FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

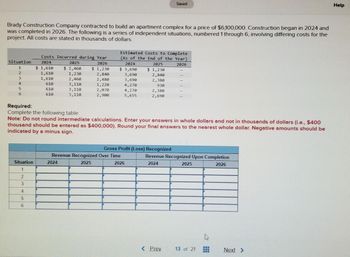

Transcribed Image Text:Brady Construction Company contracted to build an apartment complex for a price of $6,100,000. Construction began in 2024 and

was completed in 2026. The following is a series of independent situations, numbered 1 through 6, involving differing costs for the

project. All costs are stated in thousands of dollars.

Situation

1

2

3

4

5

6

Situation

1

2

2|3

3

2024

Costs Incurred during Year

2026

$1,230

2,840

2,480

1,220

2,070

2,900

4

5

6

$ 1,610

1,610

1,610

610

610

610

2025

$ 2,460

1,230

2,460

3,110

3,110

3,110

Required:

Complete the following table.

Note: Do not round intermediate calculations. Enter your answers in whole dollars and not in thousands of dollars (i.e., $400

thousand should be entered as $400,000). Round your final answers to the nearest whole dollar. Negative amounts should be

indicated by a minus sign.

2024

Estimated Costs to Complete

(As of the End of the Year)

2024

2025

2026

$ 3,690

3,690

3,690

4,270

4,270

5,655

$ 1,230

2,840

2,380

930

Revenue Recognized Over Time

2025

2026

Saved

2,380

2,690

Gross Profit (Loss) Recognized

Revenue Recognized Upon Completion

2024

2026

2025

< Prev 13 of 21

A

737

---

INC

Next >

Help

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ni.9arrow_forwardIn 2021, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2023. Information related to the contract is as follows: 2021 2022 2023 Cost incurred during the year $ 2,100,000 $ 2,450,000 $ 2,695,000 Estimated costs to complete as of year-end 4,900,000 2,450,000 0 Billings during the year 2,200,000 2,350,000 5,450,000 Cash collections during the year 1,900,000 2,300,000 5,800,000 Westgate recognizes revenue over time according to percentage of completion. 2-a. In the journal below, complete the necessary journal entries for the year 2021 (credit "Various accounts" for construction costs incurred).2-b. In the journal below, complete the necessary journal entries for the year 2022 (credit "Various accounts" for construction costs incurred).2-c. In the journal below, complete the necessary journal entries for the year 2023…arrow_forwardBeavis Construction Company was the low bidder on a construction project to build an earthen dam for $1,850,000. The project was begun in 2023 and completed in 2024. Cost and other data are presented below: 2023 2024 Costs incurred during the year $ 435,000 $ 1,150,000 Estimated costs to complete 1,015,000 0 Billings during the year 425,000 1,425,000 Cash collections during the year 325,000 1,525,000 Assume that Beavis recognizes revenue on this contract over time according to percentage of completion. Required: Compute the amount of gross profit recognized during 2023 and 2024.arrow_forward

- Sodlnoarrow_forwardWould you please help me understand how my answers are incorrect? I have been looking at this for an hour.Thank you.arrow_forwardAssume that Crane Construction Company has a non-cancellable contract to construct a $4,640,000 bridge at an estimated cost of $4,176,000. The contract is to start in July 2023, and the bridge is to be completed in October 2025. The following data pertain to the construction period. (Note that, by the end of 2024, Crane has revised the estimated total cost from $4,176,000 to $4,228,200.) Assume that progress billings are non-refundable. Costs to date (12/31) Estimated costs to complete (12/31) Progress billings during the year Cash collected during the year (a1) Account Titles and Explanation (To record cost of construction) (To record progress billings) (To record collections) (To record revenues) 2023 (To record construction expense) 3,173,760 $1,002,240 $2,959,740 $4,228,200 994,000 2024 834,960 1,268,460 2,483,000 Prepare all journal entries required for Crane to account for this contract for 2023. (Credit account titles are automatically indented when the amount is entered. Do not…arrow_forward

- Please assits with this cost accounting question Contract Masters Ltd has entered into a contract with Creative Dealers Ltd. for the construction of a new branch office. The contract began on March 1, 2022 and was completed on December 28 2022. The total value of the contract was $12,000,000. On December 30, 2022, an engineer inspected the project and issued a final certificate for work done. The following information is available with regards to the contract: $Site labour costs 3,120,000 Materials direct to site 2,000,000Materials returned 30,500 Materials from store and workshops 500,000 Maintenance of plant and use 980,000 Direct expenses 1,090,000 General overheads 750,000 Materials…arrow_forward(a) What is the weighted average of accumulated expenditures? (b) What is the avoidable interest for the building in 2018?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education