Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

![Problem 16-3 ROE and Leverage [LO1, 2]

Fujita, Incorporated, has no debt outstanding and a total market value of $356,900.

Earnings before Interest and taxes, EBIT, are projected to be $50,000 if economic

conditions are normal. If there is strong expansion in the economy, then EBIT will be 16

percent higher. If there is a recession, then EBIT will be 25 percent lower. The

company is considering a $180,000 debt Issue with an interest rate of 5 percent. The

proceeds will be used to repurchase shares of stock. There are currently 8,300 shares

outstanding. Ignore taxes for questions (a) and (b). Assume the company has a market-

to-book ratio of 1.0 and the stock price remains constant.

a-1. Calculate return on equity (ROE) under each of the three economic scenarios before

any debt is issued. (Do not round Intermediate calculations and enter your

answers as a percent rounded to 2 decimal places, e.g., 32.16.)

a-2. Calculate the percentage changes in ROE when the economy expands or enters a

recession. (A negative answer should be indicated by a minus sign. Do not round

Intermediate calculations and enter your answers as a percent rounded to 2

decimal places, e.g., 32.16.)

b-1. Assume the firm goes through with the proposed recapitalization. Calculate the

return on equity (ROE) under each of the three economic scenarios. (Do not round

Intermediate calculations and enter your answers as a percent rounded to 2

decimal places, e.g., 32.16.)

b-2. Assume the firm goes through with the proposed recapitalization. Calculate the

percentage changes in ROE when the economy expands or enters a recession. (A

negative answer should be indicated by a minus sign. Do not round Intermediate

calculations and enter your answers as a percent rounded to 2 decimal places,

e.g., 32.16.)

a-1. Recession ROE

a-1. Normal ROE

Answer is complete and correct.

a-1. Expansion ROE

a-2. Recession percentage change in ROE

a-2. Expansion percentage change in ROE

b-1. Recession ROE

b-1. Normal ROE

b-1. Expansion ROE

b-2. Recession percentage change in ROE

b-2. Expansion percentage change in ROE

%

10.51

14.01 %

16.25

%

-25.00

%

16.00

%

16.11 %

23.18✔ %

27.70 %

-30.49

%

19.51

%](https://content.bartleby.com/qna-images/question/5fa70c8e-c2c0-4088-8b85-2c424d967865/abd1baa7-9762-4477-8332-8d2ed2b4aaa9/767fsgr_thumbnail.png)

Transcribed Image Text:Problem 16-3 ROE and Leverage [LO1, 2]

Fujita, Incorporated, has no debt outstanding and a total market value of $356,900.

Earnings before Interest and taxes, EBIT, are projected to be $50,000 if economic

conditions are normal. If there is strong expansion in the economy, then EBIT will be 16

percent higher. If there is a recession, then EBIT will be 25 percent lower. The

company is considering a $180,000 debt Issue with an interest rate of 5 percent. The

proceeds will be used to repurchase shares of stock. There are currently 8,300 shares

outstanding. Ignore taxes for questions (a) and (b). Assume the company has a market-

to-book ratio of 1.0 and the stock price remains constant.

a-1. Calculate return on equity (ROE) under each of the three economic scenarios before

any debt is issued. (Do not round Intermediate calculations and enter your

answers as a percent rounded to 2 decimal places, e.g., 32.16.)

a-2. Calculate the percentage changes in ROE when the economy expands or enters a

recession. (A negative answer should be indicated by a minus sign. Do not round

Intermediate calculations and enter your answers as a percent rounded to 2

decimal places, e.g., 32.16.)

b-1. Assume the firm goes through with the proposed recapitalization. Calculate the

return on equity (ROE) under each of the three economic scenarios. (Do not round

Intermediate calculations and enter your answers as a percent rounded to 2

decimal places, e.g., 32.16.)

b-2. Assume the firm goes through with the proposed recapitalization. Calculate the

percentage changes in ROE when the economy expands or enters a recession. (A

negative answer should be indicated by a minus sign. Do not round Intermediate

calculations and enter your answers as a percent rounded to 2 decimal places,

e.g., 32.16.)

a-1. Recession ROE

a-1. Normal ROE

Answer is complete and correct.

a-1. Expansion ROE

a-2. Recession percentage change in ROE

a-2. Expansion percentage change in ROE

b-1. Recession ROE

b-1. Normal ROE

b-1. Expansion ROE

b-2. Recession percentage change in ROE

b-2. Expansion percentage change in ROE

%

10.51

14.01 %

16.25

%

-25.00

%

16.00

%

16.11 %

23.18✔ %

27.70 %

-30.49

%

19.51

%

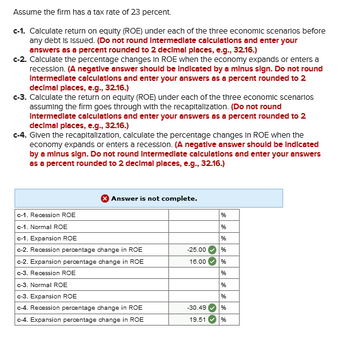

Transcribed Image Text:Assume the firm has a tax rate of 23 percent.

