FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

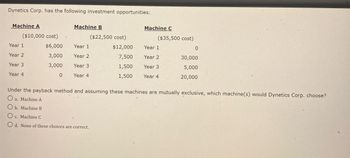

Transcribed Image Text:Dynetics Corp. has the following investment opportunities:

Machine A

Machine B

Machine C

($10,000 cost)

($22,500 cost)

($35,500 cost)

Year 1

$6,000

Year 1

$12,000

Year 1

0

Year 2

3,000

Year 2

7,500

Year 2

30,000

Year 3

3,000

Year 3

1,500

Year 3

5,000

Year 4

0

Year 4

1,500

Year 4

20,000

Under the payback method and assuming these machines are mutually exclusive, which machine(s) would Dynetics Corp. choose?

a. Machine A

b. Machine B

c. Machine C

Od. None of these choices are correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume that a company is considering a $2,400,000 capital investment in a project that would earn net income for each of the next five years as follows: Sales Variable expenses Contribution margin $ 1,900,000 800,000 1,100,000 12:46 Fixed expenses: Out-of-pocket operating costs. $ 300,000 Depreciation 400,000 700,000 Net operating income $ 400,000 Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. If the company's discount rate is 21%, then the project's net present value is closest toarrow_forwardJenson Corp. is planning to use its land to build a new manufacturing plant. Since projects R and S are mutually exclusive which project/projects should be accepted if the discount rate is 7%?arrow_forwardManagement of Ivanhoe Measures, Inc., is evaluating two independent projects. The company uses a 13 percent discount rate for such projects. The costs and cash flows for the projects are shown in the following table. Year Project 1 Project 2 0 $8,812,840 -$10,781,200 1 3,363,400 2,021,330 2 1,788,290 3,848,800 3 1,367,600 3,173,090 4 1,088,900 4,104,310 5 1,111,380 4,130,780 6 1,723,940 7 1,319,290 k A What are their NPVs? (Enter negative amounts using negative sign, e.g. -45.25. Do not round discount factors. Round other intermediate calculations and final answer to O decimal places, e.g. 1,525.) Q Ac The NPV of Project 1 is $ and the NPV of Project 2 is $ Qu Muarrow_forward

- Providence Health is evaluating two different linen supply vendors systems for handling facility linen replacement. There are no incremental revenues attached to the projects, so the decision will be made on the basis of the present value of costs. Providence's weighted average cost of capital is 6.25%. Here are the net cash flow estimates in thousands of dollars: Year 0 1 2 3 4 5 System X System Y S (1,800) $ (3,850) S (1,000) S (500) (1,000) S (500) S S (1,000) S S (1,000) S S (1,000) S (500) (500) (500) [a] Assume initially that the systems both have average risk. Which one should be chosen? [b] Assume that System Y is judged to have high risk. The organization accounts for differential risk by adjusting its corporate cost of capitalarrow_forwardCan someone please help me solve this question using Excel?arrow_forwardANSWER ALL THE QUESTIONS THANKSarrow_forward

- The investment committee of Sentry Insurance Co. is evaluating two projects, office expansion and upgrade to computer servers. The projects have different useful lives, but each requires an investment of $1,104,000. The estimated net cash flows from each project are as follows: Net Cash Flow Year OfficeExpansion Server 1 $308,000 $407,000 2 308,000 407,000 3 308,000 407,000 4 308,000 407,000 5 308,000 6 308,000 The committee has selected a rate of 15% for purposes of net present value analysis. It also estimates that the residual value at the end of each project's useful life is $0, but at the end of the fourth year, the office expansion's residual value would be $385,000. Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5…arrow_forwardSheridan Mills management is evaluating two alternative heating systems. Costs and projected energy savings are given in the following table. The firm uses 11.50 percent to discount such project cash flows. Year System 100 System 200 0 –$1,982,100 –$1,854,200 1 206,910 763,700 2 429,830 589,800 3 743,040 671,900 4 1,046,900 426,300 What is the NPV of the systems? (Enter negative amounts using negative sign, e.g. -45.25. Do not round discount factors and intermediate calculations. Round final answers to 0 decimal places, e.g. 5,275.)arrow_forwardThe production department is proposing the purchase ONE automatic insertion machine. It has identified three machines (A, B and C). Each machine has an estimated useful life of 10 years. minimum desired rate of return of 10%. The accountant has identified the following data: Machine A Machine B Machine C Present value of future cash flows computed using 10% rate of return $305,000 $295,000 $300,500 Amount of initial investment 300,000 300,000 300,000 Based on net present value method, which machine do you recommend?arrow_forward

- You work for an outdoor play structure manufacturing company and are trying to decide between the following two projects: (Click on the following icon in order to copy its contents into a spreadsheet.) Project Playhouse Fort Year-End Cash Flows ($ thousands) 1 2 18 IRR 33.8% 13.2% 52 You can undertake only one project. If your cost of capital is 7%, use the incremental IRR rule to make the correct decision. 0 -25 -75 The incremental IRR is%. (Round to two decimal places.) 20 39 Save OLarrow_forwardUsing the following information find the project's cash flow. Once you have that information find the NPV, PI and IRR. Cost of new equipt 7,800,000 Installation costs 200,000 Unit Sales Year Units sold 1 80,000 2 130,000 3 140,000 4 90,000 5 70,000 Sales price per unit $300 in years 1-4, $250 in year 5 Variable cost per unit $225/unit Annual fixed costs $225,000 in years 1-5 Working capital requirements: Initial working capital requirement $100,000 Each year net working capital equal to 10% of the year's sales All working capital terminated at the end of year 5 Depreciation Bonus depreciation method - all is taken in year 1 Income tax rate 21% Required rate of return 12%arrow_forwardYou are considering the following project. What is the NPV of the project? WACC of the project: 0.10 Revenue growth rate: 0.05 Tax rate: 0.40 Revenue for year 1: 13,000 Fixed costs for year 1: 3,000 variable costs (% of revenue): 0.30 project life: 3 years Economic life of equipment: 3 years Cost of equipment: 20,000 Salvage value of equipment: 4,000 Initial investment in net working capital: 2,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education