FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

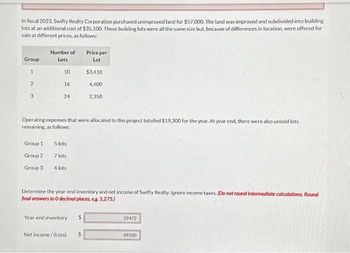

Transcribed Image Text:In fiscal 2023, Swifty Realty Corporation purchased unimproved land for $57,000. The land was improved and subdivided into building

lots at an additional cost of $35,100. These building lots were all the same size but, because of differences in location, were offered for

sale at different prices, as follows:

Group

1

2

3

Number of

Lots

Group 1

Group 2

Group 3

10

16

24

Operating expenses that were allocated to this project totalled $19,300 for the year. At year end, there were also unsold lots

remaining, as follows:

5 lots

7 lots

4 lots

Price per

Lot

Year-end inventory

$3,410

4,400

2,350

Determine the year-end inventory and net income of Swifty Realty. Ignore income taxes. (Do not round intermediate calculations. Round

final answers to O decimal places, eg. 5,275.)

Net income/(Loss) $

29472

49500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Imperial City of DooWopShaBopp just finished construction of a new municipal sewage treatment plant at a cost of $140,000,000. The MACRS depreciation for year 4 is The MACRS depreciation for years 6 is The MACRS depreciation for year 8 is At an interest rate of 6.2%, the present worth of the cumulative MACRS' depreciations for years 4, 6, and 8, rounded to the nearest ten-thousand dollars ($10,000), isarrow_forwardThe information below relates to the purchase of equipment: investment in the project: $10,000 Net annual cash inflows: 2,400 Working capital required: 5,000 Salvage value of the equipment: 1,000 Life of the project: 8 years At the completion of the project, the working capital will be released for use elsewhere. Compute the net present value of the project, using a discount rate of 10% $606 $8,271 ($1,729) $1,729arrow_forwardPlease help with answers asaparrow_forward

- Assume that Walmart Inc. has decided to surface and maintain for 10 years a vacant lot next to one of its stores to serve as a parking lot for customers. Management is considering the following bids involving two different qualities of surfacing for a parking area of 11,300 square yards. Bid A: A surface that costs $5.25 per square yard to install. This surface will have to be replaced at the end of 5 years. The annual maintenance cost on this surface is estimated at 25 cents per square yard for each year except the last year of its service. The replacement surface will be similar to the initial surface. Bid B: A surface that costs $10.75 per square yard to install. This surface has a probable useful life of 10 years and will require annual maintenance in each year except the last year, at an estimated cost of 12 cents per square yard. Click here to view factor tables. Compute present value of the bids. You may assume that the cost of capital is 12%, that the annual maintenance…arrow_forwardThe LJB Company must replace a freezer and is trying to decide betweenthe following two alternatives:Item Freezer A Freezer BInvestment required ($29,000) ($25,000)Annual electrical bill (3,000) (4,000)Salvage value 6,000 5,000Project life in years 11 11The LJB Company’s cost of capital is 8 percent.Which investment provides LJB with the lowest total cost?arrow_forwardOn March 31, 2020, Capital Investment Advisers paid $4,530,000 for land with two buildings on it. The plan was to demolish Building 1 and build a new store (Building 3) in its place. Building 2 was to be used as a company office and was appraised at a value of $1,307,320. A lighted parking lot near Building 2 had improvements (Land Improvements 1) valued at $560,280. Without considering the buildings or improvements, the tract of land was estimated to have a value of $2,801,400. Capital incurred the following additional costs: Cost to demolish Building 1 $ 691,160 Cost of additional landscaping 270,020 Cost to construct new building (Building 3) 2,472,000 Cost of new land improvements near Building 2 (Land Improvements 2) 253,800 Required:1. Allocate the costs incurred by Capital to the appropriate columns and total each column. 2. Prepare a single journal entry dated March 31, 2020, to record all the incurred costs, assuming they were paid in…arrow_forward

- Letang Industrial Systems Company (LISC) is trying to decide between two different conveyor belt systems. System A costs $335,000, has a four-year life, and requires $129,000 in pretax annual operating costs. System B costs $415,000, has a six-year life, and requires $123,000 in pretax annual operating costs. Both systems are to be depreciated straight-line to zero over their lives and will have zero salvage value. Whichever project is chosen, it will not be replaced when it wears out. The tax rate is 24 percent and the discount rate is 9 percent. Calculate the NPV for both conveyor belt systems. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) System A System Barrow_forwardInformation for two alternative projects involving machinery investments follows. Project 1 requires an initial investment of $229,500. Project 2 requires an initial investment of $156,000. Annual Amounts Project 1 Project 2 Sales of new product $ 148,000 $ 128,000 Expenses Materials, labor, and overhead (except depreciation) 77,000 44,000 Depreciation—Machinery 32,000 30,000 Selling, general, and administrative expenses 20,000 32,000 Income $ 19,000 $ 22,000 (a) Compute each project’s annual net cash flow.(b) Compute payback period for each investment.arrow_forwardThe City of Waltham wants to obtain the value of its 99 year old City Hall property. Your firm has been engaged to provide an estimate of value. You will use the Cost Approach to determine value. You will be required to estimate reproduction or replacement cost new (specify which is appropriate and why) and proceed through the steps of the Cost Approach to complete the task. Cost Estimates (000 omitted): Cost of new construction: $153,000; Since the last renovation 30 years ago, physical deterioration: $22,000; functional obsolescence: $6,000; external obsolescence: $2,000; four (4) comparable land values have been identified for the valuation estimate: $49,000; $35,000; $40,000; $52,000. Show your answer and the steps of your analysis below:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education