Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

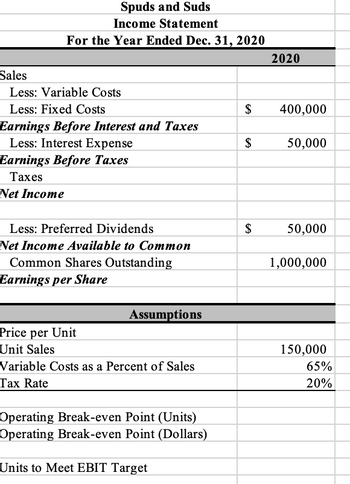

Please see this empty income statement from Spuds and Suds for FY 2020. Calculate the degree of financial leverage if price per units is 15.00. Please give your answer rounded to two decimal places. Your Answer:

Transcribed Image Text:Spuds and Suds

Income Statement

For the Year Ended Dec. 31, 2020

Sales

Less: Variable Costs

Less: Fixed Costs

Earnings Before Interest and Taxes

Less: Interest Expense

Earnings Before Taxes

Taxes

2020

GA

$

400,000

GA

$

50,000

Net Income

Less: Preferred Dividends

$

50,000

Net Income Available to Common

Common Shares Outstanding

1,000,000

Earnings per Share

Assumptions

Price per Unit

Unit Sales

Variable Costs as a Percent of Sales

Tax Rate

Operating Break-even Point (Units)

Operating Break-even Point (Dollars)

Units to Meet EBIT Target

150,000

65%

20%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Introduction to the Degree of financial leverage

VIEW Step 2: Finding the sales, variable cost, EBIT, Earnings before tax, Taxes, and Net income

VIEW Step 3: Finding the net income available to common shareholders and EPS

VIEW Step 4: Finding the degree of financial leverage

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Financial statements Net operating revenues Operating expenses Operating income Non-operating items: Interest expense Other Net income Total assets Total shareholders' equity S 2020 33.8 28.9 4.9 (1.2) (0.6) 3.1 $ $ 200.0 78.0 - Xarrow_forwardConsider the following data (be careful there might be some "unnecessary" information). EBIT = 176 Interest expense = 10 Tax rate = 30% Depreciation = 38 Net working capital = 30 Increase in net working capital = 10 Beginning of period Net PP&E = 50 Capex = 16 What is the free cash flow of the firm that year?arrow_forwardThe financial statements of Eagle Sport Supply are shown in the table below. For simplicity, "Costs" include interest. Assume that Eagle's assets are proportional to its sales. Assume a growth rate of 30% in revenue, expenses, and assets in 2023. The tax rate will remain constant. Income Statement Sales Costs $ 4,550 2,050 Pretax income Taxes (at 30.0%) $ 2,500 750 Net income $ 1,750 Balance Sheet, Year-End 2022 Net assets $ 6,600 2021 $ 6,300 Total $ 6,600 $ 6,300 Debt Equity Total 2022 $ 2,800 3,800 2021 $ 2,700 3,600 $ 6,600 $ 6,300 a. Assume that the dividend payout ratio is fixed at 60% and the equity-to-asset ratio is fixed at two-thirds. What is the internal growth rate for 2023? b. What is the sustainable growth rate for 2023? Note: For all requirements, do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. a. Internal growth rate b. Sustainable growth rate % %arrow_forward

- Can you please see attached and help me solve for part one and part two using the income statements and balance sheets. Looking to calculate the following risk ratios for 2024 and 2025 (assuming all sales were on accounr) as well as calcuate the following profitibility ratios for 2024 and 2025arrow_forwardIf a company's sales are $650,000 in 2021, and this represents an 5% increase over sales in 2020, what were sales in 2020? (Round your answer to the nearest dollar amount.) Salesarrow_forwardSuppose a firm has had the historical sales figures shown as follows. What would be the forecast for next year's sales using the average approach? Year 2017 2018 Sales $ 750,000 500,000 Multiple Choice O $695,000 $700,000 $750,000 $775.000 2019 $ 700,000 2020 $ 750,000 2021 $ 775,000arrow_forward

- Net Income for Company A is $200,000 in 2014, $300,000 in 2015, $400,000 in 2016, $500,000 in 2017, and $600,000 in 2018. The expected growth for all years after 2018 is 5%, the 90-Day T-Bill Rate is 20%, and the appropriate percentage above risk-free rate is 12%. Using this information, what is the reasonable value for Company A based on its future income stream for 2014 to 2018? A. 1,394,267.03 B. 4,394,267.03 A or B?arrow_forward1. Given the most recent financial statements for FY2023. Sales for FY2024 are expected to grow by 10 percent. The following assumption must be held in the pro forma financial statements. The tax rate (percentage), the interest expense ($ amount), and the dividend payout ratio (percentage) will remain constant. COGS, SGA, Depreciation, all current asset accounts, Net PPE, intangibles, other assets, and accounts payable increase spontaneously with sales. Calculate the pro forma value for total assets for FY24 if the firm operates at full capacity and no new debt or equity is issued. (Enter percentages as decimals and round to 4 decimals) 2. Given the most recent financial statements for FY2023. Sales for FY2024 are expected to grow by 10 percent. The following assumption must be held in the pro forma financial statements. The tax rate (percentage), the interest expense ($ amount), and the dividend payout ratio (percentage) will remain constant. COGS, SGA, Depreciation, all…arrow_forwardIs the company growing? Explain. Be sure to include the percentages you got Millions of US $ $-94 $-38 $-36 $52 $-28 $-33 $-28 Annual Net Income 2022 2021 2020 2019 2018 2017 2016 To calculate growth versus prior years, use this formula: (this year's number minus last year's number)/Last year's number). This will give you the percentage change from the previous year. • • From 2016 to 2017: ((-$33 million)-(-$28 million))/(-$28 million)) *100= 17.86% • From 2017 to 2018: ((-$28 million)-(-$33 million))/(-$33 million) *100= -15.15% From 2018 to 2019: (($52 million)-(-$28 million))/(-$28 million) *100= -285.71% From 2019 to 2020: ((-$36 million)-($52 million))/ ($52 million) *100= -169.23% ● From 2020 to 2021: ((-$38 million)-(-$36 million))/(-$36 million) *100= 5.56% From 2021 to 2022: ((-$94 million)-(-$38 million)/(-$38 million) *100= 147.36% • ●arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education