FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

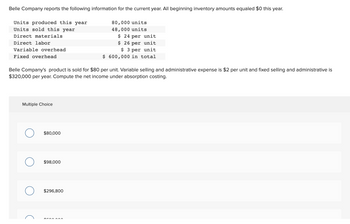

Transcribed Image Text:Belle Company reports the following information for the current year. All beginning inventory amounts equaled $0 this year.

80,000 units

48,000 units

$ 24 per unit

$ 26 per unit

$3 per unit

$ 600,000 in total

Units produced this year

Units sold this year

Direct materials

Direct labor

Variable overhead

Fixed overhead

Belle Company's product is sold for $80 per unit. Variable selling and administrative expense is $2 per unit and fixed selling and administrative is

$320,000 per year. Compute the net income under absorption costing.

Multiple Choice

O

$80,000

$98,000

$296,800

tran^^^

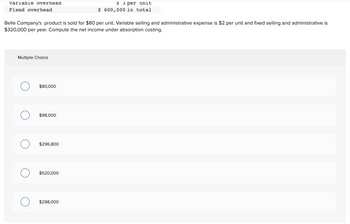

Transcribed Image Text:Variable overhead

Fixed overhead

Belle Company's product is sold for $80 per unit. Variable selling and administrative expense is $2 per unit and fixed selling and administrative is

$320,000 per year. Compute the net income under absorption costing.

Multiple Choice

O

$80,000

$98,000

$296,800

$520,000

$ 3 per unit

$ 600,000 in total

$298,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Oak Mart, a producer of solid oak tables, reports the following data from its second year of business. Sales price per unit $ 300 per unit Units produced this year 115,000 units Units sold this year 118,750 units Units in beginning-year inventory 3,750 units Beginning inventory costs Variable (3,750 units × $140) $ 525,000 Fixed (3,750 units × $70) 262,500 Total $ 787,500 Manufacturing costs this year Direct materials $ 46 per unit Direct labor $ 64 per unit Overhead costs this year Variable overhead $ 3,200,000 Fixed overhead $ 7,400,000 Selling and administrative costs this year Variable $ 1,450,000 Fixed 4,000,000 1. Prepare the current-year income statement for the company using variable costing.arrow_forwardAdvanced Company reports the following information for the current year. All beginning inventory amounts equaled $0 this year. Units produced this year 25,000 units Units sold this year 15,000 units Direct materials $8 per unit Direct labor $10 per unit Variable overhead $3 per unit Fixed overhead $50,000 in total Variable selling and administrative $5 per unit Fixed selling and administrative $20,000 in total Selling price $60 Given Advanced Company's data, compute the dollar amount of contribution margin using variable costing? THERE SEEMS TO BE A LOT OF CONFLICTING ANSWERS ON CHEGG FOR THIS QUESTION, PLEASE LOOK AT CAREFULLYarrow_forwardDuring its first year of operations, the McCormick Company incurred the following manufacturing costs: Direct materials, $5 per unit, Direct labor, $2 per unit, Variable overhead, $4 per unit, and Fixed overhead, $390,000. The company produced 39,000 units, and sold 30,000 units, leaving 9,000 units in inventory at year-end. What is the value of ending inventory under absorption costing? Multiple Choice $99,000 $189,000 $90,000 $390,000 $489,000arrow_forward

