FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

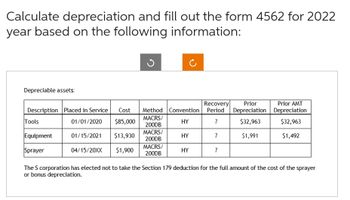

Transcribed Image Text:Calculate depreciation and fill out the form 4562 for 2022

year based on the following information:

Depreciable assets:

Recovery Prior

Description Placed in Service Cost Method Convention Period Depreciation

$32,963

MACRS/

01/01/2020 $85,000

HY

7

200DB

01/15/2021

$13,930

HY

7

$1,991

04/15/20XX $1,900

7

Tools

Equipment

Sprayer

MACRS/

200DB

MACRS/

200DB

HY

Prior AMT

Depreciation

$32,963

$1,492

The S corporation has elected not to take the Section 179 deduction for the full amount of the cost of the sprayer

or bonus depreciation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At December 31, 2019, certain accounts included in the property, plant, and equipment section of Concord Corporation’s statement of financial position had the following balances: Land $309,520 Buildings—Structure 882,660 Leasehold Improvements 704,970 Equipment 844,620 During 2020, the following transactions occurred: 1. Land site No. 621 was acquired for $799,820 plus a fee of $6,880 to the real estate agent for finding the property. Costs of $33,270 were incurred to clear the land. In clearing the land, topsoil and gravel were recovered and sold for $10,720. 2. Land site No. 622, which had a building on it, was acquired for $559,550. The closing statement indicated that the land’s assessed tax value was $308,860 and the building’s value was $101,820. Shortly after acquisition, the building was demolished at a cost of $27,990. A new building was constructed for $339,860 plus the following costs: Excavation fees $37,550 Architectural design fees…arrow_forwardA company purchased equipment for $70,000 on January 1, 2022. The equipmtment is expected to have a five-year service life, with a residiual value of $15,000 at the end of five years. Using the straight line method, depreciation expense for 2023 and the book value at December 31, 2023 would be: $______ and $__________arrow_forwardSheridan Company purchased a new plant asset on April 1, 2025, at a cost of $732,000. It was estimated to have a service life of 20 years and a salvage value of $60,000. Sheridan' accounting period is the calendar year.arrow_forward

- Based upon the provided information, how would I be able to calculate the Amortization of prior service costs and expected return on the plan assets? Additionally, would you be able to please help me understand what formula to use in these two calculations and why you use those. Thank you!arrow_forwardPrepare the entry, if necessary, to adjust the account balances because of the revision of the estimated life in 2027.arrow_forwardPlease help solvearrow_forward

- How do you prepare the depreciation for the year 2026?arrow_forwardUse the following information to answer the next two questions. Franco Company uses IFRS and owns property, plant and equipment with a historical cost of 5,000,000 euros. At December 31, 2019, the company reported a valuation reserve of 8,565,000 euros. At December 31, 2020, the property, plant and equipment was appraised at 5,525,000 euros. 18) The property, plant and equipment will be reported on the December 31, 2020 statement of financial position at a) 5,000,000 euros. b) 5,525,000 euros. c) 8,565,000 euros. d) 9,090,000 euros 19) The valuation reserve at December 31, 2020 will be reported at a) 8,040,000 euros on the Statement of Stockholders' Equity. b) 8,565,000 euros in the Assets section of the Statement of Financial Position c) 9,090,000 euros in the equity section of the Statement of Financial Position. d) 525,000 euros on the Income Statement.arrow_forwardssarrow_forward

- On June 1, 2022, Sun Construction began construction of a new building for its use. The building was finished and ready for use on May 31, 2024. Expenditures for the construction were as follows: Cost of land paid in June 1, 2022 $1,800,000 September 1/2022 600,000 December 31, 2022 800,000 march 31, 2023 395,000 May 31,2023 375,000 November 1,2023 562,500 January 31,2024 37,806 May 31, 2024 567983 Sun Construction borrowed $700,000 on a construction loan at 5% interest on June 1,2022 This loan was outstanding during the construction period. The company also had the following outstanding loan during the period: $7,000,000, 7. % bonds $5,000,000, 4% mortgage. Required 1-Compute the amount of capitalize interest, if any from first day of the project until its ready to use? 2-Journalize the entries in May 31/2024 and calculate the building total cost. 3- Journalize the depreciation in 31/12/2024 assuming the company use straight line method for depreciation with 50 years' useful life and…arrow_forwardProvide Correct answer with calculationarrow_forwardOn May 1, 2020, Vaughn Manufacturing began construction of a building. Expenditures of $620400 were incurred monthly for 5 months beginning on May 1. The building was completed and ready for occupancy on September 1, 2020. For the purpose of determining the amount of interest cost to be capitalized, the weighted-average accumulated expenditures on the building during 2020 were O $2481600. O $3102000. O $517000. O $620400.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education