Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:C

商

Home - My AUM

X

View Assessment

x +

tab

bblearn.aum.edu/ultra/courses/_56163_1/grades/assessment/_4006157_1/overview/attempt/_7286589_1?cou

236 minutes remaining

2 OF 2 QUESTIONS REMAINING

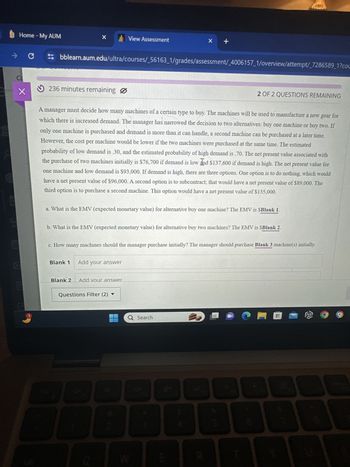

A manager must decide how many machines of a certain type to buy. The machines will be used to manufacture a new gear for

which there is increased demand. The manager has narrowed the decision to two alternatives: buy one machine or buy two. If

only one machine is purchased and demand is more than it can handle, a second machine can be purchased at a later time.

However, the cost per machine would be lower if the two machines were purchased at the same time. The estimated

probability of low demand is .30, and the estimated probability of high demand is .70. The net present value associated with

the purchase of two machines initially is $76,700 if demand is low and $137,600 if demand is high. The net present value for

one machine and low demand is $93,000. If demand is high, there are three options. One option is to do nothing, which would

have a net present value of $96,000. A second option is to subcontract; that would have a net present value of $89,000. The

third option is to purchase a second machine. This option would have a net present value of $135,000.

a. What is the EMV (expected monetary value) for alternative buy one machine? The EMV is $Blank 1.

b. What is the EMV (expected monetary value) for alternative buy two machines? The EMV is $Blank 2.

c. How many machines should the manager purchase initially? The manager should purchase Blank 3 machine(s) initially.

Blank 1 Add your answer

Blank 2 Add vour answer

Questions Filter (2) ▼

Q Search

FO

ESC

F3

W

3

R

16

E

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- LO 2, 4, 5 2-41 Designing a Balanced Scorecard, new strategies, customer measures to the In Practice description of Infosys on page 24. Refer Required (a) Why would a company with Infosys's history find the Balanced Scorecard important forca managing its growth and monitoring its performance? (b) What customer measures would you recommend that Infosys use in its Balanced Scorecard? (c) What employee measures would you recommend that Infosys use in its Balanced Scorecard?arrow_forwardPart e & f is incorrect e.)Ls=3.125+0.75=3.875 ships f.) Lq=(6^2(1/6)^2+0.75^2)/2(1-.75)=3.125 ships g.)Ws=3.875/6=0.6458 days or 15.5 hoursarrow_forwardtyping clear no chatgpt used i will give 5 upvotesarrow_forward

- 3.) Compile a hypothetical list of stakeholders’ needs. Stakeholder Wants (“Whats”) System Attributes (“Hows”)arrow_forwardHYPERCASE Questions 3. Write a short questionnaire to follow up on some aspects of the merger between Management Systems and the Training Unit at MRE that are still puzzling you. Be sure to observe all the guidelines for good questionnaire design. 4. Redesign the questionnaire you wrote in Question 3 so that it can be used as a Web surveyarrow_forwardN5arrow_forward

- 17-6 Hiring The HR department is trying to fill a vacant position for a job with a small talent pool. Valid applications arrive every week or so, and the appicants all seem to bring differnt levels of expertise. For each applicant, the HR manager gathers information by trying to verify various claims on resumes, but some doubt about fit always lingers when a decisions to hire or not is to be made. What are the type I and II decision error cost? Which decision error is more likely to be discovered by the CEO? How does this affect the HR manager's hiring decisions?arrow_forward17:49 < Vo) 4G Voi) 34% Summative Activity 3: Research - Written Assignment After the initial training, the learner will be required to complete this activity to provide evidence of his/her competency on the applicable unit. Assessment Task 1 You are required to: 115830 SO 3, AC1-AC4 SO 4, AC1, AC4, ACS Integrated EEK'S Integrated CCFO's Research the assistance and benefits SABPP offers as a professional body to those within the scope of SABPP in terms of personal and professional development. Write a thesis about your findings regarding SABPP in terms of providing a competency framework for professionals working within people practices. Assessment Environment: The thesis should be between 2000-3000 words and must be supported with a Bibliography and supporting documentation. Your assessments should include the following: 1. Thesis (Unit Standard 115830, 503-504) a) b) Maintain capability in own elective/specialist area. (503, AC1 - AC4) A professional action plan is produced which…arrow_forwardAn electrical contractor's records during the last five weeks indicate the number of job requests: Week: Requests: 1 2 3 25 27 25 4 26 57 27arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.