Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

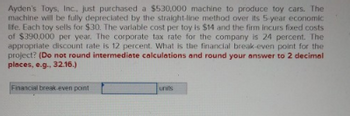

Transcribed Image Text:Ayden's Toys, Inc.. just purchased a $530,000 machine to produce toy cars. The

machine will be fully depreciated by the straight-line method over its 5-year economic

life. Each toy sells for $30. The variable cost per toy is $14 and the firm incurs fixed costs

of $390,000 per year. The corporate tax rate for the company is 24 percent. The

appropriate discount rate is 12 percent. What is the financial break-even point for the

project? (Do not round intermediate calculations and round your answer to 2 decimal

places, e.g., 32.16.)

Financial break-even point

units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Your firm is contemplating the purchase of a new $540,000 computer - based order entry system. The system will be depreciated straight - line to zero over its five - year life. It will be worth $52, 000 at the end of that time. You will save $300,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $67,000 (this is a one - time reduction). If the tax rate is 23 percent, what is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardThe Target Copy Company is contemplating the replacement of its old printing machine with a new model costing $80,000. The old machine, which originally cost $40,000, has 6 years of expected life remaining and a current book value of $25,000 versus a current market value of $17,000. Target's corporate tax rate is 40 percent. If Target sells the old machine at market value, what is the initial after-tax cash outlay for the new printing machine? Round it a whole dollar and do not include the $ sign.arrow_forwardFirm X needs 1 computer. Firm X can buy 1 computer for 3,059. The cost of debt for Firm X is 5%. The corporate tax equals 35%. Firm X follows a straight-line depreciation method and the economic life of the computer is 2 years. Compute the depreciation tax shield of year 2.arrow_forward

- Assume a machine was purchased 5 years ago for $800,000 and has been 75% depreciated. The firm decides to sell this machine for $350,000. The firm's tax rate is 20%. Calculate how much net cash the sale of this equipment will generate for the firm. Answer rounded to the nearest whole dollar; for example 42,345 for your answer.arrow_forwardam. 286.arrow_forwardA corporation is considering purchasing a machine that will save $150,000 per year before taxes. The cost of operating the machine (including maintenance) is $30,000 per year. The machine will be needed for five years, after which it will have a zero salvage value. MACRS depreciation will be used, assuming a three-year class life. The marginal income tax rate is 25%. If the firm wants 15% return on investment after taxes, how much can it afford to pay for this machine? Click the icon to view the MACRS depreciation schedules Click the icon to view the interest factors for discrete compounding when /- 15% per year. If the firm wants 15% return on investment after taxes, it can afford to pay thousand for this machine. (Round to one decimal place.)arrow_forward

- Your firm is contemplating the purchase of a new $540,000 computer - based order entry system. The system will be depreciated straight - line to zero over its five-year life. It will be worth $52,000 at the end of that time. You will save $300,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $67,000 (this is a one-time reduction). If the tax rate is 23 percent, what is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardQuick Computing installed its previous generation of computer chip manufacturing equipment 3 years ago. Some of that older equipment will become unnecessary when the company goes into production of its new product. The obsolete equipment, which originally cost $40 million, has been depreciated straight-line over an assumed tax life of 5 years, but it can be sold now for $18 million. The firm’s tax rate is 30%. What is the after-tax cash flow from the sale of the equipment? Note: Enter your answer in millions rounded to 2 decimal places.arrow_forwardQuick Computing installed its previous generation of computer chip manufacturing equipment 3 years ago. Some of that older equipment will become unnecessary when the company goes into production of its new product. The obsolete equipment, which originally cost $37.00 million, has been depreciated straight-line over an assumed tax life of 5 years, but it can be sold now for $17.40 million. The firm’s tax rate is 30%. What is the after-tax cash flow from the sale of the equipment? (Enter your answer in millions rounded to 1 decimal place.) After-tax cash flowarrow_forward

- Raiders Restaurant is considering the purchase of a $10,000,000 flat-top grill. The grill has an economic life of 6 years and will be fully depreciated using the straight-line method. The grill is expected to produce 600,000 tacos per year for the next 6 years, each taco costing $4 to make and priced at $11. Assume the discount rate is 12% and the tax rate is 21%. The restaurant expects the market value of the grill to be $0, 6 years from now. Calculate the book value of the grill at the end of year 3. (Round to 2 decimals)arrow_forwardSpherical Manufacturing recently spent $15 million to purchase some equipment used in the manufacture of disk drives. This equipment has a CCA rate of 30% and Spherical's marginal corporate tax rate is 36%. a. What are the annual CCA deductions associated with this equipment for the first five years? b. What are the annual CCA tax shields for the first five years? c. What is the present value of the first five CCA tax shields if the appropriate discount rate is 12% per year? d. What is the present value of all the CCA tax shields assuming the equiment is never sold and the appropriate discount rate is 12% per year? e. How might your answer to part (d) change if Spherical anticipates that its marginal corporate tax rate will increase substantially over the next five years? a. What are the annual CCA deductions associated with this equipment for the first five years? The CCA deduction for year 1 is $ (Round to the nearest dollar.) Question Viewerarrow_forwardThe Kings Inn Resort purchased three delivery carts 5 years ago. The delivery carts initially cost $60,000 and are depreciated on a straight line basis over 10 years. The effective tax rate for the company is 40%. Part A: What is the net cash flow if they sell the used carts for $36,000? Part B: What are the net cash flows if they sell the used carts for $30,000? Part C: What is the net cash flow if they sell the used carts for $25,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education