FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

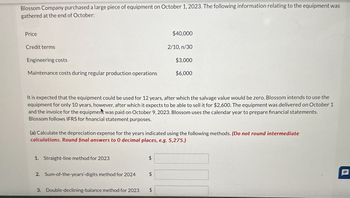

Transcribed Image Text:Blossom Company purchased a large piece of equipment on October 1, 2023. The following information relating to the equipment was

gathered at the end of October:

Price

Credit terms

$40,000

2/10, n/30

Engineering costs

$3,000

Maintenance costs during regular production operations

$6,000

It is expected that the equipment could be used for 12 years, after which the salvage value would be zero. Blossom intends to use the

equipment for only 10 years, however, after which it expects to be able to sell it for $2,600. The equipment was delivered on October 1

and the invoice for the equipment was paid on October 9, 2023. Blossom uses the calendar year to prepare financial statements.

Blossom follows IFRS for financial statement purposes.

(a) Calculate the depreciation expense for the years indicated using the following methods. (Do not round intermediate

calculations. Round final answers to 0 decimal places, e.g. 5,275.)

1. Straight-line method for 2023

$

2. Sum-of-the-years'-digits method for 2024

$

3. Double-declining-balance method for 2023

$

P

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Blossom Company is considering the purchase of a new machine. The invoice price of the machine is $151,000, freight charges are estimated to be $4,000, and installation costs are expected to be $6,000. The salvage value of the new equipment is expected to be zero after a useful life of 5 years. The company could retain the existing equipment and use it for an additional 5 years if it doesn't purchase the new machine. At that time, the equipment's salvage value would be zero. If Blossom purchases the new machine now, it would have to scrap the existing machine. Blossom's accountant, Donna Clark, has accumulated the following data for annual sales and expenses, with and without the new machine: 1. 2. 3. Without the new machine, Blossom can sell 13,000 units of product annually at a per-unit selling price of $100. If it purchases the new machine, the number of units produced and sold would increase by 10%, and the selling price would remain the same. The new machine is faster than the old…arrow_forwardCrane Company purchases an oil tanker depot on January 1, 2020, at a cost of $639,700. Crane expects to operate the depot for 10 years, at which time it is legally required to dismantle the depot and remove the underground storage tanks. It is estimated that it will cost $69,980 to dismantle the depot and remove the tanks at the end of the depot's useful life. (a) Your answer is partially correct. Prepare the journal entries to record the depot and the asset retirement obligation for the depot on January 1, 2020. Based on an effective-interest rate of 6%, the present value required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) the asset retirement obligation on January 1, 2020, is $39,076. (If no entry is Date Account Titles and Explanation Debit Credit January 1, depot 2020 639700 Cash 639700 (To record the depot) January 1, 2020 depot 39076 Asset Retirement…arrow_forwardOn January 1, 2021 the Hogan Manufacturing Company purchased a machine for $250,000. The company expects the service life of the machine to be 5 years and its anticipated residual value to be $40,000. The company's financial year end is December 31 and the straight line method is used for all depreciable assets. Jan 1, 2023, the company revised its estimate of service life from 5 to 8 years and also revised its estimated residual value to be $22,000. Required: Calculate depreciation for 2023arrow_forward

- The initial cost of the machine including its installation is 930,000. The expected life of the machine is 13 years for depreciation. The estimated salvage value of the equipment is 66,000 and the cost of dismantling is 22,000. Using the Declining Balance Method, what is the annual depreciation charge and what is the book value of the machine at the end of the eight year.arrow_forwardOn December 31, 2020, a company invested $2,150,000 in an asset. The company estimates that 3,000,000 tonnes will be excavated over the 20 year life of the asset. In order to decommission the asset at the end of the useful life it is estimated that it will cost $485,000. The depreciation method is based on units of production method. The relevant discount rate is 6%. A total of 220,000 tonnes and 205,000 tonnes were excavated in 2021 and 2022 respectively. Required Prepare all journal entries required for the years ended December 31, 2020, 2021 and 2022. (HINT: include the original purchase journal entry and subsequent depreciation and interest entries.)arrow_forwardOn January 1, 2020, Northeast USA Transportation Company purchased a used aircraft at a cost of $64,400,000. Northeast USA expects the plane to remain useful for five years (6.000,000 miles) and to have a residual value of $6,400,000. Northeast USA expects to fly the plane 725,000 miles the first year, 1,300,000 miles each year during the second, third, and fourth years, and 1,375,000 miles the last year. Read the requirements 1. Compute Northeast USA's depreciation for the first two years on the plane using the straight-line method, the units-of-production method, and the double-declining balance method. a. Straight-line method Using the straight-line method, depreciation is for 2020 and for 2021.arrow_forward

