Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Financial Account

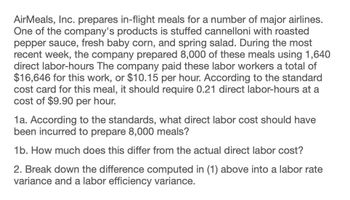

Transcribed Image Text:AirMeals, Inc. prepares in-flight meals for a number of major airlines.

One of the company's products is stuffed cannelloni with roasted

pepper sauce, fresh baby corn, and spring salad. During the most

recent week, the company prepared 8,000 of these meals using 1,640

direct labor-hours The company paid these labor workers a total of

$16,646 for this work, or $10.15 per hour. According to the standard

cost card for this meal, it should require 0.21 direct labor-hours at a

cost of $9.90 per hour.

1a. According to the standards, what direct labor cost should have

been incurred to prepare 8,000 meals?

1b. How much does this differ from the actual direct labor cost?

2. Break down the difference computed in (1) above into a labor rate

variance and a labor efficiency variance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- AirMeals, Inc. prepares in-flight meals for a number of major airlines. One of the company's products is stuffed cannelloni with roasted pepper sauce, fresh baby corn, and spring salad. During the most recent week, the company prepared 8,000 of these meals using 1,640 direct labor-hours The company paid these labor workers a total of $16,646 for this work, or $10.15 per hour. According to the standard cost card for this meal, it should require 0.21 direct labor-hours at a cost of $9.90 per hour. 1a. According to the standards, what direct labor cost should have been incurred to prepare 8,000 meals? 1b. How much does this differ from the actual direct labor cost? 2. Break down the difference computed in (1) above into a labor rate variance and a labor efficiency variance.arrow_forwardCheesy Mitch, Inc., prepares in-flight meals for a number of major airlines. One of the company's products is stuff cannelloni with roasted pepper sauce, fresh baby corn, and spring salad. During the most recent week, the company prepared 6,000 of these meals using 1,150 direct labor-hours. The company paid these direct labor workers a total of PI1,500 for this work, or PI0 per hour. According to the standard cost card for this meal, it should require 0.20 direct Tabor-hours at a cost of P9.50 per hour. Required: 1. What direct labor cost should have been incurred to prepare 6.000 meals? How much does this differ from the actual direct labor cost? 2. Break down the difference computed in (1) above into a labor rate variance and a labor efficiency variance.arrow_forwardSkyChefs, Incorporated, prepares in-flight meals for a number of major airlines. One of the company’s products is grilled salmon in dill sauce with baby new potatoes and spring vegetables. During the most recent week, the company prepared 4,000 of these meals using 750 direct labor-hours. The company paid its direct labor workers a total of $6,000 for this work, or $8.00 per hour. According to the standard cost card for this meal, it should require 0.20 direct labor-hours at a cost of $7.00 per hour. Required: 1. What is the standard labor-hours allowed (SH) to prepare 4,000 meals? 2. What is the standard labor cost allowed (SH × SR) to prepare 4,000 meals? 3. What is the labor spending variance? 4. What is the labor rate variance and the labor efficiency variance? (For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round…arrow_forward

