FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

provide correct answer general accounting

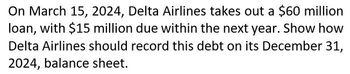

Transcribed Image Text:On March 15, 2024, Delta Airlines takes out a $60 million

loan, with $15 million due within the next year. Show how

Delta Airlines should record this debt on its December 31,

2024, balance sheet.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On September 1, 2024, Venetian Airlines borrows $39.8 million, of which $7.6 million is due next year. Show how Venetian Airlines would report the $39.8 million debt on its December 31, 2024, balance sheet. (Enter your answers in dollars, not millions. For example, $5.5 million should be entered as 5,500,000.)arrow_forwardOn September 1, 2021, Southwest Airlines borrows $40 million, of which $8.0 million is due next year. Show how Southwest Airlines would record the $40 million debt on its December 31, 2021, balance sheet. (Enter your answers in dollars, not millions. For example, $5.5 million should be entered as 5,500,000.) SOUTHWEST AIRLINES Partial Balance Sheet December 31, 2021 Current liabilities: Current portion of long-term debt Long-term liabilities: Notes payable Total liabilities $arrow_forwardCoulson Company is refinancing long-term debt. Accessed March 15, 2022. Its fiscal year ends December 31, 2021. The refinancing is scheduled to be completed on December 15, 2021. What if it's finished on January 15, 2022?arrow_forward

- On December 1, 2021, your company borrowed $48,000, a portion of which is to be repaid each year on November 30. Specifically, your company will make the following principal payments: 2022, $6,400; 2023, $9,600; 2024, $12,800; and 2025, $19,200. Show how this loan will be reported in the December 31, 2022 and 2021 balance sheets, assuming principal payments will be made when required. Balance Sheet (Partial) As of December 31 2022 2021 Total Liabilitiesarrow_forwardOn December 1, 2021, your company borrowed $15,000, a portion of which is to be repaid each year on November 30. Specifically, your company will make the following principal payments: 2022, $2,000; 2023, $3,000; 2024, $4,000; and 2025, $6,000. Show how this loan will be reported in the December 31, 2022 and 2021, balance sheets, assuming principal payments will be made when required. Total Liabilities Balance Sheet (Partial) $ As of December 31 2022 2021 0 0 4arrow_forwardOn July 1, 2020, Thomas Company, which follows calendar year accounting, issued $240.000 note to be repaid over four years in monthly installments of $5,000. What would be the proper balance sheet presentation of this transaction at December 31, year 2020. Show it: The Current Portion of the Long-Term Debt and the Long-Term Debt.arrow_forward

- Domesticarrow_forwardPresented below are two different situations related to Mckee Corporation’s debt obligations. Mckee’s next financial reporting date is December 31, 2020. The financial statements are authorized for issuance on March 1, 2021. 1. Mckee has a long-term obligation of $400,000, which is maturing over 4 years in the amount of $100,000 per year. The obligation is dated November 1, 2020, and the first maturity date is November 1, 2021. 2. Mckee has a short-term obligation due February 15, 2021. Its lender agrees to extend the maturity date of this loan to February 15, 2023. The agreement for extension is signed on January 15, 2021. Instructions Indicate how each of these debt obligations is reported on Mckee’s statement of financial position on December 31, 2020.arrow_forwardOn January 1, 2020, Pharoah Company, a calendar-year company, issued $2160000 of notes payable, of which $540000 is due on January 1 for each of the next four years. The proper balance sheet presentation on December 31, 2020, is: O Current liabilities, $540000; Long-term Debt, $1080000. O Current liabilities, $2160000. O Current liabilities, $540000; Long-term Debt, $1620000. O Long-term debt, $2160000.arrow_forward

- On December 31, 2019, Carrboro Textile Company hard short-term debt in the form of notes payable totaling $600,000. These notes were due on June 1,2020. Carrboro expected to refinance these notes on a long-term basis. On February 1, 2020, Carrboro entered into an agreement with worldwide life insurance company whereby Worldwide will lend carrboro $450,000, payable in 5 years at 12%. The money will be available to Carrboro on May 20, 2020. Carrboro issues it December 31, 2019, year-end financial statements on March 2, 2020.arrow_forwardGiven answer accounting questionsarrow_forwardOn January 1, 2020, Elmer Company, a calendar-year company, issued $2,000,000 of notes payable, of which $500,000 is due on January 1 for each of the next four years. The proper balance sheet presentation on December 31, 2020, is Group of answer choices Current liabilities $2,000,000 Long-term debt $2,000,000 Current liabilities $500,000 and Long-term debt $1,000,000 Current liabilities $500,000 and Long-term debt $1,500,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education