FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

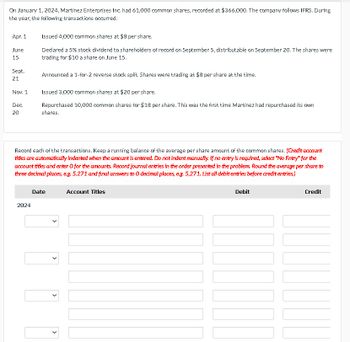

Transcribed Image Text:On January 1, 2024, Martinez Enterprises Inc. had 61,000 common shares, recorded at $366,000. The company follows IFRS. During

the year, the following transactions occurred:

Apr. 1

Issued 4,000 common shares at $8 per share.

June

15

Declared a 5% stock dividend to shareholders of record on September 5, distributable on September 20. The shares were

trading for $10 a share on June 15.

Announced a 1-for-2 reverse stock split. Shares were trading at $8 per share at the time.

Sept.

21

Nov. 1

Issued 3,000 common shares at $20 per share.

Dec.

20

Repurchased 10,000 common shares for $18 per share. This was the first time Martinez had repurchased its own

shares.

Record each of the transactions. Keep a running balance of the average per share amount of the common shares. (Credit account

titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the

account titles and enter O for the amounts. Record journal entries in the order presented in the problem. Round the average per share to

three decimal places, e.g. 5.271 and final answers to O decimal places, e.g. 5,271. List all debit entries before credit entries.)

Date

2024

Account Titles

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Clair, Inc. reports net income of $700,000. It declares and pays dividends of $100,000 for the year, one-half of which relate to the preferred shares. The weighted average number of ordinary shares outstanding during the year is 200,000 shares, and the weighted average number of preferred shares outstanding during the year is 10,000 shares. Rounded to the nearest cent, earnings per share for Clair, Inc. is O $2.95. O $3.00. O $3.25. O $3.18.arrow_forwardThe following transactions occurred for Rothman Corp. during 2024, its first quarter of operations (fiscal year ending Dec. 31): 1. 2. On Oct. 5, Rothman issued 2000 shares of $10 par common stock in an IPO and 400 shares of $40 par preferred stock for a lump sum of $85,000 cash. The values of the common and preferred stock were appraised separately at $30 and $50 per share, respectively. On Oct. 20, Rothman declared an 80% common stock dividend, when the market value per share of the common stock was $32. 3. On Dec. 5, the common stock dividend was issued. 4. On Dec. 20, a 3-for-1 stock split occurred for common stock. 5. On Dec. 30, Rothman purchased 100 shares of its own common stock for $14 per share. Instructions: A. Prepare the general journal entries to record each of the above transactions. B. Determine the number of common shares (1) issued and (2) outstanding at Dec. 31, 2024.arrow_forwardOn January 1 2018, ACI Ltd. had 5,80,000 shares of common stock outstanding . During2018, it had the following transactions that affected the common stock account:February-1 Issued 1,50,000 shares.March-1 Issued a 20% stock dividend.May-1 Acquired 1,00,000 shares of treasury stock.June-1 Issued a 4 for 1 stock split.October-1 Reissued 60,000 shares of treasury stock.Requirements:i) Determine the weighted average number of shares outstanding as of December 31,2018.[01]ii) Assume that ACI Ltd. earned net income Tk. 35,00,000 during 2018. In addition it had1,00,000 shares of 10% ,Tk100 per nonconvertible, noncumulative preferred stockoutstanding for the entire year. Because of liquidity considerations, however, thecompany did not declare and pay a preferred dividend in 2018. Compute earning pershares for 2018, using the weighted average number of shares. iii) Assume the same fact as in part (ii), except that the preferred stock was cumulative.Compute earning per shares for 2018.iv) Assume…arrow_forward