c-1. Calculate return on equity (ROE) under each of the three economic scenarios before

any debt is Issued. (Do not round Intermediate calculations and enter your

answers as a percent rounded to 2 decimal places, e.g., 32.16.)

c-2. Calculate the percentage changes in ROE when the economy expands or enters a

recession. (A negative answer should be indicated by a minus sign. Do not round

Intermediate calculations and enter your answers as a percent rounded to 2

decimal places, e.g., 32.16.)

c-3. Calculate the return on equity (ROE) under each of the three economic scenarios

assuming the firm goes through with the recapitalization. (Do not round

Intermediate calculations and enter your answers as a percent rounded to 2

decimal places, e.g., 32.16.)

c-4. Given the recapitalization, calculate the percentage changes in ROE when the

economy expands or enters a recession. (A negative answer should be indicated

by a minus sign. Do not round Intermediate calculations and enter your answers

as a percent rounded to 2 decimal places, e.g., 32.16.)

Answer is not complete.

c-1. Recession ROE

c-1. Normal ROE

c-1. Expansion ROE

c-2. Recession percentage change in ROE

c-2. Expansion percentage change in ROE

c-3. Recession ROE

c-3. Normal ROE

c-3. Expansion ROE

c-4. Recession percentage change in ROE

c-4. Expansion percentage change in ROE

-25.00

16.00

-30.49

19.51

%

%

%

%

%

%

%

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 7 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

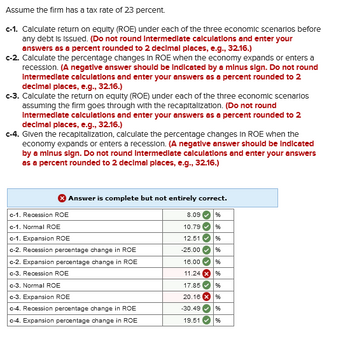

Transcribed Image Text:Assume the firm has a tax rate of 23 percent.

c-1. Calculate return on equity (ROE) under each of the three economic scenarios before

any debt is Issued. (Do not round Intermediate calculations and enter your

answers as a percent rounded to 2 decimal places, e.g., 32.16.)

c-2. Calculate the percentage changes in ROE when the economy expands or enters a

recession. (A negative answer should be indicated by a minus sign. Do not round

Intermediate calculations and enter your answers as a percent rounded to 2

decimal places, e.g., 32.16.)

c-3. Calculate the return on equity (ROE) under each of the three economic scenarios

assuming the firm goes through with the recapitalization. (Do not round

Intermediate calculations and enter your answers as a percent rounded to 2

decimal places, e.g., 32.16.)

c-4. Given the recapitalization, calculate the percentage changes in ROE when the

economy expands or enters a recession. (A negative answer should be indicated

by a minus sign. Do not round Intermediate calculations and enter your answers

as a percent rounded to 2 decimal places, e.g., 32.16.)

Answer is complete but not entirely correct.

c-1. Recession ROE

c-1. Normal ROE

c-1. Expansion ROE

c-2. Recession percentage change in ROE

c-2. Expansion percentage change in ROE

c-3. Recession ROE

c-3. Normal ROE

c-3. Expansion ROE

c-4. Recession percentage change in ROE

c-4. Expansion percentage change in ROE

8.09 %

10.79

%

12.51

%

-25.00

%

16.00✔ %

11.24

%

17.85

%

20.16 x %

-30.49 %

19.51

%

(3

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

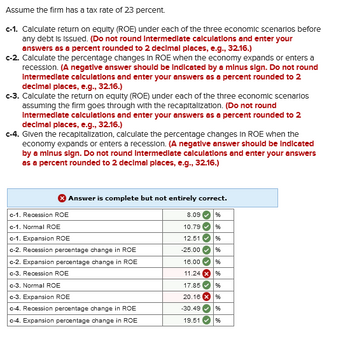

Transcribed Image Text:Assume the firm has a tax rate of 23 percent.

c-1. Calculate return on equity (ROE) under each of the three economic scenarios before

any debt is Issued. (Do not round Intermediate calculations and enter your

answers as a percent rounded to 2 decimal places, e.g., 32.16.)

c-2. Calculate the percentage changes in ROE when the economy expands or enters a

recession. (A negative answer should be indicated by a minus sign. Do not round

Intermediate calculations and enter your answers as a percent rounded to 2

decimal places, e.g., 32.16.)

c-3. Calculate the return on equity (ROE) under each of the three economic scenarios

assuming the firm goes through with the recapitalization. (Do not round

Intermediate calculations and enter your answers as a percent rounded to 2

decimal places, e.g., 32.16.)

c-4. Given the recapitalization, calculate the percentage changes in ROE when the

economy expands or enters a recession. (A negative answer should be indicated

by a minus sign. Do not round Intermediate calculations and enter your answers

as a percent rounded to 2 decimal places, e.g., 32.16.)

