FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

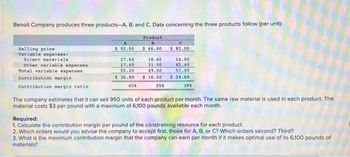

Transcribed Image Text:Benoit Company produces three products-A, B, and C, Data concerning the three products follow (per unit):

Product

B

$ 66.00

Selling price

Variable expenses:

Direct materials

Other variable expenses

Total variable expenses

Contribution margin

Contribution margin ratio

A

$ 92.00

27.60

27.60

55.20

$36.80

40%

18.00

31.50

49.50

$16.50

25%

C

$ 82.00

12.00

45.40

57.40

$ 24.60

30%

The company estimates that it can sell 950 units of each product per month. The same raw material is used in each product. The

material costs $3 per pound with a maximum of 6,100 pounds available each month.

Required:

1. Calculate the contribution margin per pound of the constraining resource for each product.

2. Which orders would you advise the company to accept first, those for A, B, or C? Which orders second? Third?

3. What is the maximum contribution margin that the company can earn per month if it makes optimal use of its 6,100 pounds of

materials?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 4 images

Knowledge Booster

Similar questions

- A company's product sells at $12.26 per unit and has a $5.39 per unit variable cost. The company's total fixed costs are $96,700. The contribution margin per unit is:arrow_forwardPlease do not give solution in image format thankuarrow_forwardBenoit Company produces three products-A, B, and C. Data concerning the three products follow (per unit): Product B $ 62.00 Selling price Variable expenses: Direct materials Other variable expenses Total variable expenses Contribution margin Contribution margin ratio A $ 80.00 24.00 24.00 48.00 $ 32.00 Required 1 Required 2 40% Required 3 18.00 25.40 43.40 $18.60 30% с $81.00 The company estimates that it can sell 800 units of each product per month. The same raw material is used in each product. The material costs $3 per pound with a maximum of 5,000 pounds available each month. 9.00 43.65 52.65 $28.35 Required: 1. Calculate the contribution margin per pound of the constraining resource for each product. 2. Which orders would you advise the company to accept first, those for A, B, or C? Which orders second? Third? 3. What is the maximum contribution margin that the company can earn per month if it makes optimal use of its 5,000 pounds of materials? 35% Complete this question by…arrow_forward

- Chip Company produces three products, Kin, Ike, and Bix. Each product uses the same direct material. Kin uses 3.4 pounds of the material, Ike uses 2.3 pounds of the material, and Bix uses 5.8 pounds of the material. Selling price per unit and variable costs per unit of each product follow. Selling price per unit Variable costs per unit Kin $ 157.02 105.00 Ike $ 105.16 84.00 Вix $ 219.18 149.00 (a) Compute contribution margin per pound of material for each product. (b) If demand is limited, list the three products in the order in which management should produce and meet demand. Product Contribution Margin Kin Ike Bix Contribution margin per pound Order in which management should produce and meet demand:arrow_forwardA tile manufacturer has supplied the following data: Boxes of tiles produced and sold Sales revenue Variable manufacturing expense Fixed manufacturing expense Variable selling and administrative expense Fixed selling and administrative expense Net operating income a. b. $ $ What is the company's unit contribution margin? $0.86 per unit $2.35 per unit $4.10 per unit $1.75 per unit C. d. 520,000 2,132,000 650,000 $ 464,000 $ 260,000 $ 312,000 $ 446,000arrow_forwardRequired information [The following information applies to the questions displayed below] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): $ 10,000 5,500 4,500 2,250 Sales Variable expenses Contribution margin Fixed expenses Net operating income 2,250 2. What is the contribution margin ratio? Contribution margin ratioarrow_forward

- The following variable production costs apply to goods made by Zachary Manufacturing Corporation: Cost per unit $ 9.00 Item Materials Labor Variable overhead 2.50 0.75 Total $12.25 Required Determine the total variable production cost, assuming that Zachary makes 6.000, 16,000, or 26,000 units. Units Produced 6,000 16,000 26,000 Total variable costarrow_forwardRequired information [The following information applies to the questions displayed below.] Felix & Company reports the following information. Period Units Produced 0 1 2 9 10 408 800 1,200 1,600 2,000 2,400 2,800 3,200 3,600 Total Costs $ 2,545 Total cost at the high point Variable costs at the high point Volume at the high point Variable cost per unit Total variable costs at the high point Total fixed costs 3,265 3,985 4,705 5,425 6,145 6,865 7,585 (1) Use the high-low method to estimate the fixed and variable components of total costs. (2) Estimate total costs if 3,000 units are produced. High-Low method- Calculation of variable cost per unit 8,305 9,025 Total cost at the low point Variable costs at the low point Volume at the low point Variable cost per unit Total variable costs at the low point Total fixed costs (2) Estimated cost if 3,000 units are produced: Estimated total cost High-Low method-Calculation of fixed costs 0arrow_forwardBenoit Company produces three products-A, B, and C. Data concerning the three products follow (per unit): Product B $ 70.00 Selling price Variable expenses: Direct materials Other variable expenses Total variable expenses Contribution margin Contribution margin ratio A $ 84.00 25.20 25.20 50.40 $ 33.60 40% Required 1 Required 2 Required 3 21.00 31.50 52.50 $ 17.50 25% с $ 74.00 The company estimates that it can sell 750 units of each product per month. The same raw material is used in each product. The material costs $3 per pound with a maximum of 5,400 pounds available each month. Contribution margin per pound of the constraining resource Product Carrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education