- On January 1, 2020, QuickAir Transportation Company purchased a used aircraft at a cost of $64,400,000. QuickAir expects the plane to remain useful for five years (7,000,000 miles) and to have a residual value of $6,400,000. QuickAir expects to fly the plane 925,000 miles the first year, 1,225,000 miles each year during the second, third, and fourth years, and 2,400,000 miles the last year. Read the requirements. 1. Compute QuickAir's depreciation for the first two years on the plane using the straight-line method, the units-of-production method, and the double-declining balance method. a. Straight-line method Using the straight-line method, depreciation is for 2020 and for 2021.arrow_forwardVincent Limited paid $100,000 to purchase equipment at the beginning of 2020. Vincent Limited estimated the useful life of the equipment to be 5 years or 200,000 units. The equipment will be considered fully amortized a when the balance in the Accumulated Depreciation account reaches $100,000. The equipment produced 50,000 units in 2020. Required:a. Determine the estimated residual value of the equipment.b. What is the amortizable cost of the equipment?c. Calculate depreciation expense for 2020 under each of the following methods:i. straight-lineii. units-of-productioniii. double-declining-balanced. If you were a new accountant in a company and you were asked to determine how best to depreciate a new machine they just bought; how would you determine the best method? What is the difference between your method and other method? How does your method affect the income statement?arrow_forwardOn March 1, 2024, a company entered into an agreement with the state to obtain the rights to operate a mineral mine for $6 million. The mine is expected to produce 155,000 tons of mineral. As part of the agreement, the company agrees to restore the land to its original condition after mining operations are completed in approximately five years. Management has provided the following possible outflows for the restoration costs that will occur five years from now: (PV of $1. PVA of $1) Cash Outflow $ 520,000 675,000 830,000 Probability 20% 30% 50% The company's credit-adjusted risk-free interest rate is 9%. During 2024, the company extracted 27,900 tons of ore from the mine. How much accretion expense will the company record in its income statement for the 2024 calendar year? Multiple Choicearrow_forward

- A new machine costs $100,000 and is expected to last 10 years. At the end of 10 years, the salvage value of the machine is $50,000. What is the depreciation of the machine in the first year and the fifth year? (Declining Balance)arrow_forwardWaterway Company purchased Machine #201 on May 1, 2020. The following information relating to Machine # 201 was gathered at the end of May. Price Credit terms Freight-in Preparation and installation costs Labor costs during regular production operations (a) It is expected that the machine could be used for 10 years, after which the salvage value would be zero. Waterway intends to use the machine for only 8 years, however, after which it expects to be able to sell it for $2,070. The invoice for Machine #201 was paid May 5, 2020. Waterway uses the calendar year as the basis for the preparation of financial statements. (1) (2) Compute the depreciation expense for the years indicated using the following methods. (3) Straight-line method for 2020 $117,300 Sum-of-the-years'-digits method for 2021 2/10, n/30 Double-declining-balance method for 2020 $1,104 $5,244 $14,490 $ LA $ $ Depreciation Expensearrow_forwardIn January, 2020, Swifty Corporation purchased a mineral mine for $4800000 with removable ore estimated by geological surveys at 2500000 tons. The property has an estimated value of $310000 after the ore has been extracted. The company incurred $1600000 of development costs preparing the mine for production. During 2020, 600000 tons were removed and 450000 tons were sold. What is the amount of depletion that Swifty should expense for 2020?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education