FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

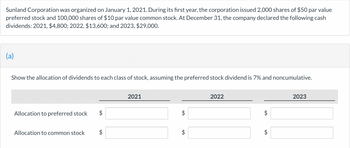

Transcribed Image Text:Sunland Corporation was organized on January 1, 2021. During its first year, the corporation issued 2,000 shares of $50 par value

preferred stock and 100,000 shares of $10 par value common stock. At December 31, the company declared the following cash

dividends: 2021, $4,800; 2022, $13,600; and 2023, $29,000.

(a)

Show the allocation of dividends to each class of stock, assuming the preferred stock dividend is 7% and noncumulative.

Allocation to preferred stock $

Allocation to common stock $

2021

LA

2022

$

$

2023

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dekalb Resorts has been in business since 1987.The stockholders' equity section of Dekalb's balance sheet on January 1, 2019 is as follows: Common Stock (Par value $25.00 per share; 50,000 shares authorized; 28,000 shares issued and outstanding) Additional Paid-in Capital on Common Stock Preferred Stock (Par value $5.00 per share; 5,000 shares authorized; 3,000 shares issued and outstanding) Additional Paid-in Capital on Preferred Stock Retained Earnings Total Stockholders' Equity Stockholders' Equity Section as of January 1, 2019 Date July 15, 2019 700,000 100,000 15,000 7,000 560.000 1,382,000 Required: 1. Prepare the journal entries for the following three transactions: On July 15, 2019, Dekalb issues 600 shares of its preferred stock, receiving $15.00 per share. Accounts debits credits On December 31, 2019, Dekalb declares annual dividends on preferred stock. Dividends are to be paid on the shares of preferred stock outstanding on December 31, 2019. Each share of preferred stock…arrow_forwardAt the beginning of 2019, Hardin Company had 280,000 shares of $10 par common stock outstanding. During the year, it engaged in the following transactions related to its common stock: March 1 Issued 43,000 shares of stock at $21 per share. June 1 Issued a 15% stock dividend. July 1 Issued 9,000 shares of stock at $26 per share. Aug. 31 Issued a 2-for-1 stock split on outstanding shares, reducing the par value to $5 per share. Oct. 31 Reacquired 84,000 shares as treasury stock at a cost of $29 per share. Nov. 30 Reissued 53,000 treasury shares at a price of $32 per share. Required: 1. Determine the weighted average number of shares outstanding for computing the current earnings per share. Round your interim computations and final answer for the number of shares to nearest whole number. fill in the blank2. Determine the number of common shares outstanding at December 31, 2019. fill in the blankarrow_forwardCrane Corporation was organized on January 1, 2027. It is authorized to issue 19,800 shares of 7%, $50 par value preferred stock and 462,000 shares of no-par common stock with a stated value of $1 per share. The following stock transactions were completed during the first year. Jan. 10 Mar. 1 1 Issued 71,000 shares of common stock for cash at $5 per share. Issued 11,600 shares of preferred stock for cash at $56 per share. Issued 116,000 shares of common stock for cash at $8 per share. May Sept. 1 Nov. 1 Issued 5,200 shares of common stock for cash at $6 per share. Issued 3,200 shares of preferred stock for cash at $58 per share. (a) Prepare a tabular summary to record the transactions. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Assets Liabilities Jan. 10 $ Mar. 1 Cash 1 $ Common Stock Paid-in-Capit Stated…arrow_forward

- The company issued its 2023 financial statements on April 30 2024. Calculate the weighted average cost of common shares to be used for 2023.arrow_forwardThe Murphy Corporation is authorized to issue 500,000 shares of $1 par value common stock. During 2019, the company has the following stock transactions. Jan. 15 Issued 200,000 shares of stock at $6 per share. Sept. 5 Purchased 30,000 shares of common stock for the treasury at $8 per share. Dec. 6 Declared a $0.50 per share dividend to stockholders of record on December 15, payable January 5, 2020. Instructions Journalize the transactions for the Murphy Corporation on journal paper. OMIT explanationsarrow_forwardAn excerpt from the financial records of Windle Inc. (Windle) at December 31, 2019, was as follows: Preferred shares, Series A, $5, cumulative, 60,000 shares issued and outstanding $ 6,000,000 Preferred shares, Series B, $6.50, non-cumulative, 40,000 shares issued and outstanding $ 4,000,000 Common shares, 1,800,000 shares issued and outstanding $25,400,000 The following common share transactions took place in 2020: April 1: Windle issued 200,000 common August 31: Windle repurchased and cancelled 60,000 common October 31: Windle issued 100,000 common shares. Additional information: Windle’s net income for the year ended December 31, 2020, was $17,600,000. Dividends on preferred shares in arrears and for the current year were declared in full on December 15, 2020 (dividends on preferred shares were in arrears and had last been declared in full on December 15, 2018). Windle is subject to tax at a rate of 30%, and reports under Required: Calculate Windle’s…arrow_forward

