FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Bike-O-Rama produces two bike models: Voltage and EasyRider. Departmental overhead data follow.

Department

Fabricating

Assembly

Required:

Budgeted Cost

$ 120,900

Allocation Base

Machine hours (MH)

Budgeted Usage

140,000

Direct labor hours (DLH)

9,300 MH

2,800 DLH

1. Compute departmental overhead rates using

(a) machine hours to allocate budgeted Fabricating costs and

(b) direct labor hours to allocate budgeted Assembly costs.

2. The company reports the following actual production usage data. Compute the overhead cost per unit for each model.

Machine hours per unit

Direct labor hours per unit

Voltage

2.0 MH

1.5 DLH

EasyRider

4.0 MH

0.5 DLH

3. The company reports additional information below. For each model, compute the product cost per unit.

Per Unit

Voltage

EasyRider

Selling Price

$ 273

182

Direct Materials

$ 103

93

Direct Labor

$ 50

15

4. For each model, compute gross profit per unit (selling price per unit minus product cost per unit).

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3 Required 4

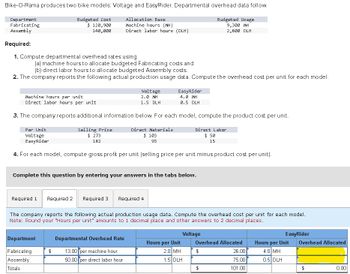

The company reports the following actual production usage data. Compute the overhead cost per unit for each model.

Note: Round your "Hours per unit" amounts to 1 decimal place and other answers to 2 decimal places.

Voltage

EasyRider

Department

Departmental Overhead Rate

Hours per Unit

Overhead Allocated

Hours per Unit

Overhead Allocated

Fabricating

Assembly

$

13.00 per machine hour

2.0 MH

$

50.00 per direct labor hour

1.5 DLH

26.00

75.00

4.0 MH

0.5 DLH

Totals

101.00

0.00

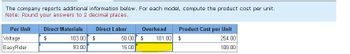

Transcribed Image Text:The company reports additional information below. For each model, compute the product cost per unit.

Note: Round your answers to 2 decimal places.

Per Unit

Direct Materials

Direct Labor

Overhead

Product Cost per Unit

Voltage

$

103.00

$

50.00

$

101.00 $

254.00

EasyRider

93.00

15.00

108.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Dawson Company manufactures small table lamps and desk lamps. The following shows the activities per product and the total overhead information: Line Item Description Units Setups Inspections Assembly (dlh) Small table lamps 4,000 3,500 9,450 45,600 Desk lamps 8,100 7,000 15,750 45,600 Activity Total Activity-Base Usage Budgeted Activity Cost Setups 10,500 $95,550 Inspections 25,200 168,840 Assembly (dlh) 79,800 255,360 The total factory overhead to be allocated to desk lamps is a. $315,145 b. $409,689 c. $567,261 d. $189,087arrow_forwardPanamint Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and wire drives. The indirect labor can be traced to four separate activity pools. The budgeted activity cost and activity base data by product are provided below. Procurement Scheduling Materials handling Product development Production Disk drives Tape drives Wire drives Activity Cost Activity Base $392,400 Number of purchase orders 233,100 Number of production orders 409,400 Number of moves 708,700 Number of engineering changes 1,526,300 Machine hours Number of Purchase Orders Number of Number Number of of Moves Engineering Changes 11 7 23 Production Orders 4,090 280 1,800 185 12,000 910 The activity-based cost for each disk drive unit is Oa. $793.58 Ob. $21.93 Oc. $235.34 Od. $191.6 1 1,410 740 4,500 Machine Hours 1,800 8,300 11,500 Number of Units 2,300 4,300 2,400arrow_forwardActivity-Based And Department Rate Product Costing and Product Cost Distortions Black and Blue Sports Inc. manufactures two products: snowboards and skis. The factory overhead incurred is as follows: Indirect labor $507,000 Cutting Department 156,000 Finishing Department 192,000 Total $855,000 The activity base associated with the two production departments is direct labor hours. The indirect labor can be assigned to two different activities as follows: Activity Budgeted Activity Cost Activity Base Production control $237,000 Number of production runs Materials handling 270,000 Number of moves Total $507,000 The activity-base usage quantities and units produced for the two products follow: Number of Production Runs Number of Moves Direct Labor Hours-Cutting Direct Labor Hours-Finishing Units Produced Snowboards 430 5,000 4,000 2,000 6,000 Skis 70 2,500 2,000 4,000…arrow_forward

