FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Need help with this general accounting question?

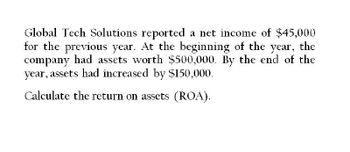

Transcribed Image Text:Global Tech Solutions reported a net income of $45,000

for the previous year. At the beginning of the year, the

company had assets worth $500,000. By the end of the

year, assets had increased by $150,000.

Calculate the return on assets (ROA).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Flitter reported net income of $23,500 for the past year. At the beginning of the year the company had $212,000 in assets and $62,000 in liabilities. By year end, assets had increased to $312,000 and liabilities were $87,000. Calculate its return on assets: Multiple Choice 11.1%. 9.0%. 7.5%. 35.7%. 26.0%.arrow_forwardThe balance sheet of Hidden Valley Farms reports total assets of $900,000 and $1,010,000 at the beginning and end of the year, respectively. The return on assets for the year is 10%. What is Hidden Valley's net income for the year? Multiple Choice $10,100,000. $9,550,000. $95,500. $101,000.arrow_forwardWhat is summits net income for the year?arrow_forward

- Calculatearrow_forwardSwiss Group reports net income of $27,000 for the year. At the beginning of the year, Swiss Group had $149,000 in assets. By the end of the year, assets had grown to $199,000. What is Swiss Group's return on assets for the current year? Did Swiss Group perform better or worse than its competitors if competitors average an 11% return on assets? Complete this question by entering your answers in the tabs below. Return on Assets Group Perform What is Swiss Group's return on assets for the current year? Numerator: Denominator: = Return on assetsarrow_forwardSwiss Group reports net income of $35,000 for the year. At the beginning of the year, Swiss Group had $186,000 in assets. By the end of the year, assets had grown to $236,000. What is Swiss Group's return on assets for the current year? Did Swiss Group perform better or worse than its competitors if competitors average an 12% return on assets? Complete this question by entering your answers in the tabs below. Return on Assets Group Perform Did Swiss Group perform better or worse than its competitors if competitors average an 12% return on assets? Did Swiss Group perform better or worse than its competitors if competitors average an 12% return on assets?arrow_forward

- Peyton's Palace has net income of $13.4 million on sales revenue of $114 million. Total assets were $80 million at the beginning of the year and $88 million at the end of the year. Calculate Peyton's return on assets, profit margin, and asset turnover ratios. (Enter your answers in millions. (i.e., $5,500,000 should be entered as 5.5).) Return on Assets Numerator/Denominator Amounts Peyton's Palace % Profit Margin Numerator/Denominator Amounts Peyton's Palace % Asset Turnover Numerator/Denominator Amounts Peyton's Palace timesarrow_forwardABC industries had the following operating results for last year: sales = $28,900; cost of goods sold = $24,600; depreciation expense = $1,700; interest expense = $1,400; dividends paid = $1,000. At the beginning of the year, net fixed assets were $14,300, current assets were $8,700, and current liabilities were $6,600. At the end of the year, net fixed assets were $23,900, current assets were $9,200, and current liabilities were $7,400. The tax rate for last year was 34 percent. Assume there is no short term investments and notes payable. What was the free cash flow for last year? $7584 $2610 O- $7584 - $2610arrow_forwardFinancial accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education