FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

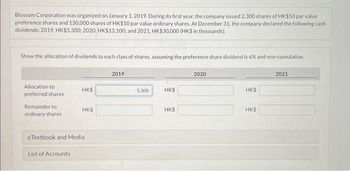

Transcribed Image Text:Blossom Corporation was organized on January 1, 2019. During its first year, the company issued 2,300 shares of HK$50 par value

preference shares and 130,000 shares of HK$10 par value ordinary shares. At December 31, the company declared the following cash

dividends: 2019, HK$5,300; 2020, HK$13,100; and 2021, HK$30,000 (HK$ in thousands).

Show the allocation of dividends to each class of shares, assuming the preference share dividend is 6% and non-cumulative.

Allocation to

preferred shares

Remainder to

ordinary shares

HK$

List of Accounts

HK$

eTextbook and Media

2019

5,300

HK$

HK$

2020

HK$

HK$

2021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Sunland Corporation was organized on January 1, 2021. During its first year, the corporation issued 2,000 shares of $50 par value preferred stock and 100,000 shares of $10 par value common stock. At December 31, the company declared the following cash dividends: 2021, $4,800; 2022, $13,600; and 2023, $29,000. (a) Show the allocation of dividends to each class of stock, assuming the preferred stock dividend is 7% and noncumulative. Allocation to preferred stock $ Allocation to common stock $ 2021 LA 2022 $ $ 2023arrow_forwardOn August 15, 2021, EasyMoney, Inc.'s Board of Directors meets and declares that EasyMoney will pay a dividend to its stockholders. Each share of EasyMoney's Common Stock will be paid a dividend of $1.25 per share. There are currently 100,000 shares of EasyMoney's Common Stock held by EasyMoney's shareholders. The following are the facts related to this dividend: D Dividend per Share D Date of Declaration D Date of Record D Date of Payment $1.25 August 15, 2021 September 5, 2021 September 20, 2021 The following is a partial list of the accounts in EasyMoney, Inc.'s General Ledger. These are the only accounts you need for this problem. D Cash D Dividends Payable > Retained Earnings As of August 1, 2021, the Beginning Balance in the Dividends Payable account is $0 and the Beginning Balance in the Retained Earnings account is $625,000.arrow_forwardThe board of directors of Tamarisk, Inc. declared a cash dividend of $1.95 per share on 33000 shares of common stock on July 15, 2020. The dividend is to be paid on August 15, 2020, to stockholders of record on July 31, 2020. The correct entry to be recorded on August 15, 2020, will include a O debit to Cash Dividends. O debit to Dividends Payable. O credit to Cash Dividends. O credit to Dividends Payable.arrow_forward

- darrow_forwardABC Co. was organized on January 1, 2019, with an authorization of 1.200.000 ordinary shares with a par value of Rp6 per share. During 2019, the corporation had the capital transactions as provided below. ABC Co. used the cost method to record the purchase and reissuance of the treasury shares. What is the total amount of share premium as of December 31, 2019?arrow_forwardZakaryan Corporation was organized on January 1, 2020. The corporation's governing documents authorized the issue of 100,000 shares of $1 par common stock. During 2020, Zakaryan had the following transactions relating to stockholders' equity: Issued 10,000 shares of common stock at $14 per share. Issued 20,000 shares of common stock at $16 per share. Reported a net income of $200,000. Paid dividends of $100,000. Purchased 3,000 shares of treasury stock at $20 (part of the 20,000 shares issued at $16). What is total shareholders' equity at the end of 2020? O $600,000. O $540,000. O $500,000. O $400,000. 4arrow_forward

- On September 15, 2023, the Board of Directors of Sandhill Company declared a $0.45 per share cash dividend, payable on October 31 to shareholders of record as of October 1. On the date of declaration, Sandhill Company had 206,000 common shares issued, of which 18,000 were held in Treasury. On October 15, 2023, the company issued an additional 66,000 common shares for $5.75 each. Prepare all the required journal entries to record these transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Record journal entries in the order presented in the problem.) Date > > > Account Titles and Explanation Debit Creditarrow_forwardOriole Corporation was organized on January 1, 2021. During its first year, the corporation issued 1,950 shares of $50 par value preferred stock and 105,000 shares of $10 par value common stock. At December 31, the company declared the following cash dividends: 2021, $5,000; 2022, $13,900; and 2023, $27,000.arrow_forwardOn January 1, 2020, Triad Corporation had 60,000 shares of $1 par value common stock issued and outstanding. During the year, the following transactions occurred: Mar 1 Issued 25,000 shares of common stock for $550,000. June 1 Declared a cash dividend of $2.00 per share to stockholders of record on June 15. June 30 Paid the $2.00 cash dividend. Dec. 1 Purchased 5,000 shares of common stock for the treasury for $22 per share. Dec. 15 Declared a cash dividend on outstanding shares of $2.25 per share to stockholders of record on December 31. Prepare journal entries to record the above transactions. (If no entry is required, select "No entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually) Account Titles and Explanation Date Mar. 1 Debit Creditarrow_forward

- Hill Corp. had 600,000 shares of common stock outstanding on January 1, issued 900,000 shares on July 1, and had income applicable to common stock of $2,940,000 for the year ending December 31, 2021. Earnings per share of common stock for 2021 would be a. $3.28. b. $2.80. c. $2.32. d. $4.90.arrow_forwardThe Murphy Corporation is authorized to issue 500,000 shares of $1 par value common stock. During 2019, the company has the following stock transactions. Jan. 15 Issued 200,000 shares of stock at $6 per share. Sept. 5 Purchased 30,000 shares of common stock for the treasury at $8 per share. Dec. 6 Declared a $0.50 per share dividend to stockholders of record on December 15, payable January 5, 2020. Instructions Journalize the transactions for the Murphy Corporation on journal paper. OMIT explanationsarrow_forwardSouthwestern Exposure Ltd. began operations on January 2, 2020. During the year, the following transactions affected shareholders' equity: 1. Southwestern Exposure's articles of incorporation authorize the issuance of 1,100,000 common shares, and the issuance of 115,000 preferred shares, which pay an annual dividend of $2.00 per share. 2. A total of 280,000 common shares were issued for $4 a share. 3. A total of 15,000 preferred shares were issued for $13 per share. 4. The full annual dividend on the preferred shares was declared. 5. The dividend on the preferred shares was paid. 6. A dividend of $0.10 per share was declared on the common shares but was not yet paid. The company had net income of $161,000 for the year. (Assume sales of $751,000 and total operating expenses of $590,000.) 7. 8. The dividends on the common shares were paid. 9. The closing entry for the dividends declared accounts was prepared. Prepare journal entries to record the above transactions, including the closing…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education