- Consider the following data for two products of Vigano Manufacturing. Activity Budgeted Cost Activity Driver Machine setup $ 16,000 (20 machine setups) Parts handling 12,800 (16,000 parts) Quality inspections 19,200 (100 inspections) Total budgeted overhead $ 48,000 Unit Information Product A Product B Units produced 1,600 units 320 units Direct materials cost $ 26 per unit $ 36 per unit Direct labor cost $ 46 per unit $ 56 per unit Direct labor hours 2 per unit 2.50 per unit 1. Using a plantwide overhead rate based on 4,000 direct labor hours, compute the total product cost per unit for each product.2. Consider the following additional information about these two products. If activity-based costing is used to allocate overhead cost, (a) compute overhead activity rates, (b) allocate overhead cost to Product A and Product B and compute overhead cost per unit for each, and (c) compute product cost per unit for each. Actual Activity Usage Product A…arrow_forwardCrash Bang, Co. uses a standard cost system and provides the following information: Standards: Static budget variable overhead $5,580.00. Static budget fixed overhead $22,380.00. Static budget direct labor hours 573 hours. Static budget number of units 21,200 units. Static budget direct labor hours 0.026 hours per unit. Crash Bang, Co. allocates manufacturing overhead to production based on standard direct labor hours. Crash Bang, Co. reported the following actual results for 2020: Actual: Number of units produced 20,800. Actual variable overhead $5,300.00 Actual fixed overhead $24,400.00. Actual direct labor hours 499. (Round your answers to two decimal places when needed and use rounded answers for all future calculations).1. Compute the variable overhead allocation rates.arrow_forwardPanamint Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and wire drives. The indirect labor can be traced to four separate activity pools. The budgeted activity cost and activity base data by product are provided below. Activity Cost Activity Base Procurement $348,600 Number of purchase orders Scheduling 200,100 Number of production orders Materials handling 471,600 Number of moves Product development 741,200 Number of engineering changes Production 1,511,600 Machine hours Number of Number of Number Number of Number Purchase Production of Engineering Machine of Orders Orders Moves Changes Hours Units Disk drives 3,910 380 1,430 10 1,900 2,400 Tape drives 1,600 235 570 8,000 3,700 Wire drives 11,300 880 4,200 28 11,500 2,300 The activity rate for the procurement activity cost pool is Oa. $133.85 per purchase order Ob. $70.64 per purchase order Oc. S20.74 per purchase order Od. S233.18 per purchase order Previous Next Submit Test for…arrow_forward

- dont give handwritten answer thnkuarrow_forwardRequired information Use the following information for the Quick Studies below. (Algo) Rafner Manufacturing has the following budgeted data for its two production departments. Budgeted Data Overhead cost Direct labor hours Machine hours $ 1,358,900 Assembly 12,700 direct labor hours. 6,700 machine hours The departmental overhead rate for Assembly QS 17-7 (Algo) Computing departmental overhead rates LO P2 What is the Assembly department overhead rate using direct labor hours? What is the Finishing department overhead rate using machine hours? The departmental overhead rate for Finishing $ 1,068,800 Finishing 20,700 direct labor ho 16,700 machine hoursarrow_forwardZeke's Bikes uses a standard cost system and provides the following information: Standards: Static budget variable overhead $5,040.00. Static budget fixed overhead $20,900.00. Static budget direct labor hours 400 hours. Static budget number of units 25,600 units. Static budget direct labor hours 0.035 hours per unit. Actual: Number of units produced 25,000. Actual variable overhead $5,220.00 Actual fixed overhead $23,600.00. Actual direct labor hours 520. (Round your answers to two decimal places when needed and use rounded answers for all future calculations).1. Compute the variable and fixed overhead allocation rates.arrow_forward

- Dawson Company manufactures small table lamps and desk lamps. The following shows the activities per product and the total overhead information: Units Setups Inspections Assembly (dlh) 3,400 3,600 8,800 7,200 Small table lamps Desk lamps 8,400 14,000 43,200 43,200 Total Activity-Base Usage Budgeted Activity Cost 10,800 $109,080 22,400 114,240 75,600 340,200 Activity Setups Inspections Assembly (dlh) The total factory overhead (rounded to the nearest cent) to be allocated to each unit of small table lamps is O a. $80.47 O b. $136.80 O c. $48.28 O d. $104.61arrow_forwardPlease help me with show all calculation thankuarrow_forwardPanamint Systems Corporation is estimating activity costs associated with producing disk drives, tapes drives, and wire drives. The indirect labor can be traced to four separate activity pools. The budgeted activity cost and activity base data by product are provided below. Activity Cost Activity Base Procurement $364,200 Number of purchase orders Scheduling 243,400 Number of production orders Materials handling 417,300 Number of moves Product development 773,900 Number of engineering changes Production 1,428,300 Machine hours Number of Number of Number Number of Number Purchase Production of Engineering Machine of Orders Orders Moves Changes Hours Units Disk drives 4,120 270 1,500 11 2,200 2,100 Tape drives 2,400 245 500 7 8,500 3,500 Wire drives 11,500 790 3,500 21 10,700 2,400 The activity-based cost for each tape drive unit is Oa. $291.69 Ob. $239.52 Oc. $740.06 Od. $20.21arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education