Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

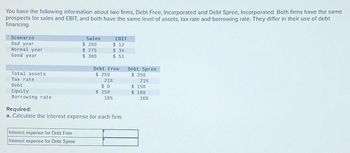

Transcribed Image Text:You have the following information about two firms, Debt Free, Incorporated and Debt Spree, Incorporated. Both firms have the same

prospects for sales and EBIT, and both have the same level of assets, tax rate and borrowing rate. They differ in their use of debt

financing.

Scenario

Bad year

Normal year

Good year

Total assets

Tax rate

Debt

Equity

Borrowing rate

Sales

Interest expense for Debt Free

Interest expense for Debt Spree

$200

$275

$380

Debt Free

$ 250

21%

EBIT

$12

$ 34

$ 51

$0

$ 250

16%

Required:

a. Calculate the interest expense for each firm:

Debt Spree

$ 250

21%

$150

$ 100

16%

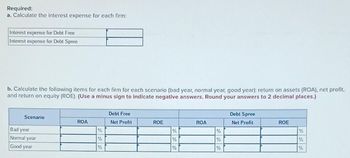

Transcribed Image Text:Required:

a. Calculate the interest expense for each firm:

Interest expense for Debt Free

Interest expense for Debt Spree

b. Calculate the following items for each firm for each scenario (bad year, normal year, good year): return on assets (ROA), net profit,

and return on equity (ROE). (Use a minus sign to indicate negative answers. Round your answers to 2 decimal places.)

Scenario

Bad year

Normal year

Good year

ROA

%

%

%

Debt Free

Net Profit

ROE

%

%

%

ROA

%

%

%

Debt Spree

Net Profit

ROE

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- A firm has been experiencing low profitability in recent years. Perform an analysis of the firm's financial position using the DuPont equation. The firm has no lease payments but has a $3 million sinking fund payment on its debt. The most recent industry average ratios and the firm's financial statements are as follows: Industry Average Ratios Current ratio 2 × Fixed assets turnover 6 × Debt-to-capital ratio 19 % Total assets turnover 3 × Times interest earned 7 × Profit margin 5.75 % EBITDA coverage 9 × Return on total assets 17.25 % Inventory turnover 7 × Return on common equity 19.40 % Days sales outstandinga 23 days Return on invested capital 17.30 % aCalculation is based on a 365-day year. Balance Sheet as of December 31, 2021 (millions of dollars) Cash and equivalents $ 77 Accounts payable $ 48 Accounts receivables 72 Other current liabilities 29 Inventories 178 Notes payable 58 Total current assets $ 327…arrow_forwardDuPONT ANALYSIS A firm has been experiencing low profitability in recent years. Perform an analysis of the firm’s financial position using the DuPont equation. The firm has no lease payments but has a $2 million sinking fund payment on its debt. The most recent industry average ratios and the firm’s financial statements are as follows: Industry Average Ratios Current ratio 3x Fixed assets turnover 6x Debt-to-capital ratio 20% Total assets turnover 3x Times intereset earned 7x Profit margin 3.75% EBITDA coverage 9x Return on total assets 11.25% Inventory turnover 10x Return on common equity 16.10% Days sales outstanding 24 days Return on invested capital 14.40% aCalculate is based on 365-day year.Balance Sheet as of December 31, 2019 (millions of dollars) Cash and equivalents $78 Accounts payable $45 Accounts receivable 66 other current liabilities 11 Inventories 159 Notes payable 29 Total current assets $303 Total current liabilities $85 Long term…arrow_forwardi need typing answerarrow_forward

- Bank A receives $70 in deposits at 5% and, together with 40 in equity, makes a loan of $90 at 7%. The remaining of assets is G-Bond. We will ignore taxes for the moment. NIM=Profit/Interest revenue Bank A Loan 7% $90 G-Bond 5% ? Deposits 5% $70 Equity $40 Total Assets $? Total Equity and Deposit $110 ROE= 66.66% 22.3% 32.6% 4.8% 9.5% 10.4% 52.13% 8.8%arrow_forwardAssuming that there is an unlevered firm and a levered firm. The basic information is given by the following table. Table 1: Information of the firms Unlevered firm Levered firm EBIT 10,000 10,000 Interest 0 3,200 Taxable income 10,000 6,800 Tax (tax rate: 34%) 3,400 2,312 Net income 6,600 4,488 CFFA 0 -3,200 Assuming that cost of debt =8%; unlevered cost of capital =10%; systematic risk of the asset is 1.5 Suppose that the firm changes its capital structure so that the debt-to-equity ratio is 1.0, then recalculate the systematic risk of the equityarrow_forwardNeed help with the 2 incorrect questionsarrow_forward

- The following information is available regarding XYZ Co. sales = $250,000net income = $35,000dividends = $10,000total debt = $100,000total equity = $80,000 What growth rate can be supported without outside financing?arrow_forwardCase 2: The risk-free rate is 1.20%, return on market is 13.00%, and corporate tax rate is 20%. Baltic & Friends Corporation is considering four levels of debt financing as in the table below. The manager wishes to select "the right proportion" of debt financing for the company. Currently the firm has no debt financing, and its beta equals 0.85. D/A ratio (%) Interest rate before tax (%) 10 3.80% 25 4.20% 40 4.75% 55 4.90% Questions Answers 1. Calculate cost of equity with leveraged beta at 10% debt 2. Calculate cost of equity with leveraged beta at 25% debt 3. Calculate cost of equity with leveraged beta at 40% debt 4. Calculate cost of equity with leveraged beta at 55% debt % % % % 5. Calculate WACC at 10% debt 6. Calculate WACC at 25% debt 7. Calculate WACC at 40% debt 8 Calculate WACC at 55% debt di % % % %arrow_forwardAssume you are given the following information for firms A and B: A B D $1,563,400.00 $2,357,316.00 E $2,051,347.00 $1,257,431.00 Price $31.25 $31.25 i 13.52% 13.52% EBIT $97,347.00 $97,347.00 No taxes How do you replicate an investment in 79% of stock B by using stock A? What is the return of the replicating strategy?arrow_forward

- Fujita, Incorporated, has no debt outstanding and a total market value of $450,000. Earnings before interest and taxes, EBIT, are projected to be $57,000 if economic conditions are normal. If there is strong expansion in the economy, then EBIT will be 16 percent higher. If there is a recession, then EBIT will be 24 percent lower. The company is considering a $215,000 debt issue with an interest rate of 8 percent. The proceeds will be used to repurchase shares of stock. There are currently 9,000 shares outstanding. Ignore taxes for questions (a) and (b). Assume the company has a market- to-book ratio of 1.0 and the stock price remains constant. a-1. Calculate return on equity (ROE) under each of the three economic scenarios before any debt is issued. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) a-2. Calculate the percentage changes in ROE when the economy expands or enters a recession. (A negative answer should be…arrow_forwardUse the information in the following table to make a suggestion concerning the proportion of debt that the firm should utilize in its capital structure. Benefit or (cost) No debt 25% debt 50% debt Tax shield $0 $15 $25 75% debt $35 Agency cost -$10 -$4 -$4 -$16 Financial distress cost -$3 -$2 -$8 -$19 The firm can maximize firm value by choosing (25%, 50%, 75% or 0%) debt capital structure.arrow_forwardGiven the following information, leverage will add how much value to the unlevered firm per dollar of debt?Corporate tax rate: 35%Personal tax rate on income from bonds: 25%Personal tax rate on income from stocks: 30% A. $-0.625 B. $0.287 C. $0.393 D. $0.635 E. None of thesearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education