EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

need help with this general accounting question

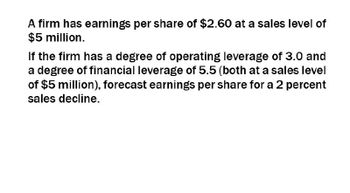

Transcribed Image Text:A firm has earnings per share of $2.60 at a sales level of

$5 million.

If the firm has a degree of operating leverage of 3.0 and

a degree of financial leverage of 5.5 (both at a sales level

of $5 million), forecast earnings per share for a 2 percent

sales decline.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- A company had WACC (weighted average cost of capital) equal to 8. % If the company pays off mortgage bonds with an interest rate of 4% and issues an equal amount of new stock considered to be relatively risky by the market, which of the following is true? a. residual income will increase. b. ROI will decrease. c. WACC will increase. d. WACC will decrease.arrow_forwardA firm has earnings per share of $2.15 at a sales level of $2 million. If the firm has a degree of operating leverage of 4.2 and a degree of financial leverage of 5.5 (both at a sales level of $2 million), forecast earnings per share for a 2 percent sales decline. Round your answer to the nearest cent. $arrow_forwardAU Inc.’s EBIT changes by 15%. The firm computed that they have a Degree of financial leverage of 2.5. What is the expected change in the earnings per share of AU Inc.?arrow_forward

- Earnings per share (EPS) for Valcor Inc. are $3 at a sales level of $4 million. If Valcor’s degree of operating leverage is 2.0 and its degree of combined leverage is 4.0, what will happen to EPS if operating income increases by 4 percent? Round your answer to the nearest whole number.%ΔEPS: % What is the new EPS? Round your answer to the nearest cent.$arrow_forwardConsider a retail firm with a net profit margin of 3.5%, a total asset turnover of 1.8, total assets of $44 million, and a book value of equity of $18 million.a. What is the firm’s current ROE?b. If the firm increased its net profit margin to 4%, what would its ROE be?c. If, in addition, the firm increased its revenues by 20% (while maintaining this higher profit margin and without changing its assets or liabilities), what would its ROE be?arrow_forwardConsider a retail firm with a net profit margin of 3.71%, a total asset turnover of 1.78, total assets of $45.9 million, and a book value of equity of $18.5 million. a. What is the firm's current ROE? b. If the firm increased its net profit margin to 4.60%, what would be its ROE? c. If, in addition, the firm increased its revenues by 21% (maintaining this higher profit margin and without changing its assets or liabilities), what would be its ROE? a. What is the firm's current ROE? The firm's current ROE is %. (Round to one decimal place.)arrow_forward

- Consider a retail firm with a net profit margin of 3.36%, a total asset turnover of 1.88, total assets of $45.5 million, and a book value of equity of $17.6 million. a. What is the firm's current ROE? b. If the firm increased its net profit margin to 4.27%, what would be its ROE? c. If, in addition, the firm increased its revenues by 18% (maintaining this higher profit margin and without changing its assets or liabilities), what would be its ROE?arrow_forwardAssume that an average firm in the office supply business has a 6% profit margin, a 40%total liabilities/assets ratio, a total assets turnover of 2 times, and a dividend payout ratioof 40%. Is it true that if such a firm is to have any sales growth (g>0), it will be forced toborrow or to sell common stock (that is, it will need some nonspontaneous external capitaleven if g is very small)? Explain.arrow_forwardA company has a required return of 12%, a profit margin of 4%, a D/E ratio of 0.5 and total asset turnover of 2. Annual dividends last year were $2.00. A) The company has a dividend payout ratio of 20%; calculate the price and forward P/E ratio. B) If the company would have changed its dividend payout ratio to 60%, what would happen to the price and forward P/E ratio? C) What variables are critical to determine if they should increase or decrease their dividend payout ratio? (Hint be specific what variables do you need to know.)arrow_forward

- Consider a retail firm with a net profit margin of 3.93 %, a total asset turnover of 1.87, total assets of $42.3 million, and a book value of equity of $18.6 million.a. What is the firm's current ROE?b. If the firm increased its net profit margin to 4.58 %, what would be its ROE?c. If, in addition, the firm increased its revenues by 19 % (maintaining this higher profit margin and without changing its assets or liabilities), what would be its ROE?arrow_forwardGamgee Company wishes to maintain a growth rate of 11.6 percent per year, a debt- equity ratio of 1.6, and a dividend payout ratio of 25 percent. The ratio of total assets to sales is constant at .88. What profit margin must the firm achieve? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Profit margin 26.17 %arrow_forwardFor the last fiscal year, your firm reported a return on assets (ROA) of 6.0 percent and a return on equity (ROE) of 15 percent. This was on sales of $36,000,000 and total assets of $30,000,000. Your CFO noted that the difference between the firm's basic earnings power (BEP) and its cost of debt (interest rate on debt is 6.4 percent) amplified ROE handsomely. Assuming a tax rate of 40 percent, calculate your firm's basic earnings power. Note: BEP EBIT/ Total Assets. Enter your answer in decimal format to 4-decimal places. For example, if your answer is 9.55%, enter 0.0955.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning