FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

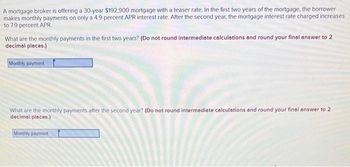

Transcribed Image Text:A mortgage broker is offering a 30-year $192,900 mortgage with a teaser rate. In the first two years of the mortgage, the borrower

makes monthly payments on only a 4.9 percent APR interest rate. After the second year, the mortgage interest rate charged increases

to 7.9 percent APR.

What are the monthly payments in the first two years? (Do not round intermediate calculations and round your final answer to 2

decimal places.)

Monthly payment

What are the monthly payments after the second year? (Do not round intermediate calculations and round your final answer to 2

decimal places.)

Monthly payment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Similar questions

- Estimating the annual interest rate with an ordinary annuity. Fill in the missing annual interest rates in the following table for an ordinary annuity stream: Number of Payments or Years 10 19 25 80 Annual Interest Rate % (Round to two decimal places.) % (Round to two decimal places.) % (Round to two decimal places.) % (Round to two decimal places.) Future Value $0.00 $12,286.30 $0.00 $1,435,078.21 C Annuity Present Value $580.00 $444.01 $1,985.57 $450.00 $2,298.49 $0.00 $37,000.00 $0.00arrow_forward$2.56 interest is due. How much do you owe in total if you pay the bill 3 months past the due date? (Round your answer to two decimal places.)arrow_forwardDetermine the amount of the ordinary annuity at the end of the given period. (Round your final answer to two decimal places.) $500 deposited annually at 5.4% for 8 yearsarrow_forward

- Answer the following (up to two decimal points) by showing the working calculation. The rates of the months for 2018 are shown in the table below. There are 28 days in February and assume you withdraw hibah at the end of each month. Any positive or negative increment in the monthly rates shown is based on the basic rate. You open a new wadiah account with a deposit of RM5000 on 28.01.2018. You deposit another RM1000 and RM5500 on 13.02.2018 and 30.03.2018 respectively. Again, you deposit another RM1550 on 31.05.2018. Then, you deposit another RM8500 on 10.06.2018 but withdraw RM5000 on 28.06.2018. On 15.12.2018, you withdraw another RM2000 from the account and then withdraw again another RM3250 on 28.12.2018. What will be your total hibah on 30.12.2018? Table 1: Monthly rates Month Rate (%) Jan 4.00%* Feb +0.00% March +0.10% April -0.10% May +0.10% June +0.20% July -0.10% Aug +0.20% Sept +0.10% Oct +0.20% Nov -0.10% Dec +0.00% * Basic rate 2. Suggest two (2) financial instruments or…arrow_forwardCompute the future values of the following annuities first assuming that payments are made on the last day of the period and then assuming payments are made on the first day of the period: (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) Payment $ 183 5,155 75,084 167,932 Years 13 8 5 9 Interest Rate (Annual) 12% 11 13 4 Future Value (Payment made on last day of period) 4 Future Value (Payment made on first day of period)arrow_forwardHow much should a family deposit at the end of every 6 months in order to have $2000 at the end of 3 years? The account pays 5.3% interest compounded semiannually. (Round your final answer to two decimal places.)arrow_forward

- Your credit card company charges you 2.33 percent per month. What is the APR on your credit card? Enter your answer as a percentage rounded off to two decimal places. Do not enter % in the answer box.arrow_forwardYou deposit $96000 into an account which pays 7% compounded semiannually. How much can you withdraw at the end of every six months forever?arrow_forwardFind the deposit at the end of month needed for 14 years to provide for a perpetuity of $9900 monthly. The 1st perpetuity payment is made at the end 19 month after the last deposit, and interest changes from iz = 17.46 % to iz65 = 9.08 % on that date. Answer: 1610.13arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education