FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

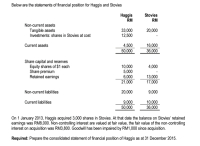

Transcribed Image Text:Below are the statements of financial position for Haggis and Stovies

Haggis

RM

Stovies

RM

Non-current assets

Tangible assets

Investments: shares in Stovies at cost

33,000

12,500

20,000

Current assets

4,500

50,000

16,000

36,000

Share capital and reserves

Equity shares of $1 each

Share premium

Retained earnings

10,000

5,000

6,000

21,000

4,000

13,000

17,000

Non-current liabilities

20,000

9,000

Current liabilities

9,000

50,000

10,000

36,000

On 1 January 2013, Haggis acquired 3,000 shares in Stovies. At that date the balance on Stovies' retained

earnings was RM8,000. Non-controlling interest are valued at fair value, the fair value of the non-controlling

interest on acquisition was RM3,800. Goodwill has been impaired by RM1,000 since acquisition.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Following are the Balance Sheets of X Ltd. for the year 2014 and 2015. 2014 2015 sin '000 sin '00 L Equity and Liabilities (1) Shareholders' Funds (a) Share Capital : Equity Share Capital 8% Redeemable Preference Share Capital (b) Reserves and Surplus : General Reserve Surplus Account (2) Non-current Liabilities 200 320 150 90 40 70 15 38 Debentures 100 90 (3) Current Liabilities Creditors 55 83 Bills Payable Proposed Dividend (Treating it as non-current liability) Provision for Tax (NCL) 20 16 42 50 40 50 Total Equity and Liabilities 662 807 II. Assets (1) Non-current Assets Fixed Assets: Land & Building Plant & Machinery Intangible Asset : Goodwill 200 80 170 200 80 100 (2) Current Assets Stock Debtors B/R Cash & Bank Balances 59 250 30 18 87 150 20 25 Total Assets 662 807 Additional Information: (1) (1) (I) (IV) An interim dividend of $ 20,000 has been paid in 2015. $ 35,000 income tax was paid during the year 2015. Dividend of $ 28,000 was paid during the year 2015. During the year…arrow_forwardThe following summarized balance sheets were prepared for the Gold Company and Mythic Corporation. Gold Mythic Current assets 350,000 185,000 Land 80,000 25,000 Building, net 250,000 325,000 Goodwill 195,000 100,000 Total Assets 875,000 635,000 Accounts payable 115,000 85,000 Bonds payable 170,000 150,000 Common stocks, P10 par 150,000 75,000 APIC 200,000 40,000 Retained Earnings 240,000 285,000 Total Liabilities and Equity 875,000 635,000 The appraised values of the Mythic Corporation’s land and buildings are P20,000 and P258,000, respectively. Gold issues 15,250 shares of common stocks with a fair value of P12 each. Gold also pays out-of-pocket costs for the following: Broker's fee 10,000 Professional fees to valuers 3,000 Legal fees…arrow_forwardThe McLaughlin Corporation declared a 6 percent stock dividend. Construct a pro forma balance sheet showing the effect of this action. The stock was selling for $37.50 per share, and a condensed version of McLaughlin's balance sheet as of December 31, 2008, before the dividend, follows ($ millions):arrow_forward

- Contributed capital: Western Grass, Inc. Equity Section of Balance Sheet December 31, 2823 Preferred shares, $3 cumulative, 10,000 shares authorized, issued and outstanding Common shares, 100,000 shares authorized; 65,000 shares issued and outstanding Total contributed capital Retained earnings Total equity 75,000 552,500 627 500 581 000 $1,208,500 Required: Using the Information provided, calculate book value per common share assuming: (Round the final answers to 2 decimal places.) a. There are no dividends in arrears. b. There are three years of dividends in arrears. Book Value of Common Sharesarrow_forwardJason’s Corp balance sheet as of December 31, 2021, reveals the following information. Preferred stock, $100 par $ 600,000 Paid-in capital in excess of par—preferred 50,000 Common stock, $1 par 300,000 Paid-in capital in excess of par—common 520,000 Retained earnings 320,000 What was the total paid-in capital as of December 31, 2021? Question 6Answer a. $320,000 b. $1,470,000 c. $900,000 d. $1,790,000arrow_forwardKindly answer number 18 and 19 only.arrow_forward

- H. Below is a partial list of account titles and balances for the TNT Corporation as of December 31, 2018. Cash P 320,000 Notes Receivable 24,000 400,000 Preference Share Capital, P 100 par, 10,000 shares authorized Ordinary Share Capital, P 20 par, 100,000 shares authorized Preference share premium 1,000,000 150,000 Ordinary share premium 200,000 Retained Earnings 250,000 150,000 Accounts Payable Sales 950,000 Compute for the following: 1) How many shares were issued for the Preference Share Capital? How many shares were issued for the Ordinary Share Capital? 2) 3) How much is the premium per share for the Preference Share Capital? 4) How much is the premium per share for the Ordinary Share Capital? 5) How much is the issuance price for the Preference Share Capital? 6) How much is the issuance price for the Ordinary Share Capital? 7) How much is the total Share Capital? 8) How much is the total Additional Paid In Capital? 9) How much is the total Contributed Capital? 10) How much is…arrow_forwardPresented below is information related to Cullumber Corporation: Common Stock, $1 par $10364000 Paid-in Capital in Excess of Par-Common Stock 6542000 Paid-in Capital from Treasury Stock 430000 Retained Earnings 9548000 696000 Treasury Common Stock (at cost) The total stockholders' equity of Cullumber Corporation is O $27580000. $26188000. $27150000. $25328000.arrow_forwardThe total assets value of Boafo Plc is GHC600,000 and the shareholders’ fund is GHC360,000. The shareholders’ fund consists of :100,000 ordinary shares issued at GHC2 per share 200,000Retained earnings 160,000Calculate the book valuation of a share of QRS Plcarrow_forward

- of stion Paid-in capital consists of: O b. O c. O d. earnings generated by the corporation. capital raised by issuing bonds. amounts paid by customers. amounts received from stockholders. Bradley Corporation issued 10,000 shares of common stock on 101. par and wasarrow_forwardThe following summarized balance sheets were prepared for the Gold Company and Mythic Corporation. Gold Mythic Current Assets 350,000 185,000 Land 80,000 25,000 Building, net 250,000 325,000 Goodwill 195,000 100,000 Total Assets 875,000 635,000 Accounts Payable 115,000 85,000 Bonds Payable 170,000 150,000 Common stocks,P10 par 150,000 75,000 APIC…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education