Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

General Account

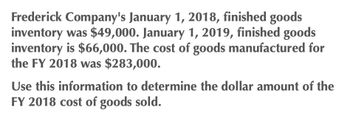

Transcribed Image Text:Frederick Company's January 1, 2018, finished goods

inventory was $49,000. January 1, 2019, finished goods

inventory is $66,000. The cost of goods manufactured for

the FY 2018 was $283,000.

Use this information to determine the dollar amount of the

FY 2018 cost of goods sold.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Brambie Corp. has 240000 of ending finished goods inventory as of December 31, 2019. If beginning finished goods inventory was 18000 and costs of goods sold was 53000, how much would Brambie report for cost of goods manufactured?arrow_forwardCost of goods manufactured equals $95000 for 2019. Finished goods inventory is $3000 at the beginning of the year and $4500 at the end of the year. Beginning and ending work in process for 2019 are $4000 and $5000, respectively. How much is cost of goods sold for the year? $96500 $93500 $95500 $92000arrow_forwardProvide correct answer for this accounting questionarrow_forward

- Need help with this questionarrow_forwardSwifty Corporation has $18000 of ending finished goods inventory as of December 31, 2019. If beginning finished goods inventory was $13000 and cost of goods sold was $50000, how much would Swifty report for cost of goods manufactured? $13000 $55000 $45000 $68000arrow_forwardWhat is the amount of the cost of goods sold in 2019?arrow_forward

- Accountingarrow_forwardDuring FY 2018 Bay Manufacturing had total manufacturing costs are $442,000. Their cost of goods manufactured for the year was $475,000. The January 1, 2019 balance of the Work-in-Process Inventory is $51,000. Use this information to give an example of the dollar amount of the FY 2018 beginning Work-in-Process Inventory.arrow_forward.arrow_forward

- During fy 2018 bay mun...accounting questionarrow_forwardDuring FY 2022 Munjya Manufacturing had total manufacturing costs are $408,000. Their cost of goods manufactured for the year was $431,000. The January 1, 2023 balance of the Work-in-Process Inventory is $42,000. Use this information to determine the dollar amount of the FY 2022 beginning Work-in-Process Inventory.arrow_forwardIn 2021, the BowWow Company purchased 17,970 units from its supplier at a cost of $10.00 per unit. BowWow sold 16,230 units of its product in 2021 at a price of $20.00 per unit. BowWow began 2021 with $995,910 in inventory (inventory is carried at a cost of $10.00 per unit). Using this information, compute BowWow's gross profit for 2021. Record your answer rounded to the nearest dollar. Do not include a dollar sign or commas in your answer. For example, record $1,234,567.89 as 1234568. Your Answer:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning