FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

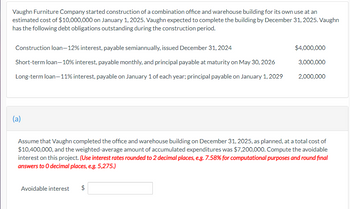

Transcribed Image Text:Vaughn Furniture Company started construction of a combination office and warehouse building for its own use at an

estimated cost of $10,000,000 on January 1, 2025. Vaughn expected to complete the building by December 31, 2025. Vaughn

has the following debt obligations outstanding during the construction period.

Construction loan-12% interest, payable semiannually, issued December 31, 2024

Short-term loan-10% interest, payable monthly, and principal payable at maturity on May 30, 2026

Long-term loan-11% interest, payable on January 1 of each year; principal payable on January 1, 2029

(a)

Assume that Vaughn completed the office and warehouse building on December 31, 2025, as planned, at a total cost of

$10,400,000, and the weighted-average amount of accumulated expenditures was $7,200,000. Compute the avoidable

interest on this project. (Use interest rates rounded to 2 decimal places, e.g. 7.58% for computational purposes and round final

answers to O decimal places, e.g. 5,275.)

Avoidable interest

$4,000,000

3,000,000

2,000,000

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

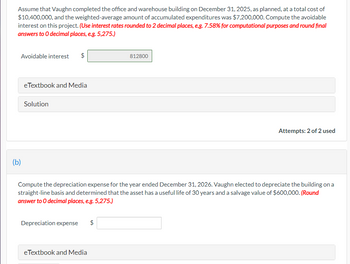

Transcribed Image Text:Assume that Vaughn completed the office and warehouse building on December 31, 2025, as planned, at a total cost of

$10,400,000, and the weighted-average amount of accumulated expenditures was $7,200,000. Compute the avoidable

interest on this project. (Use interest rates rounded to 2 decimal places, e.g. 7.58% for computational purposes and round final

answers to O decimal places, e.g. 5,275.)

Avoidable interest

(b)

$

LA

Solution

eTextbook and Media

Depreciation expense $

Compute the depreciation expense for the year ended December 31, 2026. Vaughn elected to depreciate the building on a

straight-line basis and determined that the asset has a useful life of 30 years and a salvage value of $600,000. (Round

answer to O decimal places, e.g. 5,275.)

eTextbook and Media

812800

CA

Attempts: 2 of 2 used

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

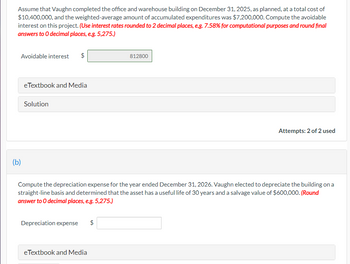

Transcribed Image Text:Assume that Vaughn completed the office and warehouse building on December 31, 2025, as planned, at a total cost of

$10,400,000, and the weighted-average amount of accumulated expenditures was $7,200,000. Compute the avoidable

interest on this project. (Use interest rates rounded to 2 decimal places, e.g. 7.58% for computational purposes and round final

answers to O decimal places, e.g. 5,275.)

Avoidable interest

(b)

$

LA

Solution

eTextbook and Media

Depreciation expense $

Compute the depreciation expense for the year ended December 31, 2026. Vaughn elected to depreciate the building on a

straight-line basis and determined that the asset has a useful life of 30 years and a salvage value of $600,000. (Round

answer to O decimal places, e.g. 5,275.)

