Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN: 9780357033609

Author: Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

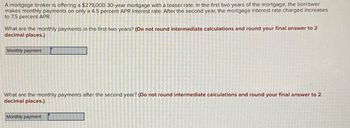

Transcribed Image Text:A mortgage broker is offering a $279,000 30-year mortgage with a teaser rate. In the first two years of the mortgage, the borrower

makes monthly payments on only a 4.5 percent APR interest rate. After the second year, the mortgage interest rate charged increases

to 7.5 percent APR.

What are the monthly payments in the first two years? (Do not round intermediate calculations and round your final answer to 2

decimal places.)

Monthly payment

What are the monthly payments after the second year? (Do not round intermediate calculations and round your final answer to 2

decimal places.)

Monthly payment

>

2 D

TRENE VAR TVUNG

S

2006-

E

-

E

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Calculating interest and APR of installment loan. Assuming that interest is the only finance charge, how much interest would be paid on a 5,000 installment loan to be repaid in 36 monthly installments of 166.10? What is the APR on this loan?arrow_forwardCalculating single-payment loan amount due at maturity. Stanley Price plans to borrow 8,000 for five years. The loan will be repaid with a single payment after five years, and the interest on the loan will be computed using the simple interest method at an annual rate of 6 percent. How much will Stanley have to pay in five years? How much will he have to pay at maturity if hes required to make annual interest payments at the end of each year?arrow_forwardCalculating and comparing add-on and simple interest loans. Eli Nelson is borrowing 10,000 for five years at 7 percent. Payments, which are made on a monthly basis, are determined using the add-on method. a. How much total interest will Eli pay on the loan if it is held for the full five-year term? b. What are Elis monthly payments? c. How much higher are the monthly payments under the add-on method than under the simple interest method?arrow_forward

- A mortgage broker is offering a 30-year $192,900 mortgage with a teaser rate. In the first two years of the mortgage, the borrower makes monthly payments on only a 4.9 percent APR interest rate. After the second year, the mortgage interest rate charged increases to 7.9 percent APR. What are the monthly payments in the first two years? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly payment What are the monthly payments after the second year? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly paymentarrow_forwardYou take out a 30-year mortgage, at a nominal annual rate of X%, with monthly compounding. Each month, you make exactly the required payment. Consider the following table of data from the amortization schedule: Month N N + 1 Beginning Balance Payment $1,322.14 Interest Principal Ending Balance $217,120.83 $216,404.82 Based on this information, what is the nominal annual interest rate (with monthly compounding) for this mortgage? Enter your answer in X.XX format (2 decimal places). For example, if your answer is 6.25%, enter "6.25".arrow_forwardSuppose a homeowner is evaluating two mortgages, both of which are arrangements for repaying a loan of $200,000. Mortgage C requires monthly payments at the end of each month for 15 years at a stated annual rate of 6%. Mortgage D has monthly payments, paid at the beginning of each month for 18 years, at a stated annual rate of 5.5%. Mortgage C has a lower monthly payment than Mortgage D. False Truearrow_forward

- A borrower has taken out a 30-year mortgage for $104,000 at an annual rate of 12%. a. Use the table to find the monthly payment for this mortgage. b. Construct the first three lines of an amortization schedule for this mortgage. c. Assume that the borrower has decided to pay an extra $200 per month to pay off the mortga more quickly. Find the first three lines of your payment schedule under this assumption. Click the icon to view a table of monthly payments on a $1,000 loan. a. The monthly payments for this mortgage are $ (Type an integer or a decimal.) Enter your answer in the answer box and then click Check Answer. 6 parts remainino Olear All Cherk Answe javascript:doExercise(3): Copyright © 2020 Pearson Education Inc. All rights reserved. | 99 a 立arrow_forwardConsider a 30-year, $115,000 fixed-rate mortgage with a nominal annual rate of 4.65 percent. All payments are made at the end of each month. What is the remaining balance on the mortgage after 5 years? Your answer should be between 98,478 and 112,670, rounded to 2 decimal places, with no special characters.arrow_forwardIronwood Bank is offering a 25-year mortgage with an APR of 5.90% based on monthly compounding. If you plan to borrow $160,000, what will be your monthly payment? (Note. Be careful not to round any intermediate steps less than six decimal places) The loan payment is $(Round to the nearest cant.)arrow_forward

- You want to pay off your mortgage on something called an accelerated bi-weekly payment plan. You have a mortgage of $480,000 amortized over 16 years at a rate of 2.5 percent APR compounded semi-annually. (Assume 52 weeks a year.) a. What would the regular bi-weekly payment be? (Do not round your intermediate calculations. Round your answer to 2 decimal places. Omit the "$" sign in your response.) Regular bi-weekly payment $ b. What would the accelerated bi-weekly payment be? (Do not round your intermediate calculations. Round your answer to 2 decimal places. Omit the "$" sign in your response.) Accelerated bi-weekly payment $ c. How much quicker would you pay off the mortgage payment? (Round your answer to 3 decimal places.) Pay off periodyears d. How much interest would you save by doing the accelerated bi-weekly payment? (Do not round your intermediate calculations. Round your answer to 2 decimal places. Omit the "$" sign in your response.) Savings in interest paymentarrow_forwardIronwood Bank is offering a 30-year mortgage with an APR of 6.10% based on monthly compounding. If you plan to borrow $161,000, what will be your monthly payment? (Note. Be careful not to round any intermediate steps less than six decimal places.) The loan payment is § (Round to the nearest cent.)arrow_forwardA homebuyer wishes to take out a mortgage of $200,000 for a 40-year period. What monthly payment is required if the interest rate is 11%? What is the total amount paid during the term of the loan? Carry out all calculations exactly and round the final answers only. Carry out all calculations exactly and round the final answer for the monthly payment to two decimal places and the final answer for the total amount paid to the nearest integer. The required monthly payment is $L The total amount paid during the term of the loan is $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT