FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

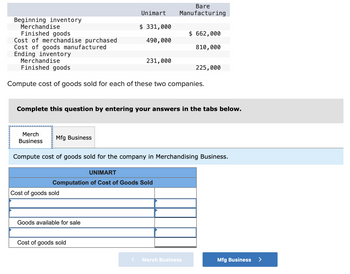

Transcribed Image Text:Beginning inventory

Merchandise

Finished goods

Cost of merchandise purchased

Cost of goods manufactured

Ending inventory

Merch

Business

Mfg Business

Merchandise

Finished goods

Compute cost of goods sold for each of these two companies.

Unimart

$ 331,000

490,000

Cost of goods sold

Complete this question by entering your answers in the tabs below.

Goods available for sale

231,000

UNIMART

Computation of Cost of Goods Sold

Cost of goods sold

Bare

Manufacturing

Compute cost of goods sold for the company in Merchandising Business.

$ 662,000

810,000

225,000

Merch Business

Mfg Business >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1 View Policies Current Attempt in Progress The cost of goods sold computations for Flint Company and Pina Colada Company are shown below. Beginning inventory Cost of goods purchased Cost of goods available for sale Ending inventory Cost of goods sold (a1) Inventory turnover eTextbook and Media norcal archives 20....zip Flint Company ^ $ 46,000 197,500 W 243,500 55,000 $188,500 Compute inventory turnover for each company. (Round answers to 2 decimal places, e.g. 15.25.) Flint Company Pina Colada Company $72,500 OCA 5.docx 294,000 366,500 73,000 $293,500 Pina Colada Company W response essay.docxarrow_forwardComplete the missing figures: Q15 Purchases of raw materials during that year Q16 Raw materials use in production during the year Q17 Cost of units completed during the year Q 18 Finished goods inventory Q19 Cost of units sold during the yeararrow_forwardBeginning inventory Merchandise Finished goods Cost of merchandise purchased Cost of goods manufactured Ending inventory Unimart $ 278,000 500,000 Merch Business Merchandise Finished goods Compute cost of goods sold for each of these two companies. 178,000 Bare Manufacturing Cost of goods sold $ 556,000 850,000 Complete this question by entering your answers in the tabs below. 172,000 Mfg Business Compute cost of goods sold for the company in Merchandising Business. UNIMART Computation of Cost of Goods Soldarrow_forward

- 5arrow_forwardes W Required information [The following information applies to the questions displayed below.] (a Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Date March 1 March 5 March 9 March 18 here to search 2 March 25 March 29 Sales Less: Cost of goods sold Gross profit Gross Margin 13 # Activities Beginning inventory Purchase Sales Purchase Purchase Sales Totals 4. Compute gross profit earned by the company for each of the four costing methods. For specific identification, units sold include 140 units from beginning inventory, 270 units from the March 5 purchase, 120 units from the March 18 purchase, and 160 units, from the March 25 purchase. Note: Round weighted average cost per unit to two decimals and final answers to nearest whole dollar. 3 Ri $ FIFO $ 64,210 $ IDI 4 LIFO 99+ 15 % Units Acquired at Cost 250 units. @ $54.00 per unit 300 units @ $59.00 per unit 160 units 300 units 5 1,010 units 64,210 $ @…arrow_forwardRoyal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Product Weedban Selling price per unit Variable expenses per unit Traceable fixed expenses per year $ $ $ 128,000 Greengrow $ 2$ 8.00 39.00 2.90 13.00 $ 37,000 Common fixed expenses in the company total $105,000 annually. Last year the company produced and sold 38,500 units of Weedban and 24,000 units of Greengrow. Required: Prepare a contribution format income statement segmented by product lines. Product Line Total Weedban Greengrow Company 0 $arrow_forward

- find cost of goods sold ending inventory and gross margin using FIFO and weighted average Kindly answer in text with all workingsarrow_forwardQuestion - Company sells three different categories of tools (small, medium, and large). The cost and market value of its inventory of tools is as follows. Cost Market Value Small $ 63,200 $ 72,000 Medium 2,89,400 2,60,800 Large 1,52,100 1,72,800 Determine the value of the company's inventory under the lower-of- cost-or-market value approach.arrow_forwardDon't provide answer in image formatarrow_forward

- The following inventory information is gathered from the accounting records of Tucker Enterprises: # of Units x Unit Cost = Total Beginning Inventory 4000 x 5 Purchases 6000 x 7 Sales 9000 x 10 Ending Inventory 1000 a. Calculate Ending Inventory # of Units Unit Cost Ending Inventory 1.FIFO 0 $- 2.LIFO 0 $- 3.Weighted Average Cost 0 $- $- $- $- b. Cost of Goods Sold # of Units # of Units Unit cost Unit cost Cost of Goods Sold 1.FIFO $- 2.LIFO $- 3.Weighted Average Cost $- $- 0 $- c.Gross profit using each of the following methods: Sales Cost of Goods Sold Gross Profit 1.FIFO $- $- $- 2.LIFO $- $- $- 3.Weighted Average Cost $- $- $-arrow_forwardPlease do not give solution in image format ? And Fast answering please and explain proper steps by Step.arrow_forwardFind COGS?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education