Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

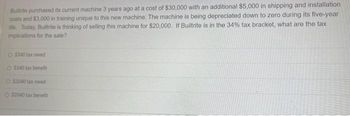

Transcribed Image Text:Builtrite purchased its current machine 3 years ago at a cost of $30,000 with an additional $5,000 in shipping and installation

costs and $3,000 in training unique to this new machine. The machine is being depreciated down to zero during its five-year

life. Today, Builtrite is thinking of selling this machine for $20,000. If Builtrite is in the 34% tax bracket, what are the tax

implications for the sale?

O $340 tax owed

O $340 tax benefit

O $2040 tax owed

O 52040 tax benefit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Taufel, Inc. is considering implementing a cost-cutting project. The pre-tax cost reduction is expected to be $ 18,000 for each of the three years of the project's life. The project has an initial cost of $40,000 and belongs in a 20% CCA class. The company has a tax rate of 32% and the discount rate for the project is 9%. The project can be sold to another company at the end of year 3 for $2,000. What is the NPV of the project? $771 $650 $1,056 $1,379arrow_forwardThe Target Copy Company is contemplating the replacement of its old printing machine with a new model costing $80,000. The old machine, which originally cost $40,000, has 6 years of expected life remaining and a current book value of $25,000 versus a current market value of $17,000. Target's corporate tax rate is 40 percent. If Target sells the old machine at market value, what is the initial after-tax cash outlay for the new printing machine? Round it a whole dollar and do not include the $ sign.arrow_forwardAyden's Toys, Inc.. just purchased a $530,000 machine to produce toy cars. The machine will be fully depreciated by the straight-line method over its 5-year economic life. Each toy sells for $30. The variable cost per toy is $14 and the firm incurs fixed costs of $390,000 per year. The corporate tax rate for the company is 24 percent. The appropriate discount rate is 12 percent. What is the financial break-even point for the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Financial break-even point unitsarrow_forward

- Corf's Dog House is considering the installation of a new computerized pressure cooker for hot dogs. The cooker will increase sales by $9,500 per year and will cut annual operating costs by $03.300. The system will cost $50100 to purchase and install. This system is expected to have a 5-year life and will be depreciated to zero using straight-line depreciation and have no salvage value. The tax rate is 40 percent and the required return is 30.8 percent. What is the NPV of purchasing the pressure cooker? Mutiple Choice O ● O $23,047 -40335 $5.603 -$2674 $6300arrow_forwardQuick Computing installed its previous generation of computer chip manufacturing equipment 3 years ago. Some of that older equipment will become unnecessary when the company goes into production of its new product. The obsolete equipment, which originally cost $40 million, has been depreciated straight-line over an assumed tax life of 5 years, but it can be sold now for $18 million. The firm’s tax rate is 30%. What is the after-tax cash flow from the sale of the equipment? Note: Enter your answer in millions rounded to 2 decimal places.arrow_forwardThe Kings Inn Resort purchased three delivery carts 5 years ago. The delivery carts initially cost $60,000 and are depreciated on a straight line basis over 10 years. The effective tax rate for the company is 40%. Part A: What is the net cash flow if they sell the used carts for $36,000? Part B: What are the net cash flows if they sell the used carts for $30,000? Part C: What is the net cash flow if they sell the used carts for $25,000arrow_forward

- Daily Enterprises is purchasing a $10.2 million machine. It will cost $51,000 to transport and install the machine. The machine has a depreciable life of five years and will have no salvage value. The machine will generate incremental revenues of $3.9 million per year along with incremental costs of $1.5 million per year. If Daily's marginal tax rate is 21%, what are the incremental earnings (net income) associated with the new machine? The annual incremental earnings are $ (Round to the nearest dollar.)arrow_forwardYour company has to liquidate some equipment that is being replaced. The originally cost of the equipment is $100,000. The firm has deprecated 65% of the original cost. The salvage value of the equipment today is $50,000. The firm has a tax rate of 30%. What is the equipment’s after-tax net salvage value? Please show your work.arrow_forwardQuick Computing installed its previous generation of computer chip manufacturing equipment 3 years ago. Some of that older equipment will become unnecessary when the company goes into production of its new product. The obsolete equipment, which originally cost $40 million, has been depreciated straight-line over an assumed tax life of 5 years, but it can be sold now for $18 million. The firm's tax rate is 30%. What is the after-tax cash flow from the sale of the equipment? Note: Enter your answer in millions rounded to 2 decimal places. After-tax cash flow millionarrow_forward

- Arnold Inc. is considering a new project that requires use of an existing warehouse, which the firm acquired three years ago for $1 million and which it currently rents out for $121,000. Rental rates are not expected to change going forward. In addition to using the warehouse, the project requires an upfront investment into machines and other equipment of $1.6 million. This investment can be fully depreciated straight-line over the next 10 years for tax purposes. However, Arnold Inc. expects to terminate the project at the end of eight years and to sell the machines and equipment for $471,000. Finally, the project requires an initial investment into net working capital equal to 10% of predicted first-year sales. Subsequently, net working capital is 10% of the predicted sales over the following year. Sales of protein bars are expected to be $4.6 million in the first year and to stay constant for eight years. Total manufacturing costs and operating expenses (excluding depreciation) are…arrow_forwardffarrow_forwardFor specialized devices for use with its latest GPS / GIS system, Freeman Engineering charged $28,500. Using MACRS depreciation, the equipment was depreciated over a 3 year recovery period. After 2 years, the company sold the equipment for $5000 when it bought an improved system. (a) Assess the value of the recapture of depreciation or the capital loss involved in the asset sale. (b) What tax impact is that number going to have?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education