- Green Thumb, Inc. had 18,000 shares of common stock outstanding on January 1. An additional 6,000 shares were issued on May 1. The company also had 1,000 shares of 5.5%, $100 par, convertible preferred stock outstanding during the year. Each share is convertible into 8 shares of common stock. Net income for the year was $82,500. Required:Compute the appropriate earnings per share amount(s) that would appear on the Green Thumb's income statement. If required, round your answers to two decimal places. Basic earnings per share ________ Diluted earnings per share ________arrow_forwardWeaver Corporation had the following stock issued and outstanding at January 1, Year 2: 1.147,000 shares of $4 par common stock. 2. 7,500 shares of $50 par, 5 percent, noncumulative preferred stock. On June 10, Weaver Corporation declared the annual cash dividend on its 7,500 shares of preferred stock and a $3 per share dividend for the common shareholders. The dividend will be paid on July 1 to the shareholders of record on June 20. 券 Required Determine the total amount of dividend to be paid to the preferred shareholders and common shareholders, 彩 Preferred stock Common stock Total dividend Mc Graw Hill Prey 15 of 20 Next >arrow_forwardRidgetown Corporation started the year with 50,000 common shares outstanding. On April 1st, Ridgetown reacquired 5,000 of its own common shares. On July 1st, 10,000 common shares were issued. What will Ridgetown use in the denominator for its earnings per share calculation?arrow_forward

- The annual report for Sneer Corporation disclosed that the company declared and paid preferred dividends in the amount of $170,000 in the current year. It also declared and paid dividends on common stock in the amount of $2.70 per share. During the current year, Sneer had 1 million common shares authorized; 370,000 shares had been issued; and 163,000 shares were in treasury stock. The opening balance in Retained Earnings was $870,000 and Net Income for the current year was $370,000. Required: 1. Prepare journal entries to record the declaration, and payment, of dividends on (a) preferred and (b) common stock. 2. Using the information given above, prepare a statement of retained earnings for the year ended December 31. 3. Prepare a journal entry to close the dividends account.arrow_forwardWindsor, Inc. has 46,000 shares of $10 par value common stock outstanding. It declares a 13% stock dividend on December 1 when the market price per share is $16. The dividend shares are issued on December 31. Prepare the entries for the declaration and issuance of the stock dividend.arrow_forwardOn January 1, 2022, Skysong, Inc. had $1,190,000 of common stock outstanding that was issued at par and retained earnings of $749,000. The company issued 43,000 shares of common stock at par on July 1 and earned net income of $395,000 for the year. Journalize the declaration of a 15% stock dividend on December 10, 2022, for the following two independent assumptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) (a) (b) No. Account Titles and Explanation (a) Par value is $10 and market price is $15. Par value is $5 and market price is $8. (b) Retained Earnings Common Stock Dividends Distributable Paid-in Capital in Excess of Par-Common Stock Retained Earnings Common Stock Dividends Distributable Paid-in Capital in Excess of Par-Common Stock Debit 277,425 147,960 Credit 184,950 277,425 92,475 332,910arrow_forward

- During the year ended December 31, 20--, Choi Company completed the following transactions: Apr. 15 Declared a semiannual dividend of $1.50 per share on preferred stock and $0.40 per share on common stock to shareholders of record on May 5, payable on May 10. Currently, 6,000 shares of $50 par preferred stock and 80,000 shares of $1 par common stock are outstanding. May 10 Paid the cash dividends. Oct. 15 Declared semiannual dividend of $1.50 per share on preferred stock and $0.40 per share on common stock to shareholders of record on November 5, payable on November 20. Nov. 20 Paid the cash dividends. 22 Declared a 10% stock dividend to common shareholders of record on December 8, distributable on December 16. Market value of the common stock was estimated at $7 per share. Dec. 16 Issued certificates for common stock dividend. 20 Board of directors declared a two-for-one common stock split. Required: Prepare journal entries for the transactionsarrow_forwardOn January 1, the board of directors of Zion, Inc. declare a 10% stock dividend. On this date, there were 10,000 shares of $1 par value stock issued and outstanding and the market value was $5 per share. On March 15, the date of payment, Zion issued the stock. The entry necessary on March 15 would include a (credit/debit) to Common Stock Dividends distributable for O debit; $5,000 O debit; $1,000 O credit; $5,000 O credit; $1,000arrow_forwardLangley Corporation has 57,000 shares of $11 par value common stock outstanding. It declares a 15% stock dividend on December 1 when the market price per share is $16. The dividend shares are issued on December 31.Prepare the entries for the declaration and issuance of the stock dividend.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education