- Chuck Wagon Grills, Incorporated, makes a barbecue grill it sells for $210. Data for last year's operations follow: Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Total variable.cost per unit Fixed costs: Fixed manufacturing overhead Fixed selling and administrative Total fixed costs 0 20,000 19,000 1,000 $ 50 80 20 10 $ 160 $ 700,000 285,000 $ 985,000 Required: 1. Assume the company uses variable costing. Compute the unit product cost for one barbecue grill. 2. Assume the company uses variable costing. Prepare a contribution format income statement for last year. 3. How many barbecue grills must be sold to break even?arrow_forwardYaHo, Ltd. is a manufacturer that produces a single product. Below is data concerning its most recent month of operations: Units in beginning inventory 0 Units produced 81,450 Units sold 77,820 Selling price per unit: $13.80 Variable costs per unit: Direct materials $2.90 Direct labor $2.05 Variable manufacturing overhead $1.30 Variable selling and administrative expense $1.05 Fixed costs (per month): Fixed manufacturing overhead $195,480 Fixed selling and administrative expense $218,825 Calculate net income for the month using variable costing. a. $173,236 b. $153,781 c. $115,120 d. $100,237 e. $91,525arrow_forwardDowell Company produces a single product. Its income statements under absorption costing for its first two years of operation follow. Income Statements (Absorption Costing) Year 1 Year 2 Sales ($50 per unit) $ 1,350,000 $ 2,550,000 Cost of goods sold ($39 per unit) 1,053,000 1,989,000 Gross profit 297,000 561,000 Selling and administrative expenses 247,000 271,000 Income $ 50,000 $ 290,000 Additional Information Sales and production data for these first two years follow. Units Year 1 Year 2 Units produced 39,000 39,000 Units sold 27,000 51,000 Variable costs per unit and fixed costs per year are unchanged during these years. The company's $39 per unit product cost using absorption costing consists of the following. Direct materials $ 16 Direct labor 9 Variable overhead 5 Fixed overhead ($351,000/39,000 units) 9 Total product cost per unit $ 39 Selling and administrative expenses consist of the following. Selling and…arrow_forward

- Potter Company has the following information for the current year: Beginning fixed manufacturing overhead in inventory $95,000 Fixed manufacturing overhead in production 375,000 Ending fixed manufacturing overhead in inventory 25,000 Beginning variable manufacturing overhead in inventory $10,000 Variable manufacturing overhead in production 50,000 Ending variable manufacturing overhead in inventory 15,000 What would be the estimated cost per unit if Potter Company expects to sell 2,000 units next year? a. $300 b. $312 c. $370 d. $498 e. $500arrow_forwardCavy Company completed 10,510 units during the year at a cost of $746,210. The beginning finished goods inventory was 2,310 units valued at $152,460. Assuming a FIFO cost flow, determine the cost of goods sold for 9,490 units. $4arrow_forwardAdams Company makes a single product that it sells for $8.45 per unit. Provided below is information about this product for the past nine months: Month January February March April May June July August September Total Cost Incurred $28,730 $24,580 $30,660 $16,890 $19,120 $20,610 $17,490 $25,380 $15,540 Units Sold 6,400 5,150 6,900 2,950 3,600 4,150 3,350 5,500 2,700 Adams Company expects to sell 4,620 units of this product during October. Using the high-low method, calculate Adams Company's expected margin of safety for October.arrow_forward

- Data concerning Dakota Enterprises' operations last year appear below: Units in the Beginning Inventory -0- Units Units Produced 4,000 Units Units Sold 3,900 Units Selling Price Per Unit $140 Variable Costs Per Unit: Direct Material $41 Direct Labor 43 Manufacturing Overhead 6 Sellling and Administrative Costs 4 Fixed Costs in Total: Manufacturing Overhead $84,000 Selling and Administrative Costs 39,000 Match each of the following items with the proper amount. Unit Product Cost , Using Absorption Costing Unit Gross Margin…arrow_forwardBelle Company reports the following information for the current year. All beginning inventory amounts equaled $0 this year. Units produced this year 105,000 units Units sold this year 63,000 units Direct materials $ 29 per unit Direct labor $ 31 per unit Variable overhead $ 3 per unit Fixed overhead $ 918,750 in total Belle Company's product is sold for $89 per unit a Variable selling and administrative expense is $2 per unit and fixed selling and administrative is $370,000 per year. Compute the net income under variable costing.arrow_forwardA manufacturer reports the following costs to produce 14,000 units In Its first year of operations: direct materials, $14 per unit, direct lalbor, $10 pe w and fixed overhead, $224,000. Of the 14,000 units produced, 12,900 were sold, and 1,100 remain in Inventory at year-end.Under varlable conting, the Multiple Cholce $27,500. $26,400. $38,500. $44,000. $56,100.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education