Current Liabilities Accounts Payable Income Taxes Payable Dividends Payable Other Operating Expenses Total Current Liabilities Stockholders' Equity Stockholders' Equity > > > Total Paid-in Capital and Retained Earnings Stockholders' Equity $ $ BLUE SPRUCE CORP. Balance Sheet December 31, 2021 Cash Accounts receivable $14,760 Accounts payable $15,360 27,300 Common stock ($10 par) 48,000 Allowance for doubtful accounts (900) Retained earnings 76,440 Supplies 2,640 Land 24,000 Buildings 85,200 Accumulated depreciation-buildings (13,200 ) $139,800 $139,800 During 2022, the following transactions occurred. 1. On January 1, Blue issued 720 shares of $40 par, 7% preferred stock for $29,520. 2. On January 1, Blue also issued 540 shares of the $10 par value common stock for $12,600. 3. Blue performed services for $192,000 on account. 4. On April 1, 2022, Blue collected fees of $21,600 in advance for services to be performed from April 1, 2022, to March 31, 2023. 5. Blue collected $165,600 from customers on account. 6. Blue bought $21,060 of supplies on account.

Current Liabilities Accounts Payable Income Taxes Payable Dividends Payable Other Operating Expenses Total Current Liabilities Stockholders' Equity Stockholders' Equity > > > Total Paid-in Capital and Retained Earnings Stockholders' Equity $ $ BLUE SPRUCE CORP. Balance Sheet December 31, 2021 Cash Accounts receivable $14,760 Accounts payable $15,360 27,300 Common stock ($10 par) 48,000 Allowance for doubtful accounts (900) Retained earnings 76,440 Supplies 2,640 Land 24,000 Buildings 85,200 Accumulated depreciation-buildings (13,200 ) $139,800 $139,800 During 2022, the following transactions occurred. 1. On January 1, Blue issued 720 shares of $40 par, 7% preferred stock for $29,520. 2. On January 1, Blue also issued 540 shares of the $10 par value common stock for $12,600. 3. Blue performed services for $192,000 on account. 4. On April 1, 2022, Blue collected fees of $21,600 in advance for services to be performed from April 1, 2022, to March 31, 2023. 5. Blue collected $165,600 from customers on account. 6. Blue bought $21,060 of supplies on account.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.23E: Unusual income statement items Assume that the amount of each of the following items is material to...

