Concept explainers

On January 1, 2018, the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The building was completed on September 30, 2019.

Expenditures on the project were as follows:

| January 1, 2018 | $ | 1,710,000 | |

| March 1, 2018 | 1,320,000 | ||

| June 30, 2018 | 1,520,000 | ||

| October 1, 2018 | 1,320,000 | ||

| January 31, 2019 | 378,000 | ||

| April 30, 2019 | 711,000 | ||

| August 31, 2019 | 1,008,000 | ||

On January 1, 2018, the company obtained a $4,200,000 construction loan with a 16% interest rate. The loan was outstanding all of 2018 and 2019. The company’s other interest-bearing debt included two long-term notes of $4,000,000 and $6,000,000 with interest rates of 12% and 14%, respectively. Both notes were outstanding during all of 2018 and 2019. Interest is paid annually on all debt. The company’s fiscal year-end is December 31.

Required:

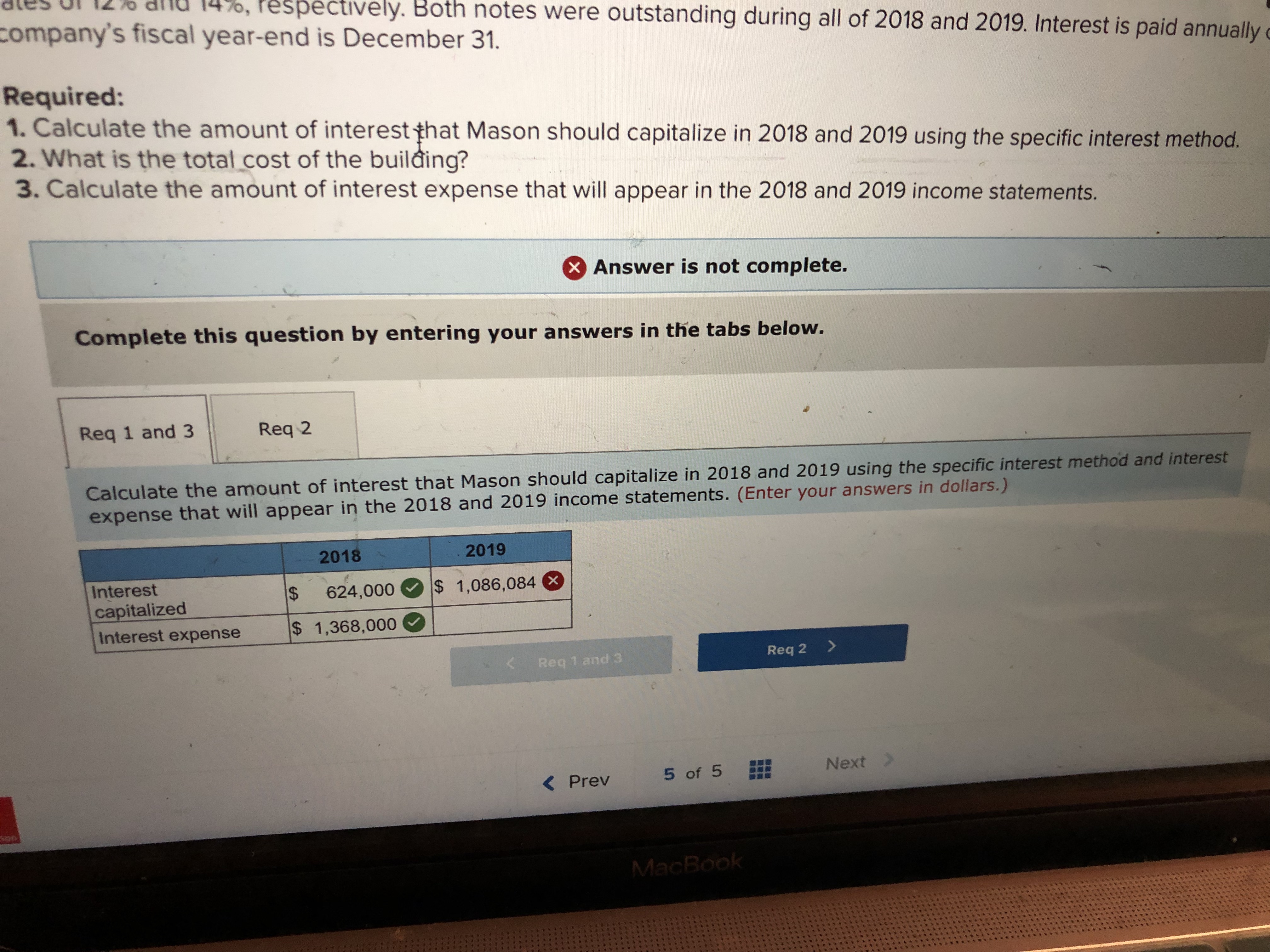

1. Calculate the amount of interest that Mason should capitalize in 2018 and 2019 using the specific interest method.

2. What is the total cost of the building?

3. Calculate the amount of interest expense that will appear in the 2018 and 2019 income statements.

I keep getting the wrong answer for total capitalization and expense

also i try doing the cost of the building

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

- < On August 1, 20Y4, the controller of Handy Dan Tools Inc. is planning capital expenditures for the years 2015-20Y8. The controller interviewed several Handy Dan executives to collect the necessary information for the capital expenditures budget. Excerpts of the interviews are as follows: Director of Facilities: A construction contract was signed in May 20Y4 for the construction of a new factory building at a contract cost of $11,500,000. The construction is scheduled to begin in 20Y5 and completed in 20Y6. Vice President of Manufacturing: Once the new factory building is finished, we plan to purchase $5.8 million in equipment in late 20Y6. I expect that an additional $870,000 will be needed early in the following year (20Y7) to test and install the equipment before we can begin production. If sales continue to grow, I expect we'll need to invest another 500,000 in equipment in 20Y8. Vice President of Marketing: We have really been growing lately. I wouldn't be surprised if we need to…arrow_forwardIn 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is as follows: Cost incurred during the year Estimated costs to complete as of year-end Billings during the year 2024 $ 2,523,000 6,177,000 2,070,000 2025 $ 3,177,000 1,800,000 3,630,000 2026 $ 1,980,000 0 Cash collections during the year 1,835,000 3,400,000 4,300,000 4,765,000 Westgate recognizes revenue over time according to percentage of completion. Problem 6-10 (Algo) Part 5 5. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years, assuming the following costs incurred and costs to complete information. Note: Do not round intermediate calculations and round your final answers to the nearest whole dollar amount. Loss amounts should be indicated with a minus sign. Costs incurred during the year Estimated costs to complete as of year-end 2024 $…arrow_forwardIn 2021, the Kokosing Construction Company of Columbus, Ohio entered into a contract to construct a road for Franklin County for $20,000,000. The road was completed in 2023. Information pertaining to the contract is provided below: 2021 2022 2023 Costs incurred during the year Estimated costs to complete as of year end Billings during the year Cash Collections during the year $4,800,000 $7,200,000 $4,400,000 11,200,000 4,000,000 4,000,000 8,000,000 8,000,000 3,600,000 7,200,000 9,200,000 Kokosing recognizes revenue over time according to percentage of completion. Required: 1. Compute the amount of revenue and gross profit to be recognized in 2021, 2022, and 2023. 