Answer is complete but not entirely correct.

c-1. Recession ROE

c-1. Normal ROE

c-1. Expansion ROE

c-2. Recession percentage change in ROE

c-2. Expansion percentage change in ROE

c-3. Recession ROE

c-3. Normal ROE

c-3. Expansion ROE

c-4. Recession percentage change in ROE

c-4. Expansion percentage change in ROE

8.09 %

10.79

%

12.51

%

-25.00

%

16.00✔ %

11.24

%

17.85

%

20.16 x %

-30.49 %

19.51

%

(3

Solution

by Bartleby Expert

Knowledge Booster

Similar questions

- Please do not give solution in image format thankuarrow_forwardGenerally speaking, do the following indicate good news or bad news?a. Increase in times interest earned ratio.b. Decrease in days to sell.c. Increase in gross profit percentage.d. Decrease in EPS.e. Increase in fixed asset turnover ratio.arrow_forwardSelected current year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $52,900; total assets, $219,400; common stock, $86,000; and retained earnings, $31,757.) Assets Cash Short-term investments Accounts receivable, net Merchandise inventory. Prepaid expenses Plant assets, net Total assets CABOT CORPORATION Income Statement For Current Year Ended December 31 Sales Cost of goods sold Gross profit $ 14,000 8,200 30,000 38,150 2,600 149,300 $ 242, 250 Operating expenses Interest expense Income before taxes Income tax expense Net income $ 456,600 297,750 158,850 99,000 4,600 55,250 22,257 $32,993 CABOT CORPORATION Balance Sheet December 31 of current year Liabilities and Equity Accounts payable Accrued wages payable Income taxes payable Long-term note payable, secured by mortgage on plant assets Common stock Retained earnings Total liabilities and equity $ 18,500 3,600 4,000…arrow_forward

- The following are methods in calculating the capital cost allowance, EXCEPT a. Double-Declining Method b. Quarterly-Deduction Method c. None of the Above d. Straight-Line Method Xarrow_forward__________ provides comparative changes about various line items of each financial statement over time. Multiple Choice Percentage change A pivotable Vertical analysis Horizontal analysisarrow_forwardAssets Cash Receivables (net) Inventory PP & E (net) Patents&Licenses Goodwill Total assets Liabilities & Equity Accounts payable Short term debt Long term debt Preferred stock Common Equity Total Liabilities + Equity New Chip Corp Balance Sheet at 12/31/22 ($ in Millions) 31 45 64 215 28 19 402 53 19 179 23 128 402arrow_forward

- Coronado Corporation began operations on December 1, 2019. The only inventory transaction in 2019 was the purchase of inventory on December 10, 2019, at a cost of $ 23 per unit. None of this inventory was sold in 2019. Relevant information is as follows. Ending inventory units December 31, 2019 165 December 31, 2020, by purchase date December 2,2020 165 July 20, 2020 50 215 During the year 2020, the following purchases and sales were made. Purchases Sales March 15 365 units at $28 April 10 265 July 20 365 units at 29 August 20 365 September 4 265 units at 32 November 18 215 December 2 165 units at 35 December 12 265 The company uses the periodicinventory method. (a1)arrow_forwardConsider the following data. Period 1 2 3 4 Rate of Return (%) - 5.8 - 8.0 - 3.8 2.0 5 5.2 What is the mean growth rate over these five periods (to 2 decimals)? Enter negative value as negative figure. X %arrow_forwardAssume the following ratios are constant: Total asset turnover Profit margin Equity multiplier Payout ratio 2.5 6.5% 1.6 20% What is the sustainable growth rate? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Sustainable growth rate %arrow_forward

- Consider the following information: State of Economy Recession Normal Boom Probability of State of Economy .22 .47 .31 Expected return Rate of Return if State Occurs -.11 .13 .32 Calculate the expected return. (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) %arrow_forwardCalculate the standard deviation of this scenario Outcome 1: Recession. Probability = 40% . Return = 7.38%. Outcome 1: Recovery. Probability = 60%. Return = 17.27 %. Answer in % terms w/o % sign and to 4 decimal places (1.2345)arrow_forwardConsider the following data. ▾ Hide Feedback Period 1 Incorrect 2 3 Rate of Return (%) - 5.8 4 5 5.2 What is the mean growth rate over these five periods (to 2 decimals)? Enter negative value as negative figure. -2.08 % - 8.0 - 3.8 2.0arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education