FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

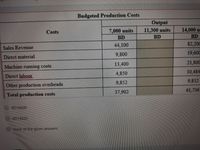

Additional Information Sales revenue per unit will be decreased by BD 1.200 fils for sales more than 9,000 units. a. b. Direct material cost is a variables cost and other production overheads are fixed cost. C. Direct labour consists of machine operatives wages and the total wages behave as a step cost: Total Direct Labour cost Output Up to 7.500 units Over 7,501 and up to 11.000 units Over 11.001 and up to 15,000 units Machine running costs are a semi-variable cost. There is a fixed charge of BD 5,000 plus BD 4,850 BD 8,563 BD 10,484 d. BD 1.200 fils per unit. Required the budgeted direct material under the output of 11300 unit is:

Transcribed Image Text:Budgeted Production Costs

Output

11,300 units

7,000 units

BD

14,000 u

BD

Costs

BD

44,100

82,200

Sales Revenue

9,800

19,600

Direct material

13,400

21,800

Machine running costs

4,850

10,484

Direct labour

9,852

9,852

Other production overheads

37.902

61,736

Total production costs

BD19600

BD15820

none of the given answers

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Evaluating Selected Cost Driver Assume that a manufacturer of specialized machine parts developed the following total cost estimating equation for manufacturing costs. Y = $14,400 + $1,250 (actual units) a. What is total estimated manufacturing costs if 180 units are produced? $Answer 0arrow_forwardA corporation's cost data is: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Sales commissions Variable administrative expense Fixed selling and administrative expense What is the amount of product costs, if 4,000 units are produced? Multiple Choice O O O O $57,200 $8,800 $44,400 $53,200 Cost per Cost per Unit Period $ 6.00 $ 3.35 $ 1.75 $ 1.00 $ 0.40 $ 8,800 $ 4,000arrow_forwardProvide answer this questionarrow_forward

- Question 1 Answer: Question 2 a Total Manufacturing Costs: Variable Fixed Factory Overhead Total Cost Per Unit b Markup Percentage % Seling Pricearrow_forwardA tile manufacturer has supplied the following data: Boxes of tiles produced and sold Sales revenue Variable manufacturing expense Fixed manufacturing expense Variable selling and administrative expense Fixed selling and administrative expense Net operating income a. b. $ $ What is the company's unit contribution margin? $0.86 per unit $2.35 per unit $4.10 per unit $1.75 per unit C. d. 520,000 2,132,000 650,000 $ 464,000 $ 260,000 $ 312,000 $ 446,000arrow_forward1 of 12 Assignment: 1 Case: 1 The Cost Sheet of a product is given as under: Direct Materials Direct Wages Factory Overheads: Fixed Variable Administrative Expenses: Selling and Distribution Overheads: Fixed Variable Total OMR 6.00 3.00 0.50 0.50 0.75 0.25 0.50 11.50 The selling price per unit is OMR 13. The above figures are for an output of 85,000 units, the capacity of the firm is 100,000 units. A foreign customer is desirous of buying 15,000 units at a price of OMR 10.50 per unit. (A) Advise the manufacturer, whether the order should be accepted. (B) What will be your advice, if the orders were from a local merchant, at the same price? (C) What would be the profits, if the local selling price falls to OMR 11 from OMR 13, after acceptance of the order from a local merchant?arrow_forward

- A manufacturer reports the following. Compute contribution margin. Sales Variable cost of goods sold Fixed overhead Variable selling and administrative costs Fixed selling and administrative costs Multiple Choice $800,000 $642,000 $762,000 $524,000 $ 1,218,000 418,000 338,000 158,000 118,000arrow_forwardAverage Cost per Unit Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense $6.55 $3.45 $1.45 $3.80 $1.40 $0.95 $1.35 $0.85 Sales commissions Variable administrative expense If 7,300 units are sold, the variable cost per unit sold is closest to:arrow_forwardThe following variable production costs apply to goods made by Zachary Manufacturing Corporation: Cost per unit $ 9.00 Item Materials Labor Variable overhead 2.50 0.75 Total $12.25 Required Determine the total variable production cost, assuming that Zachary makes 6.000, 16,000, or 26,000 units. Units Produced 6,000 16,000 26,000 Total variable costarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education