- Riverbed Corporation was organized on January 1, 2022. It is authorized to issue 14,500 shares of 8%, $100 par value preferred stock, and 475,000 shares of no-par common stock with a stated value of $2 per share. The following stock transactions were completed during the first year. Jan. 10 Mar. 1 Apr. May Aug. 1 Issued 83,000 shares of common stock for cash at $5.25 per share. Issued 12,000 shares of common stock to attorneys in payment of their bill of $40,500 for services performed in helping the company organize. Sept. 1 Issued 11,500 shares of common stock for cash at $5 per share. Nov. 1 Issued 2,500 shares of preferred stock for cash at $111 per share. (a) 1 Issued 84,500 shares of common stock for cash at $4 per share. Issued 4,050 shares of preferred stock for cash at $110 per share. Issued 24,000 shares of common stock for land. The asking price of the land was $88,500. The fair value of the land was $83,500. 1 Journalize the transactions. (List all debit entries before…arrow_forwardSheridan Company was organized on January 1, 2022. It is authorized to issue 12,500 shares of 8%, $100 par value preferred stock, and 477,000 shares of no-par common stock with a stated value of $2 per share. The following stock transactions were completed during the first year. Jan. 10 Issued 80,500 shares of common stock for cash at $4 per share. Mar. 1 Issued 4,550 shares of preferred stock for cash at $105 per share. Issued 24,500 shares of common stock for land. The asking price of the land was $92,500. The fair value of the land was $85,000. Apr. 1 May 1 Issued 80,000 shares of common stock for cash at $5.00 per share. Issued 10,000 shares of common stock to attorneys in payment of their bill of $44,500 for services performed in helping the company organize. Aug. 1 Sept. 1 Issued 11,500 shares of common stock for cash at $7 per share. Nov. 1 Issued 2,500 shares of preferred stock for cash at $114 per share.arrow_forwardAt the beginning of 2019, Hardin Company had 200,000 shares of $10 par common stock outstanding. During the year, it engaged in the following transactions related to its common stock: March 1 Issued 48,000 shares of stock at $25 per share. June 1 Issued a 15% stock dividend. July 1 Issued 10,000 shares of stock at $30 per share. Aug. 31 Issued a 2-for-1 stock split on outstanding shares, reducing the par value to $5 per share. Oct. 31 Reacquired 94,000 shares as treasury stock at a cost of $33 per share. Nov. 30 Reissued 46,000 treasury shares at a price of $36 per share. Required: 1. Determine the weighted average number of shares outstanding for computing the current earnings per share. Round your interim computations and final answer for the number of shares to nearest whole number. fill in the blank 1 shares2. Determine the number of common shares outstanding at December 31, 2019. fill in the blank 2 sharesarrow_forward

- Wildhorse Corporation was organized on January 1, 2025. It is authorized to issue 9,200 shares of 8%, $100 par value preferred stock, and 538,600 shares of no-par common stock with a stated value of $1 per share. The following stock transactions were completed during the first year. Jan. 10 Mar. 1 Apr. May Aug. 1 1 1 Sept. 1 Nov. 1 Issued 80,120 shares of common stock for cash at $6 per share. Issued 5,470 shares of preferred stock for cash at $112 per share. Issued 24,910 shares of common stock for land. The asking price of the land was $90,180; the fair value of the land was $80,120. Issued 80,120 shares of common stock for cash at $9 per share. Issued 9,200 shares of common stock to attorneys in payment of their bill of $51,900 for services rendered in helping the company organize. Issued 9,200 shares of common stock for cash at $11 per share. Issued 1,090 shares of preferred stock for cash at $113 per share. Prepare the journal entries to cord the above transactions. (List all…arrow_forwardSplish Company's ledger shows the following balances on December 31, 2025. 7% Preferred stock-$10 par value, outstanding 21,200 shares Common stock-$100 par value, outstanding 32,100 shares Retained earnings Assuming that the directors decide to declare total dividends in the amount of $396,000, determine how much each class of stock should receive under each of the conditions stated below. One year's dividends are in arrears on the preferred stock. a. The preferred stock is cumulative and fully participating. (Round the rate of participation to 6 decimal places, e.g.0.014278. Round answers to O decimal places, e.g. 38,487.) $ $ Preferred b. The preferred stock is noncumulative and nonparticipating. (Round answers to O decimal places, e.g. 38,487.) $ Preferred $ Preferred Common c. The preferred stock is noncumulative and is participating in distributions in excess of a 9% dividend rate on the common stock. (Round the rate of participation to 6 decimal places, e.g.0.014278. Round…arrow_forwardNautical has two classes of stock authorized: $10 par preferred, and $1 par value common. As of the beginning of 2024, 100 shares of preferred stock and 1,800 shares of common stock have been issued. The following transactions affect stockholders' equity during 2024: March 1 Issue 1,800 additional shares of common stock for $17 per share. Issue 200 additional shares of preferred stock for $28 per share. April 1 June 1 Declare a cash dividend on both common and preferred stock of $0.60 per share to all stockholders of record on June 15. June 30 Pay the cash dividends declared on June 1. August 1 Purchase 200 shares of common treasury stock for $14 per share. October 1 Resell 100 shares of treasury stock purchased on August 1 for $16 per share. Nautical has the following beginning balances in its stockholders' equity accounts on January 1, 2024: Preferred Stock, $1,000; Common Stock, $1,800; Additional Paid-in Capital, $18,300; and Retained Earnings, $10,300. Net income for the year…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education