+ Aquatic Line Company (ALC) manufactures a variety of strong and durable ropes. The company manufactures all their products in a large factory located near Nephi, Utah. All the types of ropes the company manufactures can be produced using the same machines in the factory. Workers can adjust the machines to produce the specific type of rope needed for production. ALC is reviewing the profitability of its products to understand if changes need to be made to its product portfolio. Product N3 is a heavy, durable rope used to secure ships when they dock. The following is the product-line contribution margin statement for the most recent year. Revenue $ 1,150,000 Variable Costs Direct Material $ 600,000 Direct Labor $ 100,000 Variable Overhead $ 150,000 Shipping $ 85,000 Contribution Margin $ 215,000 Fixed Costs Rent $ 50,000 Indirect Labor $ 115,000 Marketing $ 56,000 Operating Income $ (6,000) For the most recent year, ALC sold 10,000 yards of N3. The sales price of N3 is $115 per yard. Management is concerned about the $6,000 operating loss for N3 and considering dropping the product line altogether and has asked you to analyze the choice to either keep N3 in the portfolio or drop the product. If ALC drops N3, ALC will lose all the sales revenue associated with N3 but also save on all of the variable costs associated with N3. N3 is produced in a factory with other products, so total rent will not decrease even if N3 is dropped. Indirect labor includes the salaries and wages of product and factory supervisors. ALC expects 80% of the indirect labor costs associated with N3 to be eliminated if N3 is dropped because some of the supervisors oversee other products besides N3 and so will remain with the company. ALC expects 75% of the marketing costs with N3 to be eliminated if N3 is dropped. Because dropping N3 will result in excess capacity in the factory, ALC has explored ways to utilize that capacity. N3 has found an outside textile manufacturing that would be willing to pay $120,000 a year to utilize ALC's factory and machines to make their own products if N3 is dropped. Finally, ALC has found that the purchase of N3 is somewhat correlated with the purchase of another rope product they manufacture, the N4. Therefore, ALC believes that the contribution margin of N4 will decrease by 12% from the previous year amount if N3 is dropped. N4 had a total of $150,000 of contribution margin last year. Nothing else about N4 would change if N3 is dropped. Should ALC drop N3?

+ Aquatic Line Company (ALC) manufactures a variety of strong and durable ropes. The company manufactures all their products in a large factory located near Nephi, Utah. All the types of ropes the company manufactures can be produced using the same machines in the factory. Workers can adjust the machines to produce the specific type of rope needed for production. ALC is reviewing the profitability of its products to understand if changes need to be made to its product portfolio. Product N3 is a heavy, durable rope used to secure ships when they dock. The following is the product-line contribution margin statement for the most recent year. Revenue $ 1,150,000 Variable Costs Direct Material $ 600,000 Direct Labor $ 100,000 Variable Overhead $ 150,000 Shipping $ 85,000 Contribution Margin $ 215,000 Fixed Costs Rent $ 50,000 Indirect Labor $ 115,000 Marketing $ 56,000 Operating Income $ (6,000) For the most recent year, ALC sold 10,000 yards of N3. The sales price of N3 is $115 per yard. Management is concerned about the $6,000 operating loss for N3 and considering dropping the product line altogether and has asked you to analyze the choice to either keep N3 in the portfolio or drop the product. If ALC drops N3, ALC will lose all the sales revenue associated with N3 but also save on all of the variable costs associated with N3. N3 is produced in a factory with other products, so total rent will not decrease even if N3 is dropped. Indirect labor includes the salaries and wages of product and factory supervisors. ALC expects 80% of the indirect labor costs associated with N3 to be eliminated if N3 is dropped because some of the supervisors oversee other products besides N3 and so will remain with the company. ALC expects 75% of the marketing costs with N3 to be eliminated if N3 is dropped. Because dropping N3 will result in excess capacity in the factory, ALC has explored ways to utilize that capacity. N3 has found an outside textile manufacturing that would be willing to pay $120,000 a year to utilize ALC's factory and machines to make their own products if N3 is dropped. Finally, ALC has found that the purchase of N3 is somewhat correlated with the purchase of another rope product they manufacture, the N4. Therefore, ALC believes that the contribution margin of N4 will decrease by 12% from the previous year amount if N3 is dropped. N4 had a total of $150,000 of contribution margin last year. Nothing else about N4 would change if N3 is dropped. Should ALC drop N3?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 9E: GrillMaster Inc. sells an industry-leading line of outdoor charcoal and gas grills to customers...

