FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

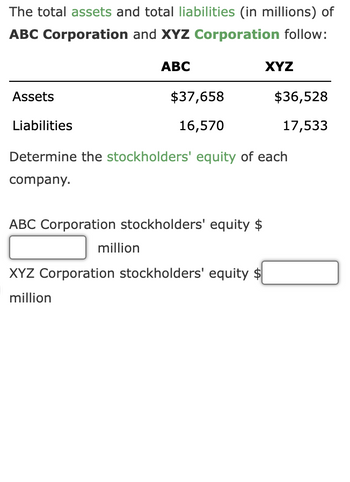

Transcribed Image Text:The total assets and total liabilities (in millions) of

ABC Corporation and XYZ Corporation follow:

Assets

Liabilities

ABC

$37,658

16,570

million

ABC Corporation stockholders' equity $

Determine the stockholders' equity of each

company.

XYZ

XYZ Corporation stockholders' equity $

million

$36,528

17,533

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardAtlanta Company $ 429,000 572,000 Atlanta Company Spokane Company Total liabilities Total equity Compute the debt-to-equity ratio for each of the above companies. Debt to equity ratio Choose Numerator: Spokane Company $ 549,000 1,830,000 / Choose Denominator: 1 1 1 = Debt-to-equity ratio =arrow_forwardWhat is the net increase or (net decrease) in the identifiable assets of SD Corporation?a. 13,700,500b. 13,307,500c. 13,957,500d. 13,050,500arrow_forward

- The following summarized balance sheets were prepared for the Gold Company and Mythic Corporation. Gold Mythic Current assets 350,000 185,000 Land 80,000 25,000 Building, net 250,000 325,000 Goodwill 195,000 100,000 Total Assets 875,000 635,000 Accounts payable 115,000 85,000 Bonds payable 170,000 150,000 Common stocks, P10 par 150,000 75,000 APIC 200,000 40,000 Retained Earnings 240,000 285,000 Total Liabilities and Equity 875,000 635,000 The appraised values of the Mythic Corporation’s land and buildings are P20,000 and P258,000, respectively. Gold issues 15,250 shares of common stocks with a fair value of P12 each. Gold also pays out-of-pocket costs for the following: Broker's fee 10,000 Professional fees to valuers 3,000 Legal fees…arrow_forwardssarrow_forwardHansel Corporation's condensed balance sheets appear below: 20X3 20X2 20X1 Assets: $ 55,000 495,000 20,000 $ 56,500 410,000 27,500 Current assets Plant & equipment, net Intangible assets, net 70,000 440,000 40,000 Total assets $570,000 $494,000 $550,000 Liabilities & Stockholders' Equity: Current liabilities Long-term liabilities Stockholders' equity $ 40,000 395,000 135,000 $ 35,000 310,000 149,000 $ 32,500 375,000 142,500 Total liabilities & equity $570,000 $494,000 $550,000 In a common size balance sheet for 20X3, total liabilities and equity are expressed asarrow_forward

- Balance Sheet for Dex Company and Ed Company on December 31, 2023 are as follows: Dex Company Ed Company Cash P850,000 P75,000 Other Assets 2,200,000 425,000 Total Assets P3,050,000 P500,000 Liabilities P1,200,000 P100,000 Common Stock, P50 par 2,000,000 - Common Stock, P10 par - 250,000 Additional Paid-in Capital 500,000 - Retained Earnings (600,000) 150,000 Total Liabilities and Equity P3,050,000 P500,000 On this date, Dex Company acquired 80% of the stock of Ed Company. Instructions: Prepare a consolidated balance sheet and the eliminating entries as of December 31, 2023, under each set of conditions listed below. Subsidiary stock is acquired in exchange for 5,000 shares of the parent company stock, and the investment accounts is recorded at P300,000, the current market value of the shares issued. The difference between the investment balance an the book value of the interest acquired is…arrow_forwardnkt.4arrow_forwardPagle Corporation holds 80 percent of Standard Company's common shares. The companies report the following balance sheet data for December 31, 20X1: Assets Cash Accounts Receivable Inventory Buildings and Equipment Less: Accumulated Depreciation Investment in Standard Company Stock Total Assets Liabilities and Owners' Equity Accounts Payable Taxes Payable Preferred Stock ($10 par value) Common Stock: $10 par value $5 par value Retained Earnings Total Liabilities and Owners' Equity Pagle Corporation $ 53,000 85,000 126,000 700,000 (295,000) 160,000 $ 829,000 Basic earnings per share Diluted earnings per share $ 120,000 79,000 200,000 100,000 330,000 $ 829,000 Required: Compute basic and diluted EPS for the consolidated entity for 20X1. Note: Round your answers to 2 decimal places. Standard Company $ 43,000 65,000 76,000 330,000 (130,000) $ 384,000 $ 84,000 100,000 An 8 percent annual dividend is paid on the Pagle preferred stock and a 12 percent dividend is paid on the Standard…arrow_forward

- Poppy Corporation owns 60 percent of Seed Company's common shares. Balance sheet data for the companies on December 31, 20X2, are as follows: Assets Cash Accounts Receivable Inventory Buildings and Equipment Less: Accumulated Depreciation Investment in Seed Company Stock Total Assets Liabilities and Owners' Equity Accounts Payable Bonds Payable Common Stock ($10 par value) Retained Earnings Total Liabilities and Owners' Equity Poppy Corporation Basic earnings per share Diluted earnings per share $ 94,000 $ 35,000 83,000 57,000 117,000 100,000 92,000 (77,000) $ 487,000 690,000 (225,000) 135,000 $ 894,000 Seed Company $ 62,000 $ 119,000 250,000 200,000 300,000 100,000 225,000 125,000 $ 894,000 $ 487,000 The bonds of Poppy Corporation and Seed Company pay annual interest of 8 percent and 10 percent, respectively. Poppy's bonds are not convertible. Seed's bonds can be converted into 10,000 shares of its company stock any time after January 1, 20X1. An income tax rate of 40 percent is…arrow_forwardAccounting equation The total assets and total liabilities (in millions) of ABC Corporation and XYZ Corporation follow: Assets ABC Liabilities XYZ $47,172 $45,757 20,756 21,963 Determine the stockholders' equity of each company. ABC Corporation stockholders' equity $ XYZ Corporation stockholders' equity $ million millionarrow_forwardPlease write to text format answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education