FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

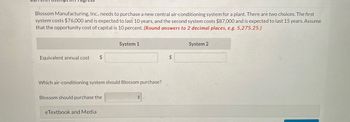

Blossom Manufacturing, Inc., needs to purchase a new central air-conditioning system for a plant. There are two choices. The first system costs $76,000 and is expected to last 10 years, and the second system costs $87,000 and is expected to last 15 years. Assume that the opportunity cost of capital is 10 percent. (Round answers to 2 decimal places, e.g. 5,275.25.) System 1 System 2 Equivalent annual cost $ $ Which air-conditioning system should Blossom purchase? Blossom should purchase the eTextbook and Media

Transcribed Image Text:Blossom Manufacturing, Inc., needs to purchase a new central air-conditioning system for a plant. There are two choices. The first

system costs $76,000 and is expected to last 10 years, and the second system costs $87,000 and is expected to last 15 years. Assume

that the opportunity cost of capital is 10 percent. (Round answers to 2 decimal places, e.g. 5,275.25.)

Equivalent annual cost

EA

$

System 1

$

+A

System 2

Which air-conditioning system should Blossom purchase?

Blossom should purchase the

eTextbook and Media

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 3arrow_forward3- BROWN Co. is determining whether they should purchase a new machine. The machine cost is $380,000, installation costs are $20,000. MACRS 3 years. Tax rate 30% WACC 12%. The expected EBITDA for this 3 year project is $160,000, $230,000, $100,000 respectively. The machine could be sold at the end of the 3 years for $60,000. What is the OCF (operating cash flow) for year 2 for this project? 4- BROWN Co. is determining whether they should purchase a new machine. The machine cost is $380,000, installation costs are $20,000. MACRS 3 years. Tax rate 30% WACC 12%. The expected EBITDA for this 3 year project is $160,000, $230,000, $100,000 respectively. The machine could be sold at the end of the 3 years for $60,000. What is the terminal cash flow for this project?arrow_forwardProject Phoenix costs $1.25 million and yields annual cost savings of $300,000 for seven years. The assets involved in the project can be salvaged for $100,000 at the end of the project. Ignoring taxes, what is the payback period for Project Phoenix? Select one: a. 4 years b. 4 years and 1.7 months c. 4 years and 2 months d. 4 years and 3 months e. 5 yearsarrow_forward

- A new machine can be purchased for $1,500,000. It will cost $45,000 to ship and $55,000 to install the machine. The new machine will replace an older machine that is fully depreciated and will be sold for $125,000. The firm’s income tax rate is 40%. What is the initial outlay (IO) for the new machine? $1,525,000 $1,600,000 $1,675,000 $1,725,000arrow_forward2. A new electric power generation plant is expected to cost $42,000,000 to complete. The revenues generated by the new plant are expected to be $3,875,000 per year, while operational expenses are estimated to be $2,000,000 per year. The plant will last 40 years, and the electric authority uses a 3% interest rate. Determine if the plant will be able to recover its investment using the following methods: a. IRR (show your solution for interpolation; use 5 decimal places for the interpolation procedure) b. Payback periodarrow_forwardA tunnel to transport water initially cost $1,000,000 and has expected maintenance costs that will occur in a 6-year cycle as shown below, assume MARR is 5% per year. End of Year Maintenance $35,00 535,000 535,000 $45,000 S48,000 so0.00) Compute the Equivalent Annual Cost of the maintenance. Hint: Don't insert the negative sign Compute the Capitalized Cost? Hint: Don't insert the negative signarrow_forward

- H3. Show proper step by step calculationarrow_forward1. CB Electronix needs to expand its plant. It is considering an alternative plan that will last indefinitely. The MARR is 15%. Please determine the capitalized cost of the alternative. Alternative: Expand by 20 000 square feet First cost = $2 000 000 Annual Maintenance costs = $10 000 per year starting in year 3 Periodic maintenance costs = $15 000 every 15 years, starting in 20 yearsarrow_forwardPROBLEM 1. New Project You must evaluate a proposal to buy a new milling machine. The base price is $108,000, and shipping and installation costs would add another $12,500. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $65,000. The applicable depreciation rates are 33%, 45%, 15%, and 7%. The machine would require a $5,500 increase in working capital (increased inventory less increased accounts payable). There would be no effect on revenues, but pretax labor costs would decline by $44,000 per year. The marginal tax rate is 35%, and the WACC is 12%. Also, the firm spent $5,000 last year investigating the feasibility of using the machine. What are the project's annual net cash flows during Years 0 through 3?arrow_forward

- A company must purchase a new machine to increase production. The machine will cost $50,000 to purchase. The following are the remaining cash flows of the machine and its probabilities. The machine is supposed to be used for 6 years and the MARR is 10%. Annual Cost Annual Revenue Calculate the Present Worth. Probability .2 .6 .2 .6 .4 Outcome $3,000 $4,500 $5,500 $35,000 $40,000arrow_forwardT1).arrow_forwardManagement of Wildhorse, Inc., is considering switching to a new production technology. The cost of the required equipment will be $4,000,000. The discount rate is 11 percent. The cash flows that management expects the new technology to generate are as follows. Years 1-2 3-5 6-9 CF 0 $750,000 $1,450,000 a. Compute the payback and discounted payback periods for the project. (Round answers to 2 decimal places, e.g. 15.25.) The payback for the project is The NPV of the project is $ years, and the discounted payback period is b. What is the NPV for the project? Should the firm go ahead with the project? (Enter negative amounts using negative sign e.g. -45.25. Do not round discount factors. Round intermediate calculations to O decimal places, e.g. 1,525 and final answer to O decimal places, e.g. 5,125.) The IRR of the project is , and using the NPV rule the project should be c. What is the IRR, and what would be the decision based on the IRR? (Round answer to 3 decimal places, e.g.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education