Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Hi teacher please help me this question

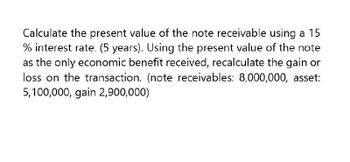

Transcribed Image Text:Calculate the present value of the note receivable using a 15

% interest rate. (5 years). Using the present value of the note

as the only economic benefit received, recalculate the gain or

loss on the transaction. (note receivables: 8,000,000, asset:

5,100,000, gain 2,900,000)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What's the answer?arrow_forwardClassify the financial problem. Assume a 4% interest rate compounded annually. Find the value of a $1,000 certificate in 6 years. A. amortizationB.ordinary annuity C.present valueD. sinking fundE.future value Answer the question. (Round your answer to the nearest cent.)arrow_forwardFind the future value of the following ordinary annuities. Payments are made and interest is compounded as given. R = $9000, 5% interest compounded annually for 15 years What is the future value of the ordinary annuity? $ (Round to the nearest cent.)arrow_forward

- 1. Let's assume that a loan of $100,000 with an annual interest rate of 6% over 30 years pays monthly payments of $500. a. Calculate the accumulation rate b. Calculate the payment rate . c. Answer : How will the balance of the principal be at the end of the loan in relation to the original amount of the loan? Less, equal or greater? Provide calculations.arrow_forwardFind the payment that should be used for the annuity due whose future value is given. Assume that the compounding period is the same as the payment period. $168, 000; monthly payments for 5 years; interest rate 3% .arrow_forwardDetermine the present value of a $3,500 perpetuity if the interest rate is 7%. If interest rates were to double to 14%, calculate the present value.arrow_forward

- Find the future value of an annuity due with an annual payment of $14,000 for three years at 4% annual interest using the simple interest formula. How much was invested? How much interest was earned? What is the future value of the annuity? $ (Round to the nearest cent as needed.) How much was invested? S How much interest was earned? S (Round to the nearest cent as needed.) ←arrow_forwardThe following loan is a simple interest amortized loan with monthly payments. $155000, 9 1/2%, 30 years(a) Find the monthly payment. (Give your answer to the nearest cent.)Payment $ (b) Find the total interest for the given simple interest amortized loan. (Give your answer to the nearest cent.)Total interest $arrow_forwardThe following loan is a simple interest amortized loan with monthly payments. $5000, 7 1/2%, 4 years (a) Find the monthly payment. (Give your answer to the nearest cent.)Payment $ (b) Find the total interest for the given simple interest amortized loan. (Give your answer to the nearest cent.)Total interest $arrow_forward

- Classify the financial problem. Assume a 9% interest rate compounded annually. Deposit $200 at the end of each year. What is the total in the account in 10 years? A. sinking fundB.present value C.amortizationD. ordinary annuityE. future value Answer the question. (Round your answer to the nearest cent.)arrow_forwardCalculate the future value of $4,000 in 5 years at an interest rate of 6% per year. (Round to the nearestdollar.) 10 years at an interest rate of 6% per year. (Round to the nearestdollar.) 5 years at an interest rate of 12% per year. (Round to the nearestdollar.) Why is the amount of interest earned in part (a) less than half the amount of interest earned in part (b)?(Round to the nearestdollar.)arrow_forwardFind the future value of the following ordinary annuities. Payments are made and interest is compounded as given. R = $4000, 7% interest compounded annually for 5 What is the future value of the ordinary annuity? $ (Round to the nearest cent.) yearsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you