2. Prepare the necessary journal entries for 2021 and 2022. Use the following accounts for your journal entries - "Construction in Progress", "Cash, Materials etc.", "Accounts Receivable", "Billings on Construction in Progress", "Cash", "Cost of Construction", and "Revenue from Long-term contracts". 3. Prepare a partial…arrow_forward

- On January 1, 2024, the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The building was completed on September 30, 2025. Expenditures on the project were as follows: January 1, 2024 March 1, 2024 June 30, 2024 October 1, 2024 January 31, 2025 April 30, 2025 August 31, 2025 $1,000,000 600,000 800,000 600,000 270,000 585,000 900,000 On January 1, 2024, the company obtained a $3 million construction loan with a 10% interest rate. The loan was outstanding all of 2024 and 2025. The company's other interest-bearing debt included two long-term notes of $4,000,000 and $6,000,000 with interest rates of 6% and 8%, respectively. Both notes were outstanding during all of 2024 and 2025. Interest is paid annually on all debt. The company's fiscal year-end is December 31. 4. Compute the cost to be allocated to the building in 2025 other than Capitalized Interest, Show your computation in the workpaper provided. 4. 1/31/2025 4/30/2025 8/31/2025…arrow_forward10) On January 1, 2024, the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The building was completed on September 30, 2025. Expenditures on the project were as follows: January 1, 2024 $ 1,000,000 March 1, 2024 600,000 June 30, 2024 800,000 October 1, 2024 600,000 January 31, 2025 270,000 April 30, 2025 585,000 August 31, 2025 900,000 On January 1, 2024, the company obtained a $3 million construction loan with a 10% interest rate. Assume the $3 million loan is not specifically tied to construction of the building. The loan was outstanding all of 2024 and 2025. The company’s other interest-bearing debt included two long-term notes of $4,000,000 and $6,000,000 with interest rates of 6% and 8%, respectively. Both notes were outstanding during all of 2024 and 2025. Interest is paid annually on all debt. The company’s fiscal year-end is December 31. Required: Using the weighted-average interest method, answer the…arrow_forwardOn January 1, 2024, the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The building was completed on September 30, 2025. Expenditures on the project were as follows: January 1, 2024 March 1, 2024 June 30, 2024 October 1, 2024 January 31, 2025 April 30, 2025 August 31, 2025 On January 1, 2024, the company obtained a $3,900,000 construction loan with a 12% interest rate. The loan was outstanding all of 2024 and 2025. The company's other interest-bearing debt included two long-term notes of $6,000,000 and $9,000,000 with interest rates of 8% and 10%, respectively. Both notes were outstanding during all of 2024 and 2025. Interest is paid annually on all debt. The company's fiscal year-end is December 31. Required: 1. Calculate the amount of interest that Mason should capitalize in 2024 and 2025 using the specific interest method. 2. What is the total cost of the building? 3. Calculate the amount of interest expense that will appear in…arrow_forward