Related questions

Question

I need help on the

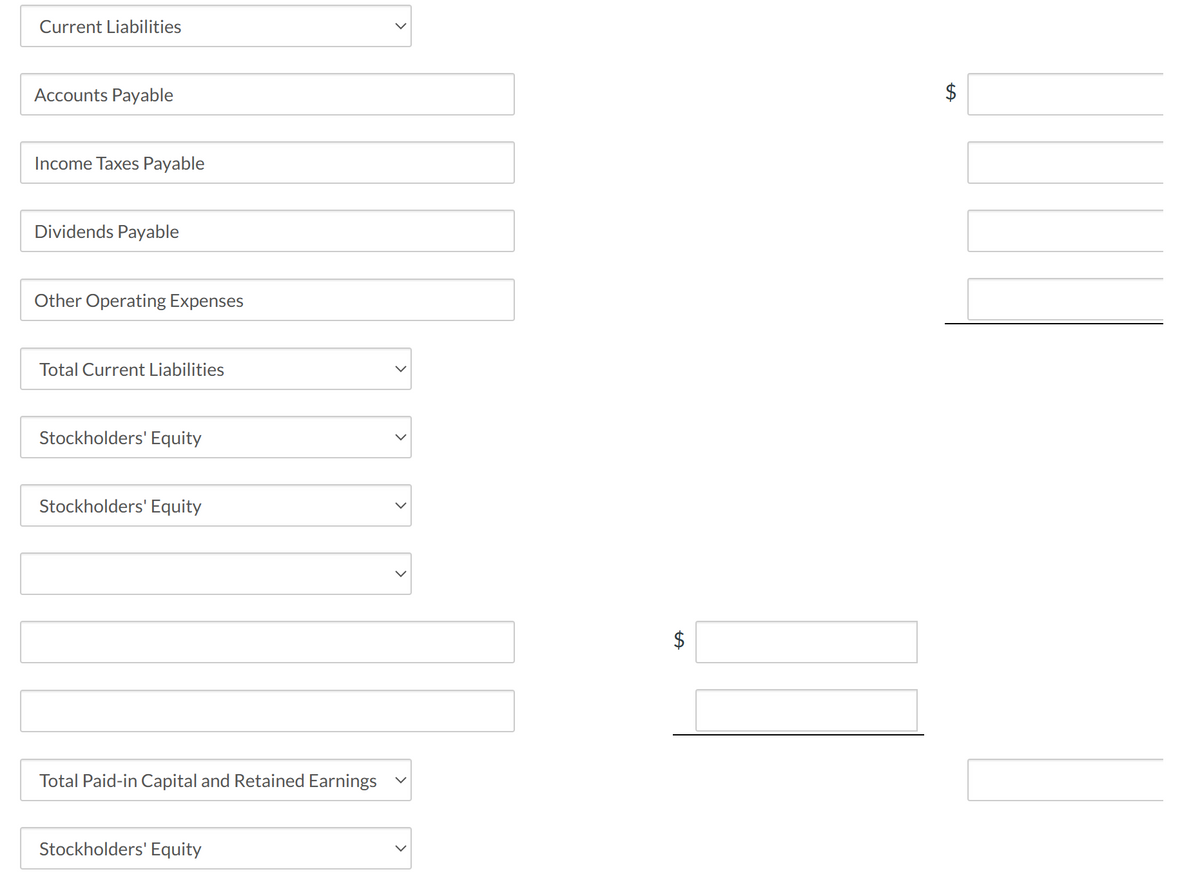

Transcribed Image Text:Current Liabilities

Accounts Payable

Income Taxes Payable

Dividends Payable

Other Operating Expenses

Total Current Liabilities

Stockholders' Equity

Stockholders' Equity

>

>

>

Total Paid-in Capital and Retained Earnings

Stockholders' Equity

$

$

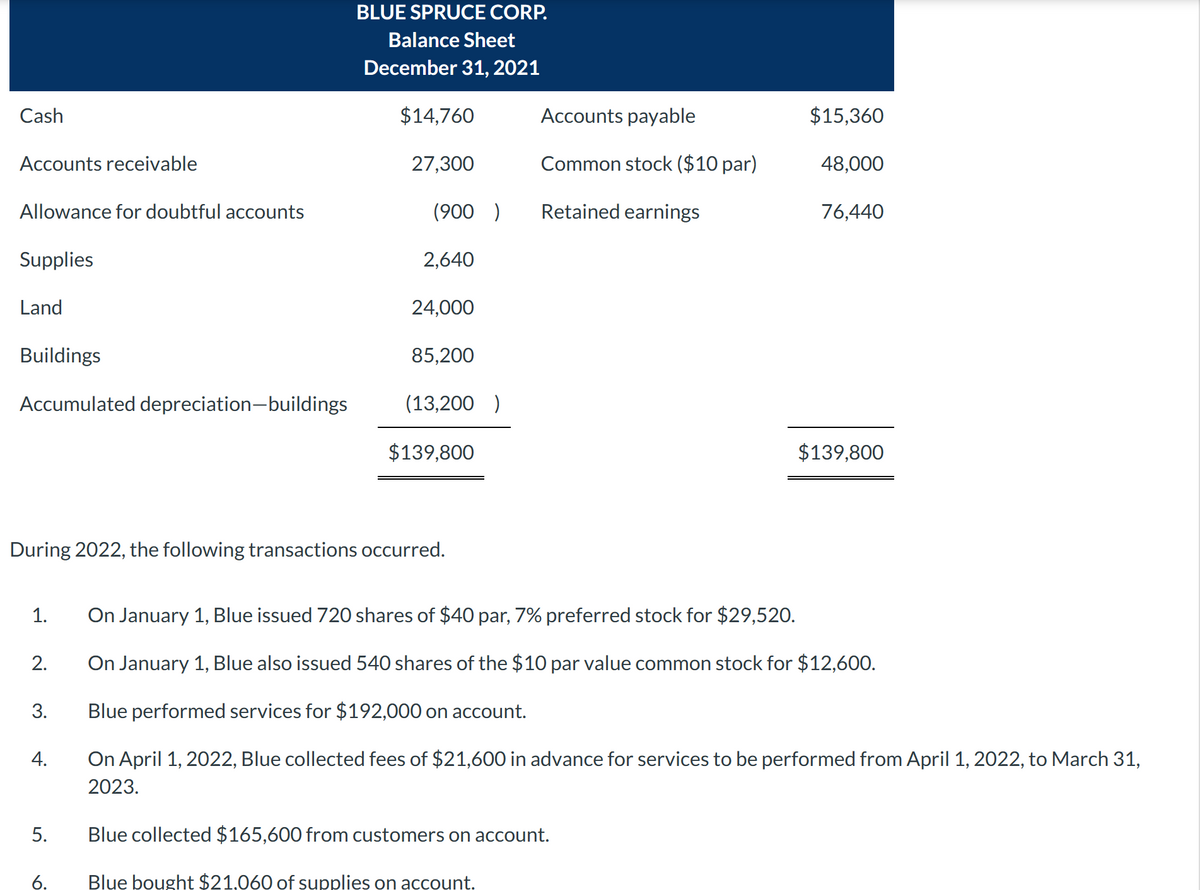

Transcribed Image Text:BLUE SPRUCE CORP.

Balance Sheet

December 31, 2021

Cash

Accounts receivable

$14,760

Accounts payable

$15,360

27,300

Common stock ($10 par)

48,000

Allowance for doubtful accounts

(900)

Retained earnings

76,440

Supplies

2,640

Land

24,000

Buildings

85,200

Accumulated depreciation-buildings

(13,200 )

$139,800

$139,800

During 2022, the following transactions occurred.

1.

On January 1, Blue issued 720 shares of $40 par, 7% preferred stock for $29,520.

2.

On January 1, Blue also issued 540 shares of the $10 par value common stock for $12,600.

3.

Blue performed services for $192,000 on account.

4.

On April 1, 2022, Blue collected fees of $21,600 in advance for services to be performed from April 1, 2022, to March 31,

2023.

5.

Blue collected $165,600 from customers on account.

6.

Blue bought $21,060 of supplies on account.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning