FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:7.

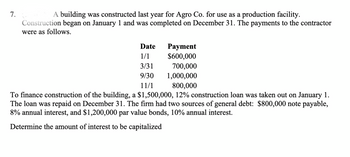

A building was constructed last year for Agro Co. for use as a production facility.

Construction began on January 1 and was completed on December 31. The payments to the contractor

were as follows.

Date

Payment

1/1

$600,000

3/31

700,000

9/30

1,000,000

11/1

800,000

To finance construction of the building, a $1,500,000, 12% construction loan was taken out on January 1.

The loan was repaid on December 31. The firm had two sources of general debt: $800,000 note payable,

8% annual interest, and $1,200,000 par value bonds, 10% annual interest.

Determine the amount of interest to be capitalized

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Buildmore Construction limited received a contract for $6000000 in year 1 to build a parking complex for the federal government. The following data was accumulated during the construction period: Total costs to date year1 $1800 000,Year 2 $2090 000,Year 3 $5000 000;Estimated cost to complete Year 1 $2700 000,Year 2 $3410 000,Year 3 $0;Progress billings during year Year 1 $2000 000,Year 2 $2000 000,Year 3 $2000 000:Cash collected during year Year 1 $1500 000,Year 2 $2000 000,Year 3 $2500 000. Prepare journalsarrow_forwardA company constructs a building for its own use. Construction began on January 1 and ended on December 30. The expenditures for construction were as follows: January 1, $680,000; March 31, $780,000; June 30, $580,000; October 30, $1,140,000. To help finance construction, the company arranged a 9% construction loan on January 1 for $1,060,000. The company's other borrowings, outstanding for the whole year, consisted of a $4 million loan and a $6 million note with interest rates of 10% and 8%, respectively. Assuming the company uses the specific interest method, calculate the amount of interest capitalized for the year. Note: Enter your answers in whole dollars and not in millions. Do not round intermediate calculations. Round your percentage answers to 2 decimal places (i.e. 0.1234 should be entered as 12.34%). Date January 1 March 31 June 30 October 30 Accumulated expenditures Average accumulated expenditures Expenditure Amount X X X Weight Interest Rate % % "1 II = = Average…arrow_forwardAt the end of Year 1, how much is the balance of the assets account Production-in-Progress if WW Guy uses the percentage of completion method? see the options in attached screenshot.arrow_forward

- Whispering Ltd. is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were HK$ 1,470,000 on March 1, HK$984,000 on June 1, and HK$ 2,406,000 on December 31. Whispering Ltd. had outstanding all year a 12%, 5-year, HK$ 3,840,000 note payable and on 13 %, 4-year, HK$3,360,000 note payable. Determine the amount of borrowing cost that Whispering Ltd. would capitalize. Use the capitalization rate used for borrowing cost capitalization purposearrow_forwardPlease walk me through problem.arrow_forwardCurrent Attempt in Progress Crane Company is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were $1,800,000 on March 1, $1,200,000 on June 1, and $3,026,000 on December 31. Crane Company borrowed $1.159,000 on March 1 on a 5-year, 12% note to help finance construction of the building. In addition, the company had outstanding all year a 9%, 5-year, $2,017,000 note payable and an 10 %, 4-year, $3,600,000 note payable. Compute avoidable interest for Crane Company. Use the weighted-average interest rate for interest capitalization purposes. (Round weighted- average interest rate to 4 decimal places, eg. 0.2152 and final answer to 0 decimal places, e.g. 5,275.) I Avoidable interest $ eTextbook and Media Save for Later Assistance Used Attempts: 0 of 3 used Submit Answerarrow_forward

- At the beginning of 2009, Florida Road Construction entered into a contract to build a road for the government. Construction will take four years. Th e following information as of 31 December 2009 is available for the contract: Total revenue according to contract $10,000,000 Total expected cost $ 8,000,000 Cost incurred during 2009 $ 1,200,000 Assume that the company estimates percentage complete based on costs incurred as a percentage of total estimated costs. Under the completed contract method, how much revenue will be reported in 2009? B . $300,000.arrow_forwardStar Construction Corporation has a contract to construct a building for $10,950,000. The building is controlled by the customer throughout the term of the contract. Total costs to complete the building were originally estimated at $8,850,000. Construction commenced on 4 February 20×5. Actual costs were in line with estimated costs for 20×5 and 20×6. In 20×7, actual costs exceeded estimated costs by $150,000. Total construction costs incurred in each year were as follows: 20X5: $2,700,00020X6: $4,500,00020X7: $1,800,000 Progress billings based on the amount of work completed were collected each year. Star Construction uses the percentage-of-completion method. The percentage-of-completion is based on costs incurred compared with estimated total costs of the project. Company also billed the client and collected the following payments Year Billings Payments Received 20X5: $2,300,000 $2,100,000 20X6: $4,900,000 $4,700,000 20X7: $3,750,000 $4,150,000…arrow_forwardPlease help mearrow_forward

- please give me answerarrow_forwardA construction company entered into a fixed-price contract to build a soccer stadium for $15,000,000. Construction costs incurred during the first year were $3,675,000, and estimated costs to complete at the end of the year were $6,825,000. The company recognizes revenue over time according to percentage of completion. Fixed-price contract amount: $15,000,000 Construction costs incurred in first year: $3,675,000 Estimated costs to complete at end of first year: $6,825,000 How much revenue and gross profit or loss will appear in the company’s income statement in the first year of the contract? Percentage of completion at end of first year Revenue Gross profit (loss) Nothing in this area will be graded, but it will be submitted with your assignment.arrow_forwardVikramarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education