- In 2021, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2023. Information related to the contract is as follows: 2021 2022 2023 Cost incurred during the year $ 3,344,000 $ 3,960,000 $ 1,645,600 Estimated costs to complete as of year-end 5,456,000 1,496,000 0 Billings during the year 2,800,000 4,504,000 2,696,000 Cash collections during the year 2,600,000 4,400,000 3,000,000 Assume that Westgate Construction’s contract with Santa Clara County does not qualify for revenue recognition over time.Required:1. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years.2-a. In the journal below, complete the necessary journal entries for the year 2021 (credit "Various accounts" for construction costs incurred).2-b. In the journal below, complete the necessary journal entries…arrow_forwardIn 2021, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2023. Information related to the contract is as follows: 2021 2022 2023 Cost incurred during the year $ 2,100,000 $ 2,450,000 $ 2,695,000 Estimated costs to complete as of year-end 4,900,000 2,450,000 0 Billings during the year 2,200,000 2,350,000 5,450,000 Cash collections during the year 1,900,000 2,300,000 5,800,000 Westgate recognizes revenue over time according to percentage of completion. 2-a. In the journal below, complete the necessary journal entries for the year 2021 (credit "Various accounts" for construction costs incurred).2-b. In the journal below, complete the necessary journal entries for the year 2022 (credit "Various accounts" for construction costs incurred).2-c. In the journal below, complete the necessary journal entries for the year 2023…arrow_forwardOn January 1, 2024, a company began construction of an automated cattle feeder system. The system was finished and ready for use on September 30, 2025. Expenditures on the project were as follows: January 1, 2024 $ 280,000 September 1, 2024 $ 360,000 December 31, 2024 $360,000 March 31, 2025 $ 360,000 September 30, 2025 $ 280,000 The company borrowed $770,000 on a construction loan at 10% interest on January 1, 2024. This loan was outstanding throughout the construction period. The company had $4,600,000 in 10% bonds payable outstanding in 2024 and 2025. Interest (using the specific interest method) capitalized for 2025 was: Multiple Choice A) $57,750. B) $97,070. C ) $113,820. D) $96,000.arrow_forward

- Explain clearlyarrow_forwardIn 2021, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2023. Information related to the contract is as follows: 2021 2022 2023 Cost incurred during the year $2,581,000 $2,347,000 $3,049,200 Estimated costs to complete as of year-end 6,319,000 2,772,000 0 Billings during the year 2,090,000 2,838,000 5,072,000 Cash collections during the year 1,845,000 2,900,000 5,255,000 Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years assuming the…arrow_forwardOn January 1, 2024, the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The building was completed on September 30, 2025. Expenditures on the project were as follows: January 1, 2024 March 1, 2024 June 30, 2024 October 1, 2024 January 31, 2025 April 30, 2025: August 31, 2025 On January 1, 2024, the company obtained a $4,300,000 construction loan with a 12% interest rate. The loan was outstanding all of 2024 and 2025. The company's other interest-bearing debt included two long-term notes of $3,000,000 and $7,000,000 with interest rates of 8% and 10%, respectively. Both notes were outstanding during all of 2024 and 2025. Interest is paid annually on all debt. The company's fiscal year-end is December 31. $1,740,000 1,380,000 1,580,000 1,380,000 387,000 720,000 1,017,000 Required: 1. Calculate the amount of interest that Mason should capitalize in 2024 and 2025 using the specific interest method. 2. What is the total cost of the…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education