the ratio rounded to 2 decimal places :1arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education