FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

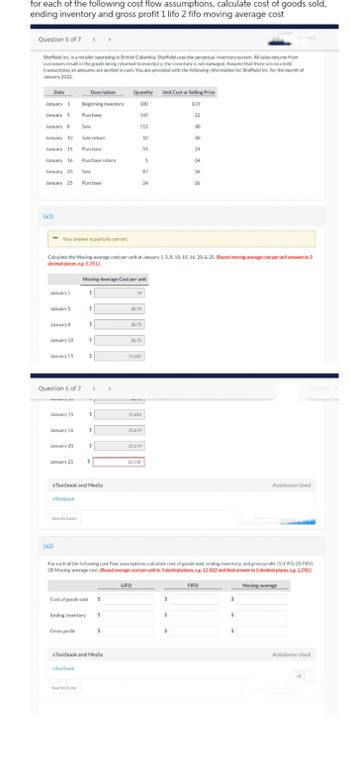

Transcribed Image Text:for each of the following cost flow assumptions, calculate cost of goods sold,

ending inventory and gross profit 1 lifo 2 fifo moving average cost

Question 6 of 7

Sheffield Inc. is a retailer operating in British Columbia. Sheffield uses the perpetual inventory system. All sales returns from

customers result in the goods being returned to inventory; the inventory is not damaged. Assume that there are no credit

transactions; all amounts are settled in cash. You are provided with the following information for Sheffield Inc. for the month of

January 2022.

Date

January 1 Beginning inventory

January 5

Purchase

January 8

January 10

January 15

January 16

January 20

January 25

(a1)

January 1

- Your answer is partially correct.

January 5

January 8

January 10

January 15

Question 6 of 7

ya

January 15

January 16

January 20

January 25

eTextbook

Save for Later

(a2)

Calculate the Moving-average cost per unit at January 1, 5, 8, 10, 15, 16, 20, & 25. (Round moving-average cost per unit answers to 3

decimal places, eg. 5.251)

Description

Sale

Sale return

Purchase

Purchase return

Sale

Purchase

Gross profit

Cost of goods sold

Ending inventory

eTextbook

Save for Later

$

$

$

Moving-Average Cost per unit

$

eTextbook and Media

$

<

7

$

$

$

$

$

$

eTextbook and Media

$

Quantity Unit Cost or Selling Price

100

$19

22

>

140

113

19

20.75

20.75

20.75

21.681

21.681

21.619

LIFO

21.619

10

22.118

55

5

87

24

For each of the following cost flow assumptions, calculate cost of goods sold, ending inventory, and gross profit. (1) LIFO. (2) FIFO

(3) Moving-average cost. (Round average-cost per unit to 3 decimal places, eg. 12.502 and final answer to O decimal places, eg. 1.250)

$

30

$

30

$

24

24

36

26

FIFO

$

$

Assistance Used

$

Moving-average

Assistance Used

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Question Content Area Three identical units of merchandise were purchased during July, as follows: Date Product Basic H Units Cost July 3 Purchase 1 $20 10 Purchase 1 23 24 Purchase 1 26 Total 3 $69 Average cost per unit $23 Assume one unit sells on July 28 for $34. Determine the gross profit, cost of goods sold, and ending inventory on July 31 using the (a) first-in, first-out, (b) last-in, first-out, and (c) weighted average cost flow methods. Line Item Description Gross Profit Cost of Goods Sold Ending Inventory a. First-in, first-out $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 b. Last-in, first-out $fill in the blank 4 $fill in the blank 5 $fill in the blank 6 c. Weighted average $fill in the blank 7 $fill in the blank 8 $fill in the blank 9arrow_forwardW Using the specific identification method: Units purchased 15 Echo Show's 360 45 Echo Show's 360 60 Echo Show's 360 a. Calculate the cost of ending inventory. Date June 1 July 1 August 1 Ending inventory b. Calculate the cost of goods sold. Cost of goods sold Cost per unit $ 275 250 240arrow_forwardces Date March 1 March 5 March 9 March 18 March 25 March 29 Problem 6-1A (Algo) Part 3 Perpetual FIFO Perpetual LIFO Date March 1 Complete this question by entering your answers in the tabs below. March 5 Weighted Average Compute the cost assigned to ending inventory using LIFO. Total March 5 Activities Beginning inventory Purchase Sales Purchase Purchase Sales Totals 3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. For specific identification, units sold include 60 units from beginning inventory, 190 units from the March 5 purchase, 40 units from the March 18 purchase, and 80 units from the March 25 purchase. March 9 Total March 9 March 18 Total March 18 Units Acquired at Cost 90 units @ $50.80 per unit 220 units @ $55.80 per unit Goods Purchased # of units 80 units @ $60.80 per unit 140 units @ $62.80 per unit Specific Id 530 units Cost per # of units unit sold Perpetual LIFO: Cost of Goods Sold Cost per…arrow_forward

- find cost of goods sold ending inventory and gross margin using FIFO and weighted average Kindly answer in text with all workingsarrow_forwardJanuary 1 January 12 January 24 January 28 Balance: 30 units @ 40 units @ 3 units @ 50 units @ $35 per unit $36 per unit $36 per unit $50 per unit Purchases: Purchase Return: Sales: The company uses the last in first out (LIFO) method of accounting for inventory. All purc and sales are done on account. Record all required entries related to inventory movemer order of occurrence using the period method (NOT THE PERPETUAL). Action/Date Periodic Method Beginning 1/1 Purchase 1/12 Return 1/24 Sales 1/28 Adjustment 1/31arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Ay 3. item Beta. Units. Cost The following three identical units of items PX2T are purchased during April April 2 Purchase 1 $104 April 15 Purchase 1 108 April 20. Purchase. 1. 112 Total. 3. $324 Average cost per unit. $108. ($324 ~ 3 units) Assume that one unit is sold on April 27 for $152. Determine the gross profit for April and ending inventory on April 30 using the (a) first -in, first-out (FIFO); (b) last-in, first-out (LIFO); and (c)weighted average cost method a. First-in, first-out (FIFO). Gross Profit. Ending Inventory b. Last-in, first-out (LIFO) c. Weighted average carrow_forwardPlease do not give solution in image format thankuarrow_forwardConcept Videos i es Required information UNIT 30s $45 May 1 April 5 April 10 April 15 April 201 April 22 # Knowledge Check 01 Assume that we use a perpetual inventory system and that five identical units are purchased at the following four dates and costs: 3 $ 10 $ 12 0:00-0:54 $14 $16 - $17 Cost of the ending inventory $ One unit is sold on April 25. The company uses the weighted average inventory costing method. Identify the cost of the ending inventory on the balance sheet. Note: Round your answer to 2 decimal places. 4 % 5 H 6 Inarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education