Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

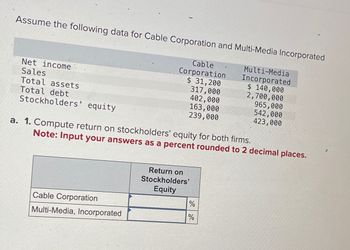

Transcribed Image Text:Assume the following data for Cable Corporation and Multi-Media Incorporated

Net income

Sales

Total assets

Total debt

Stockholders' equity

Cable

Corporation

Cable Corporation

Multi-Media, Incorporated

$ 31,200

317,000

402,000

163,000

239,000

a. 1. Compute return on stockholders' equity for both firms.

Note: Input your answers as a percent rounded to 2 decimal places.

Return on

Stockholders'

Equity

do do

%

$

%

Multi-Media

Incorporated

$ 140,000

2,700,000

965,000

542,000

423,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Gadubhaiarrow_forwardAnalyzing EPS through Financial Statement Presentation Sundry Inc. reported the following information in its consolidated statement of earnings for the fiscal year ended January 31. Required a. Estimate the average number of common shares outstanding for its fiscal year ended January 31. Note: Round your answer to the nearest whole share (in millions). ✓ million shares. b. Does the company have a simple or a complex capital structure? ✓ capital structure. c. If diluted weighted-average common shares were 1,547 million, recompute diluted EPS. d. Based on part c, what type(s) of dilutive securities would we assume the company reported in its financial statements? Stock plans Convertible securitiesarrow_forwardFinancial statement data for the current year for Hanz Corp. are as follows: Line Item Description Amount Net income $5,700,000 Preferred dividends $70,000 Average number of common shares outstanding 200,000 The earnings per share for the current year are? a.$28.15 b.$28.50 c.$28.85 d.$0.35arrow_forward

- what is the the quick ratio for both yearsarrow_forwardBelow is the financial data for Arla Inc. for the year ended December 31, 2020: Market price per share... Net Income...... $150.00 $1,750,000 Preferred Dividends declared... $75,000 Average # of common shares....... Dividends per share...... Average common shareholders' equity..... Total assets..... Total Liabilities... Accumulated Other Comprehensive Income..... 100,000 $2.50 10,000,000 $22,500,000 $11,675,000 $185,000 Instructions Calculate the Return on shareholders' equity (use up to 2 decimal places and do not include a % sign)arrow_forwardThe following selected data were taken from the financial statements of Vidahill Inc. for December 31, 20Y7, 20Y6, and 20Y5: December 31 20Υ7 20Y6 20Υ5 Total assets $192,000 $173,000 $154,000 Notes payable (8% interest) 60,000 60,000 60,000 Common stock 24,000 24,000 24,000 Preferred 4% stock, $100 par 12.000 12,000 12,000 (no change during year) Retained earnings 70,415 45,870 36,000 The 20Y7 net income was $25,025, and the 20Y6 net income was $10,350. No dividends on common stock were declared between 20Y5 and 20Y7. Preferred dividends were declared and paid in full in 20Y6 and 20Y7. a. Determine the return on total assets, the return on stockholders' equity, and the return on common stockholders' equity for the years 20Y6 and 20Y7. Round percentages to one decimal place. 20Y7 20Υ6 Return on total assets % Return on stockholders' equity Return on common stockholders' equity % b. The profitability ratios indicate that the company's profitability has Since the rate of return on total…arrow_forward

- Vishnuarrow_forwardI need help with this question to understand the topicarrow_forwardgiven the following data for the cheyenne company: current liabilities 602; long-term debt 630; common stock 858; retained earnings 1210; total liabilities & stockholders' equity 3300. how would common stock apprear on a common size balance sheet?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education