Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

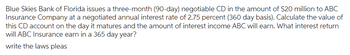

Transcribed Image Text:Blue Skies Bank of Florida issues a three-month (90-day) negotiable CD in the amount of $20 million to ABC

Insurance Company at a negotiated annual interest rate of 2.75 percent (360 day basis). Calculate the value of

this CD account on the day it matures and the amount of interest income ABC will earn. What interest return

will ABC Insurance earn in a 365 day year?

write the laws pleas

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You borrowed $200,000 from the Bank of Nova Scotia. The loan is to be repaid at the end of five (5) years. The bank is to receive 8% interest on the loan balance that is outstanding. i. Calculate the yearly payment on a $200 000 loan. ii. Prepare an amortization schedule for this loan. iii. What is the loan balance just after the end of year two (2)? iv. What is the total interest paid over the life of the loan? v. What is the effective rate of interest on the loan if interest is compounded quarterly?arrow_forwardA floating rate mortgage loan is made for $185,000 for a 30-year period at an initial rate of 12 percent interest. However, the borrower and lender have negotiated a monthly payment of $1,480. Required: a. What will be the loan balance at the end of year 1? b. If the interest rate increases to 13 percent at the end of year 2, how much is the payment plus negative amortization in year 2 and year 5 if the payment remains at $1,480?arrow_forwardIf you borrow $1000.00 on May 1, 2019, at 10% compounded semi dash annually, and interest on the loan amounts to $134.11, on what date is the loan due?arrow_forward

- Lorena's Cart took out a loan from the bank today for $245,800.00. The loan requires Lorena's Cart to make a special payment of $82,400.00 to the bank in 3 years and also make regular, fixed payments of X to the bank each year forever. The interest rate on the loan is 9.60 percent per year and the first regular, fixed annual payment of X will be made to the bank in 1 year. What is X, the amount of the regular, fixed annual payment? O $15,686.40 (plus or minus 3 dollars) O $62,588.64 (plus or minus 3 dollars) O $17,588.29 (plus or minus 3 dollars) O $23,596.80 (plus or minus 3 dollars) O none of the answers are within 3 dollars of the correct answerarrow_forwardAssuming a 28% lender's affordability ratio, estimated monthly property taxes and insurance of P250, a 25% down payment (of the purchase price), and an annual gross income of P84,800, calculate the maximum purchase price based on monthly income. The monthly payment will occur at the end of the month and you plan to pay off the mortgage over a 30-year period at a 6.25% annual interest rate. a.P374,343b.P280,757c.P282,219d.P321,360e.None of the abovearrow_forwardA mortgage broker is offering a $279,000 30-year mortgage with a teaser rate. In the first two years of the mortgage, the borrower makes monthly payments on only a 4.5 percent APR interest rate. After the second year, the mortgage interest rate charged increases to 7.5 percent APR. What are the monthly payments in the first two years? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly payment What are the monthly payments after the second year? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly payment > 2 D TRENE VAR TVUNG S 2006- E - Earrow_forward

- On January 1, 2022, Anderson Company purchased a machine with a cost of $14,409.50. To complete the purchase, Anderson signs a note specifying monthly payments of $600 beginning one month from the purchase date. The interest rate is 18% compounded monthly. How many payments will Anderson make for this loan? What is the total amount of interest that Anderson will pay over the life of this loan?arrow_forwardIf you borrow $1000.00 on May 1, 2019, at 10% compounded semi - annually, and interest on the loan amounts to $154.87, on what date is the loan due? The due date is (Round down to the nearest day.)arrow_forwardA mortgage broker is offering a $279,000 30-year mortgage with a teaser rate. In the first two years of the mortgage, the borrower makes monthly payments on only a 4.5 percent APR interest rate. After the second year, the mortgage interest rate charged increases to 7.5 percent APR. What are the monthly payments in the first two years? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly payment What are the monthly payments after the second year? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly paymentarrow_forward

- A mortgage broker is offering a 30-year $192,900 mortgage with a teaser rate. In the first two years of the mortgage, the borrower makes monthly payments on only a 4.9 percent APR interest rate. After the second year, the mortgage interest rate charged increases to 7.9 percent APR. What are the monthly payments in the first two years? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly payment What are the monthly payments after the second year? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly paymentarrow_forwardOn December 31, 2023, ABC company borrows $480,000 from the First Bank to start a business. The loan requires quarterly payments for 10 years and the interest rate on the loan is 12%. ABC company's quarterly payment is:arrow_forwardTiary has obtained a special 3-year, $12,000,000 increasing graduated payment mortgage from Nopay Bank requiring annual mortgage payment at 10% mortgage rate. The annual payment will increase by 10% each year. What is the total interest expense of the mortgage? a) $ 1,200,000 b) $ 1,684,000 c) $ 2,080,000 d) $ 2,476,133 e) $ 2,564,000 Answer is Darrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education