- SkyChefs, Inc., prepares in-flight meals for a number of major airlines. One of the company's products is grilled salmon in dill sauce with baby new potatoes and spring vegetables. During the most recent week, the company prepared 5,100 of these meals using 2,000 direct labor-hours. The company paid these direct labor workers a total of $28,000 for this work, or $14.00 per hour. According to the standard cost card for this meal, it should require 0.40 direct labor- hours at a cost of $13.50 per hour. Required: 1. According to the standards, what direct labor cost should have been incurred to prepare 5,100 meals? How much does this differ from the actual direct labor cost? (Round labor-hours per meal and labor cost per hour to 2 decimal places.) Number of meals prepared Standard direct labor-hours per meal Total direct labor-hours allowed Standard direct labor cost per hour Total standard direct labor cost Actual cost incurred Total standard direct labor cost Total direct labor variance…arrow_forwardSkyInc provides in-flight meals for a number of major airlines. One of the company’s products is stuffed cannelloni with roasted pepper sauce, fresh baby corn, and spring salad. During the most recent week, the company made 6,000 of these meals, actually using 1,150 direct labour-hours. The company actually paid these direct labour workers a total of $11,500 for this work, or $10 per hour. According to the standard cost card for this meal, it should require 0.20 direct labour hours at a cost of $9.50 per hour. Required: 1. Break down the difference computed in (1) above into a labour rate variance and a labour efficiency variance. Part 1 AH x AR AH x SR SH x SR…arrow_forwardSkyChefs, Incorporated, prepares in-flight meals for a number of major airlines. One of the company's products is grilled salmon with new potatoes and mixed vegetables. During the most recent week, the company prepared 4,400 of these meals using 1,700 direct labor-hours. The company paid its direct labor workers a total of $17,000 for this work, or $10.00 per hour. According to the standard cost card for this meal, it should require 0.40 direct labor-hours at a cost of $9.40 per hour. Required: 1. What is the standard labor-hours allowed (SH) to prepare 4,400 meals? 2. What is the standard labor cost allowed (SH x SR) to prepare 4,400 meals? 3. What is the labor spending variance? 4. What is the labor rate variance and the labor efficiency variance? Note: For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Answer is not complete. 1.…arrow_forward

- SkyChefs, Inc., prepares in-flight meals for a number of major airlines. One of the company's products is grilled salmon in dill sauce with baby new potatoes and spring vegetables. During the most recent week, the company prepared 4,000 of these meals using 750 direct labor-hours. The company paid its direct labor workers a total of $6,000 for this work, or $8.00 per hour. According to the standard cost card for this meal, it should require 0.20 direct labor-hours at a cost of $7.00 per hour. Required: 1. What is the standard labor-hours allowed (SH) to prepare 4,000 meals? 2. What is the standard labor cost allowed (SH × SR) to prepare 4,000 meals? 3. What is the labor spending variance? 4. What is the labor rate variance and the labor efficiency variance? (For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do no round intermediate…arrow_forwardDhapaarrow_forwardSkyChefs, Inc., prepares in-flight meals for a number of major airlines. One of the company’s products is grilled salmon in dill sauce with baby new potatoes and spring vegetables. During the most recent week, the company prepared 5,100 of these meals using 2,000 direct labor-hours. The company paid its direct labor workers a total of $28,000 for this work, or $14.00 per hour. According to the standard cost card for this meal, it should require 0.40 direct labor-hours at a cost of $13.50 per hour. Required: 1. What is the standard labor-hours allowed (SH) to prepare 5,100 meals? 2. What is the standard labor cost allowed (SH × SR) to prepare 5,100 meals? 3. What is the labor spending variance? 4. What is the labor rate variance and the labor efficiency variance? (For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round…arrow_forward

- SkyChefs, Incorporated, prepares in-flight meals for a number of major airlines. One of the company’s products is grilled salmon with new potatoes and mixed vegetables. During the most recent week, the company prepared 5,100 of these meals using 2,000 direct labor-hours. The company paid its direct labor workers a total of $28,000 for this work, or $14.00 per hour. According to the standard cost card for this meal, it should require 0.40 direct labor-hours at a cost of $13.50 per hour. Required: 1. What is the standard labor-hours allowed (SH) to prepare 5,100 meals? 2. What is the standard labor cost allowed (SH × SR) to prepare 5,100 meals? 3. What is the labor spending variance? 4. What is the labor rate variance and the labor efficiency variance? (For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.)arrow_forwardSkyChefs, Incorporated, prepares in-flight meals for a number of major airlines. One of the company's products is grilled salmon in dill sauce with baby new potatoes and spring vegetables. During the most recent week, the company prepared 3,500 of these meals using 950 direct labor-hours. The company paid its direct labor workers a total of $10,450 for this work, or $11.00 per hour. According to the standard cost card for this meal, it should require 0.30 direct labor-hours at a cost of $9.50 per hour. Required: 1. What is the standard labor-hours allowed (SH) to prepare 3,500 meals? 2. What is the standard labor cost allowed (SHSR) to prepare 3,500 meals? 3. What is the labor spending variance? 4. What is the labor rate variance and the labor efficiency variance? (For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round…arrow_forwardMunabhaiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning