Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

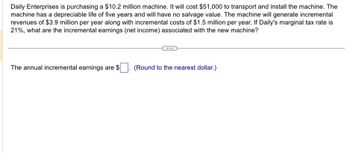

Transcribed Image Text:Daily Enterprises is purchasing a $10.2 million machine. It will cost $51,000 to transport and install the machine. The

machine has a depreciable life of five years and will have no salvage value. The machine will generate incremental

revenues of $3.9 million per year along with incremental costs of $1.5 million per year. If Daily's marginal tax rate is

21%, what are the incremental earnings (net income) associated with the new machine?

The annual incremental earnings are $

(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Gluon Incorporated is considering the purchase of a new high pressure glueball. It can purchase the glueball for $150,000 and sell its old low-pressure glueball, which is fully depreciated, for $26,000 The new equipment has a 10-year useful life and will save $34,000 a year in expenses before tax. The opportunity cost of capital is 11%, and the firm's tax rate is 21%. What is the equivalent annual saving from the purchase if Gluon can depreciate 100% of the investment immediately. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Answer is complete but not entirely correct. Equivalent annual savings $ 16,934.51arrow_forwardKarsted Air Services is now in the final year of a project. The equipment originally cost $23 million, of which 100% has been depreciated. Karsted can sell the used equipment today for $6 million, and its tax rate is 20%. What is the equipment's after-tax salvage value? Write out your answer completely. For example, 13 million should be entered as 13,000,000. Round your answer to the nearest dollar. $arrow_forwardAcefacto Inc., has asked for you to calculate the after-tax salvage value of an asset it plans on using in a construction project. The project will be depreciated straight line to a value of$670,000at the end of the project's and assets ten year life. Ace's marginal tax rate is32%. The firm will have to pay$8,047,675to buy the asset. You have estimated that they could sell the asset for$787,309to a Brazilian firm at the end of the project. Answer in dollars and cents.arrow_forward

- Allen Air Lines must liquidate some equipment that is being replaced. The equipment originally cost $11.5 million, of which 65% has been depreciated. The used equipment can be sold today for $4.6 million, and its tax rate is 25%. What is the equipment's after-tax net salvage value? Enter your answer in dollars. For example, an answer of $1.2 million should be entered as 1,200,000. Round your answer to the nearest dollar. $arrow_forwardPaulita's Products Inc. is considering the new piece of equipment that costs P75,000. The equipment is expected to generate revenues before-tax cash inflows of P25,000 per year for five year. The equipment would be depreciated using straight-line method over its five-year useful life. Upon retirement, the machine is expected to have a market value of P8,000. The company considers the maximum impact of income taxes in all of its capital investment decisions. The company has a 35 percent income tax rate and desires an after-tax return of 12 percent on its investment. The present value of 1, end of 5 years at 12% is 0.56743 and for ordinary annuity is 3.60478. The net present value of the equipment is: c. P 21,248 b. P 4,539 a. P 7,042 d. P 5,453arrow_forwardTanner Corporation is considering the acquisition of a new machine that is expected to produce annual savings in cash operating costs of $70,000 before income taxes. The machine costs $244,000, has a useful life of five years, and no salvage value. Tanner uses straight-line depreciation on all assets, is subject to a 30% income tax rate, and has an after-tax hurdle rate of 8 %. FV of $1 at FV of an ordinary annuity at PV of $1 at PV of an ordinary annuity at Yr .8% 8% 8% 8% 1 1.080 1.000 0.926 0.926 2 1.166 2.080 0.857 1.783 3 1.260 3.246 0.794 2.577 4 1.360 4.506 0.735 3.312 5 1.469 5.867 0.681 3.993 6 1.587 7.336 0.630 4.623 Required: If the machine's accounting rate of return on the initial investment is 6%. Compute the machine's net present valuearrow_forward

- The Wet Corporation has an investment project that will reduce expenses by $20,000 per year for 3 years. The project's cost is $25,000. If the asset is part of the 3-year MACRS category (33.33% first year depreciation) and the company's combined tax rate is 35%, what is the cash flow from the project in year 1 ?arrow_forwardLaurel's Lawn Care Ltd., has a new mower line that can generate revenues of $174,000 per year. Direct production costs are $58,000, and the fixed costs of maintaining the lawn mower factory are $24,000 a year. The factory originally cost $1.45 million and is being depreciated for tax purposes over 25 years using straight-line depreciation. Calculate the operating cash flows of the project if the firm's tax bracket is 25%. (Enter your answer in dollars not in millions.) Operating cash flowsarrow_forwardIlana Industries Incorporated needs a new lathe. It can buy a new high-speed lathe for $2.0 million. The lathe will cost $31,000 per year to run, but it will save the firm $184,000 in labor costs and will be useful for 10 years. Suppose that, for tax purposes, the lathe is entitled to 100% bonus depreciation. At the end of the 10 years, the lathe can be sold for $470,000. The discount rate is 10%, and the corporate tax rate is 21%. What is the NPV of buying the new lathe? Note: A negative amount should be indicated by a minus sign. Enter your answer in dollars not in millions. Do not round intermediate calculations. Round your answer to 2 decimal places. NPVarrow_forward

- Karsted Air Services is now in the final year of a project. The equipment originally cost $27 million, of which 100% has been depreciated. Karsted can sell the used equipment today for $6 million, and its tax rate is 30%. What is the equipment's after-tax salvage value? Write out your answer completely. For example, 13 million should be entered as 13,000,000. Round your answer to the nearest dollar.arrow_forwardIlana Industries Incorporated needs a new lathe. It can buy a new high-speed lathe for $1 million. The lathe will cost $35,000 per year to run, but it will save the firm $125,000 in labor costs and will be useful for 10 years. Suppose that, for tax purposes, the lathe is entitled to 100% bonus depreciation. At the end of the 10 years, the lathe can be sold for $100,000. The discount rate is 8%, and the corporate tax rate is 21%. What is the NPV of buying the new lathe? Note: A negative amount should be indicated by a minus sign. Enter your answer in dollars not in millions. Do not round intermediate calculations. Round your answer to 2 decimal places.arrow_forwardDaily Enterprises is purchasing a $10.45 million machine. It will cost $64,247.00 to transport and install the machine. The machine has a depreciable life of five years using the straight-line depreciation and will have no salvage value. The machine will generate incremental revenues of $4.13 million per year along with incremental costs of $1.50 million per year. Daily's marginal tax rate is 34.00%. The cost of capital for the firm is 15.00%. (answer in dollars..so convert millions to dollars) The project will run for 5 years. What is the NPV of the project at the current cost of capital?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education