FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

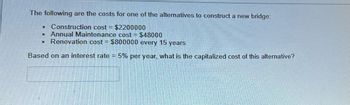

Transcribed Image Text:The following are the costs for one of the alternatives to construct a new bridge:

Construction cost = $2200000

M Annual Maintenance cost = $48000

Renovation cost = $800000 every 15 years

Based on an interest rate = 5% per year, what is the capitalized cost of this alternative?

M

R

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Suppose a theater organization is going to purchase new sound equipment for its auditorium. Option A has a net present cost of $40,000 and a useful life of 6 years; Option B has a net present cost of $35,000 and a useful life of 5 years. Both options involve annual maintenance costs which are included in their respective net present costs. If the organization uses a discount rate of 3.5%, it should purchase:arrow_forwardi need the answer quicklyarrow_forwardplease ASAP, direct thumps up :)arrow_forward

- Compute the payback statistic for Project A if the appropriate cost of capital is 7 percent and the maximum allowable payback period is four years. (Round your answer to 2 decimal places.) Project A Time: 0 1 2 3 4 5 Cash flow: −$1,400 $510 $600 $600 $380 $180 Payback years: _______.__arrow_forward4.) Two mutually exclusive alternative public works projects are under consideration. Their respective costs and benefits are included in the table below. Project A has an anticipated life of 35 years, and the useful life of Project B has been estimated to be 25 years. If the interest rate is 9%, which, if either, of these projects should be selected? Capital investment Annual oper. & maint. costs Annual benefit Useful life of project (years) PROJECT A 375,000 60,000 122,500 35 PROJECT B 312,500 55,000 115,000 25arrow_forwardThe following two alternatives are given. Data A B. First Cost $8,200 $5,600 Annual Cost $1,000 $800 Annual Benefit $2,700 $2,100 Life, Years 7. Salvage Value $2,800 $1,000 Assume that MARR is 15%. Use the incremental rate of return analysis to determine which alternative (A or B) one should choose. Find the AIRR, or a range of AIRR. O 10% O 10-12% O 12-15% O > 15%arrow_forward

- The Dry Dock is considering a project with an initial cost of $107,770 and cash inflows for years 1 to 3 of $37,200 $54,600 and $46,900 respectively. What is the IRR?arrow_forwardResurfacing a particular section of highway would result in cost of maintenance savings of $500 per year for the first five years and $1,000 per year for the next five years. If maintenance costs are the only consideration, the maximum amount to spend now on the project at 5% interest is __________. A. $5,556 B. $4,349 C. $3,392 D. $2,165arrow_forwardYou are considering the following project. What is the NPV of the project? WACC of the project: 0.10 Revenue growth rate: 0.05 Tax rate: 0.40 Revenue for year 1: 13,000 Fixed costs for year 1: 3,000 variable costs (% of revenue): 0.30 project life: 3 years Economic life of equipment: 3 years Cost of equipment: 20,000 Salvage value of equipment: 4,000 Initial investment in net working capital: 2,000arrow_forward

- Can some one please help me to solve the following question correctly per the directions. PLEASE AND THANK YOU!!!!!!arrow_forwardCAPITALIZED COST, INFLATION AND REPLACEMENT STUDIESarrow_forwardA new tennis court complex is planned. Each of two alternatives will last 18 years, and the interest rate is 7%. Use present worth analysis to determine which should be selected.Construction CostAnnual O&M A$500,000 $25,000 B640,000 10,000.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education