Related questions

Question

Transcribed Image Text:+

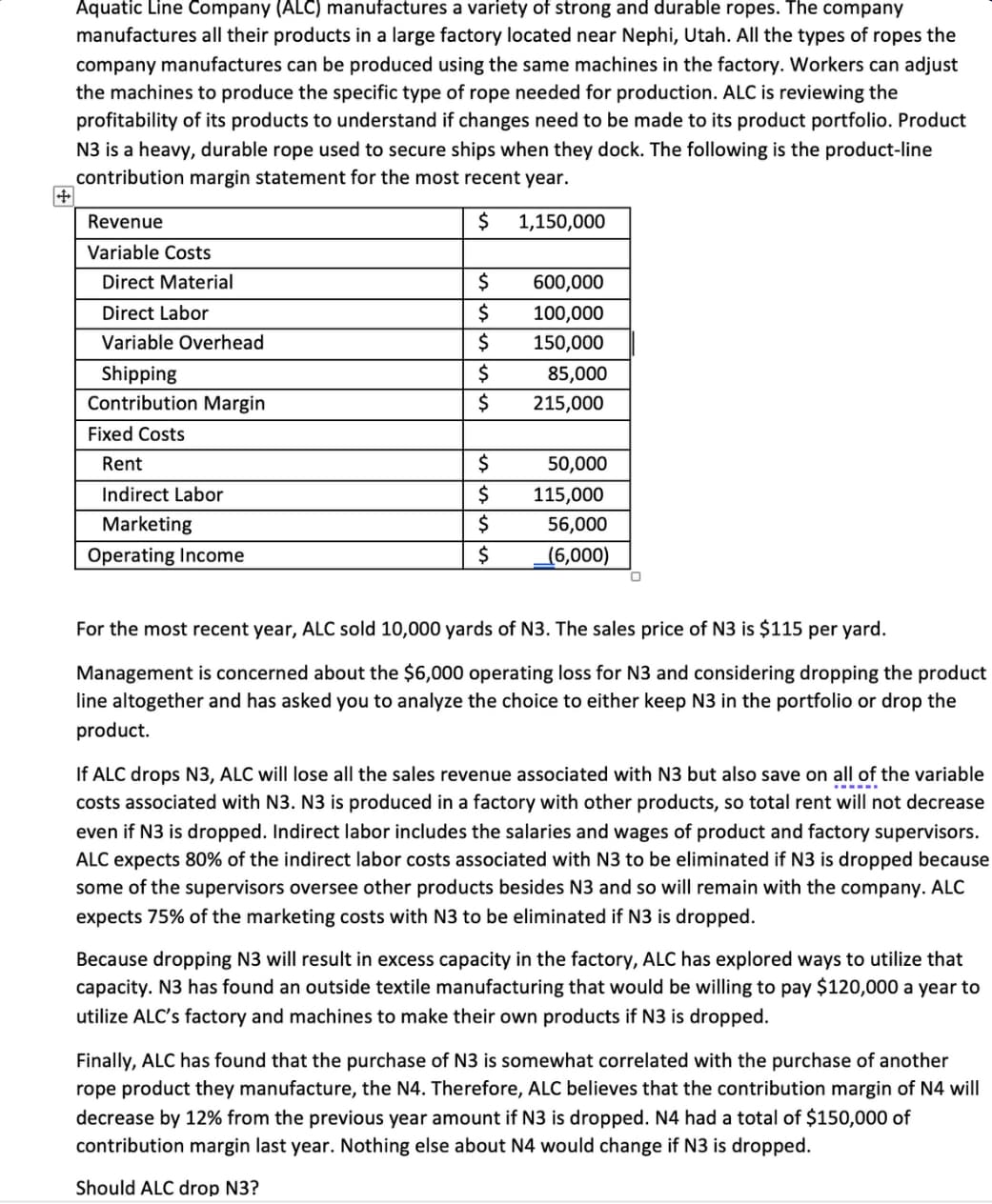

Aquatic Line Company (ALC) manufactures a variety of strong and durable ropes. The company

manufactures all their products in a large factory located near Nephi, Utah. All the types of ropes the

company manufactures can be produced using the same machines in the factory. Workers can adjust

the machines to produce the specific type of rope needed for production. ALC is reviewing the

profitability of its products to understand if changes need to be made to its product portfolio. Product

N3 is a heavy, durable rope used to secure ships when they dock. The following is the product-line

contribution margin statement for the most recent year.

Revenue

$

1,150,000

Variable Costs

Direct Material

$

600,000

Direct Labor

$

100,000

Variable Overhead

$ 150,000

Shipping

$

85,000

Contribution Margin

$

215,000

Fixed Costs

Rent

$

50,000

Indirect Labor

$

115,000

Marketing

$

56,000

Operating Income

$

(6,000)

For the most recent year, ALC sold 10,000 yards of N3. The sales price of N3 is $115 per yard.

Management is concerned about the $6,000 operating loss for N3 and considering dropping the product

line altogether and has asked you to analyze the choice to either keep N3 in the portfolio or drop the

product.

If ALC drops N3, ALC will lose all the sales revenue associated with N3 but also save on all of the variable

costs associated with N3. N3 is produced in a factory with other products, so total rent will not decrease

even if N3 is dropped. Indirect labor includes the salaries and wages of product and factory supervisors.

ALC expects 80% of the indirect labor costs associated with N3 to be eliminated if N3 is dropped because

some of the supervisors oversee other products besides N3 and so will remain with the company. ALC

expects 75% of the marketing costs with N3 to be eliminated if N3 is dropped.

Because dropping N3 will result in excess capacity in the factory, ALC has explored ways to utilize that

capacity. N3 has found an outside textile manufacturing that would be willing to pay $120,000 a year to

utilize ALC's factory and machines to make their own products if N3 is dropped.

Finally, ALC has found that the purchase of N3 is somewhat correlated with the purchase of another

rope product they manufacture, the N4. Therefore, ALC believes that the contribution margin of N4 will

decrease by 12% from the previous year amount if N3 is dropped. N4 had a total of $150,000 of

contribution margin last year. Nothing else about N4 would change if N3 is dropped.

Should ALC drop N3?

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning