Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

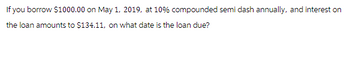

Transcribed Image Text:If you borrow $1000.00 on May 1, 2019, at 10% compounded semi dash annually, and interest on

the loan amounts to $134.11, on what date is the loan due?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- castor borrowed today from Chuchu P100,000.00 and agreed to repay the loan with 3 equal monthly amounts, the first payment to start 1 month from today. How much is the value of the monthly payment? construct an amortization schedule. Interest is 12%compounded monthly.arrow_forwardIf I plan to avail of a loan today and I will pay it P7,338 every start of the month for 6 years charged by an interest rate of 11.6% compounded quarterly. How much money will I take home today if I will avail of the loan, in pesos, answer in two decimal places?arrow_forwardYou plan to borrow $37,200 at a 7.2% annual interest rate. The terms require you to amortize the loan with 7 equal end-of-year payments. How much interest would you be paying in Year 2? O a. $2,678.40 O b. $2,370.79 O c. $2,404.40 O d. $6,950.78 Oe. $6,483.94arrow_forward

- You receive a car loan of $22,000 and must pay off the loan in 60 monthly installments. If your interest rate is 18% per year compounded monthly, what are your approximate monthly payments on this loan? O $558.66 $885.50 O $658.35 O $500.00 O $605.89arrow_forwardYou plan to borrow $40,100 at a 6.9% annual interest rate. The terms require you to amortize the loan with 7 equal end-of-year payments. How much interest would you be paying in Year 2? O a. $2,446.20 O b. $2,479.22 O c. $2,766.90 O d. $6,936.17 O e. $7,414.76arrow_forwardA debt of $5487.81 is due August 1, 2025. What is the value of the obligation on February 1, 2015, if money is worth 9% compounded monthly?arrow_forward

- Mortgage is $100000 for 30 years. Interest is 0.6% per month. Calculate monthly payment Please show formula used to calculate monthly payment.arrow_forwardFind the interest on a loan of $3300 at 7% if I borrow on April 7 and repay on June 2 using the following THREE time methods: Exact Time, Ordinary Time, AND Banker's Timearrow_forwardWhat is the monthly payment on a 30 year, $666,000 mortgage, with an interest rate of 2%, compounded monthly?arrow_forward

- Use the Amortization Table to determine the payment required to amortize a loan of $7500 at an annual interest rate of 12% with a term of 15 years. Payments are to be made monthly.What is the amount of each payment?arrow_forwardes If you borrow $6,100 at $510 interest for one year, what is your annual interest cost for the following payment plan? (Round the final answers to 2 decimal places.) a. Annual payment b. Semiannual payments c. Quarterly payments d. Monthly payments Effective ratearrow_forwardYou plan to borrow $33,600 at a 6.5% annual interest rate. The terms require you to amortize the loan with 7 equal end-of-year payments. How much interest would you be paying in Year 2? O a. $6,126.33 O b. $5,752.43 O c. $2,184.00 O d. $1,927.75 O e. $1,952.05arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education