eTextbook and Media

812800

CA

Attempts: 2 of 2 used

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Skysong Industries Inc. started construction of a manufacturing facility for its own use at an estimated cost of $8,600,000 on January 1, 2017. Skysong expected to complete the building by December 31, 2017. Skysong’s debt, all of which was outstanding during the construction period, was as follows. ● Construction loan—11% interest, payable semiannually, issued December 31, 2016; $4,300,000 ● Long-term loan #1 – 10% interest, payable on January 1 of each year. Principal payable on January 1, 2019; $1,290,000 ● Long-term loan #2—12% interest, payable on December 31 of each year. Principal payable on December 31, 2025; $3,010,000 Assume that Skysong completed the facility on December 31, 2017, at a total cost of $8,858,000, and the weighted-average amount of accumulated expenditures was $5,848,000.A. Compute the avoidable interest on this project. (Use interest rates rounded to 2 decimal places, e.g. 7.58% and round final answer to 0 decimal places,…arrow_forwardLCD Industries purchased a supply of electronic components from Entel Corporation on November 1, 2024. In payment for the $25.1 million purchase, LCD issued a 1-year installment note to be paid in equal monthly payments at the end of each month. The payments include interest at the rate of 12%. Questions: 1. & 2. Prepare the journal entries for LCD’s purchase of the components on November 1, 2024 and the first installment payment on November 30, 2024. 3. What is the amount of interest expense that LCD will report in its income statement for the year ended December 31, 2024? Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)arrow_forwardUser In February 2024, Cullumber Corp, began the construction of a 10-storey building. The construction is expected to be completed by January 2025. during 2024, the following payments were made: Apr. 1: 1010000 Jun. 1: 1500000 Aug. 1: 840000 Oct. 1: 890000 No asset specific debt was incurred. During 2024, Cullumber's general debt consisted of the following: $1.8 million, 5%, 2-year note, $1.1 million, 4.5%, 2-year note, $0.50 million, 3%, 5-year note. Calculate the avoidable borrowing costs. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Construction loan-12% interest, payable semiannually, issued December 31, 2019 Short-term loan-10% interest, payable monthly, and principal payable at maturity on May 30, 2021 Long-term loan-11% interest, payable on January 1 of each year. Principal payable on January 1, 2024 Ⓒ Whispering Furniture Company started construction of a combination office and warehouse building for its own use at an estimated cost of $3,000,000 on January 1, 2020. Whispering expected to complete the building by December 31, 2020. Whispering has the following debt obligations outstanding during the construction period. $1,200,000 840,000 600,000 Show Time Assume that Whispering completed the office and warehouse building on December 31, 2020, as planned at a total cost of $3.120,000, and the weighted average amount of accumulated expenditures was $2.160,000. Compute the avoidable interest on this project. (Use interest rates rounded to 2 decimal places, e.g. 7.58% for computational purposes and round final…arrow_forwardKlutlan Industries began construction of a warehouse on July 1, 2018. The project was completed on March 31, 2019. No new loans were required to fund construction. Klutlan does have the following two interest-bearing liabilities that were outstanding throughout the construction period: $2,000,000, 8% note $8,000,000, 5% bonds Construction expenditures incurred were as follows: July 1, 2018 $520,000 September 30, 2018 600,000 November 30, 2018 600,000 January 30, 2019 540,000 The company's fiscal year-end is December 31. Question The total value of the warehouse at the end of construction would be: a $2,288,000 b $2,317,702 c $1,745,760 d $2,260,000arrow_forwardEe.52.arrow_forward

- Skysong Industries Inc. started construction of a manufacturing facility for its own use at an estimated cost of $11,000,000 on January 1, 2017. Skysong expected to complete the building by December 31, 2017. Skysong’s debt, all of which was outstanding during the construction period, was as follows. ● Construction loan—11% interest, payable semiannually, issued December 31, 2016; $5,500,000 ● Long-term loan #1 – 10% interest, payable on January 1 of each year. Principal payable on January 1, 2019; $1,650,000 ● Long-term loan #2—12% interest, payable on December 31 of each year. Principal payable on December 31, 2025; $3,850,000 (a) Assume that Skysong completed the facility on December 31, 2017, at a total cost of $11,330,000, and the weighted-average amount of accumulated expenditures was $7,480,000.Compute the avoidable interest on this project. (Use interest rates rounded to 2 decimal places, e.g. 7.58% and round final answer to 0 decimal…arrow_forwardVishnuarrow_forwardRequired information [The following information applies to the questions displayed below.] On January 1, 2021, Stoops Entertainment purchases a building for $580,000, paying $110,000 down and borrowing the remaining $470,000, signing a 9%, 15-year mortgage. Installment payments of $4,767.05 are due at the end of each month, with the first payment due on January 31, 2021. 4. Total payments over the 15 years are $858,069 ($4,767.05 x 180 monthly payments). How much of this is interest expense and how much is actual payment of the loan? Interest expense Actual payments on the loanarrow_forward

- Vdarrow_forwardIvanhoeFurniture Company started construction of a combination office and warehouse building for its own use at an estimated cost of $10,500,000 on January 1, 2020. Ivanhoe expected to complete the building by December 31, 2020. Ivanhoe has the following debt obligations outstanding during the construction period. Construction loan-12% interest, payable semiannually, issued December 31, 2019 $4,200,000 Short-term loan-10% interest, payable monthly, and principal payable at maturity on May 30, 2021 3,150,000 Long-term loan-11% interest, payable on January 1 of each year. Principal payable on January 1, 2024 2,100,000 Assume that Ivanhoe completed the office and warehouse building on December 31, 2020, as planned at a total cost of $10,920,000, and the weighted-average amount of accumulated expenditures was $7,560,000. Compute the avoidable interest on this project. (Use interest rates rounded to 2 decimal places, e.g. 7.58% for computational purposes and…arrow_forwardMartinez Furniture started construction of a combination office and warehouse building for its own use at an estimated cost c €4,400,000 on January 1, 2022. Martinez expected to complete the building by December 31, 2022. Martinez has the followir obligations outstanding during the construction period. Construction loan-8% interest, payable semiannually, issued December 31, 2021 €1,800,000 Short-term loan-6% interest, payable monthly, and principal payable at maturity on May 30, 2023 1,440,000 Long-term loan-7% interest, payable on January 1 of each year. Principal payable on January 1, 2026 900,000 (a) Assume that Martinez completed the office and warehouse building on December 31, 2022, as planned at a total cost of €4,680,000. The following expenditures were made during the period forthis project: January 1, €900,000; April 1, €1,300,000; July 1, €1,700,000; and October 1, €560,000. Excess funds from the construction loans were invested during the period and earned €20,000 of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education