FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

| Beginning inventory | ||

|---|---|---|

| Merchandise | $ 321,000 | |

| Finished goods | $ 642,000 | |

| Cost of merchandise purchased | 420,000 | |

| Cost of goods manufactured | 940,000 | |

| Ending inventory | ||

| Merchandise | 221,000 | |

| Finished goods | 215,000 |

Compute cost of goods sold for each of these two companies.

Transcribed Image Text:Beginning inventory

Merchandise

Finished goods

Cost of merchandise purchased

Cost of goods manufactured

Ending inventory

Merch

Business

Mfg Business

Unimart

$ 321,000

Merchandise

Finished goods

Compute cost of goods sold for each of these two companies.

Cost of goods sold

420,000

Goods available for sale

Cost of goods sold

221,000

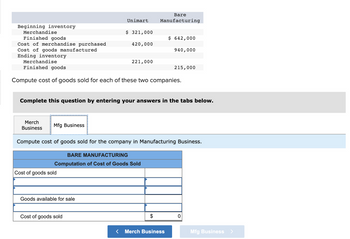

Complete this question by entering your answers in the tabs below.

BARE MANUFACTURING

Computation of Cost of Goods Sold

Bare

Manufacturing

Compute cost of goods sold for the company in Manufacturing Business.

$ 642,000

$

940,000

Merch Business

215,000

0

Mfg Business

Transcribed Image Text:Beginning inventory

Merchandise

Finished goods

Cost of merchandise purchased

Cost of goods manufactured

Ending inventory

Merch

Business

Unimart

Mfg Business

$ 321,000

420,000

Merchandise

Finished goods

Compute cost of goods sold for each of these two companies.

Cost of goods sold

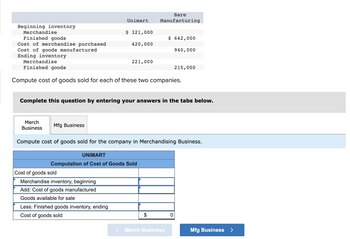

Merchandise inventory, beginning

Add: Cost of goods manufactured

Goods available for sale

Less: Finished goods inventory, ending

Cost of goods sold

221,000

Bare

Manufacturing

Complete this question by entering your answers in the tabs below.

UNIMART

Computation of Cost of Goods Sold

$ 642,000

$

Compute cost of goods sold for the company in Merchandising Business.

940,000

Merch Business

215,000

0

Mfg Business

Expert Solution

arrow_forward

Step 1

SCHEDULE OF COST OF GOODS MANUFACTURED

Schedule Of Cost Of Goods Manufactured are those Cost Which is Directly or Indirectly Associates with the Production of the Goods.

Direct Cost & Indirect Cost Both are Included in Cost of Goods Manufactured.

Direct Cost Includes Direct Materials & Direct Labour. Manufacturing Overhead Includes all Indirect Cost & Factory Overhead Cost.

SCHEDULE OF COST OF GOODS SOLD

Schedule of Cost of Goods Sold States the Amount of Cost Included in the number of Units Sold During the Period.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardBeginning inventory Merchandise Finished goods Cost of merchandise purchased Cost of goods manufactured Ending inventory Unimart $ 278,000 500,000 Merch Business Merchandise Finished goods Compute cost of goods sold for each of these two companies. 178,000 Bare Manufacturing Cost of goods sold $ 556,000 850,000 Complete this question by entering your answers in the tabs below. 172,000 Mfg Business Compute cost of goods sold for the company in Merchandising Business. UNIMART Computation of Cost of Goods Soldarrow_forwardEvans Company reported the following: Manufacturing costs Units manufactured Units sold Beginning inventory $2,385,000 53,000 40,000 units sold for $100 per unit O units What is the amount of gross profit margin? $2,915,000 $4,000,000 $1,615,000 $2,200,000arrow_forward

- Parker Corp. included the following items under its inventory account: Raw materials.. .P 1,400,000 200,000 650,000 60,000 150,000 2,000,000 Advances for materials ordered. Work in process.. Unexpired inventory insurance.. Advertising catalogs and packaging cartons. Finished goods inventory in the warehouse... Finished goods in the company owned retail store, stated at 50% mark-up on its cost... Finished goods in the hands of consignees including 40% profit on sales.... Finished goods in transit to customers, Shipped at FOB-Destination 750,000 400,000 stated at cost... 250,000 100,000 50,000 40,000 Finished goods out on customers' approval, at cost. Unsalable finished goods, at cost. Office stationeries and supplies. Materials in transit, shipped FOB-Shipping point, excluding P 30,000 freight cost... Goods held on consignment, at sales price, cost, P 150,000.. What is the correct amount of inventory? A. P5,375,000 330,000 200,000 В. Р 5,500,000 C. P5,540,000 D. P5,250,000arrow_forwardThe following is the year ended data for Tiger Company: Sales Revenue $58,000 Cost of Goods Manufactured 21,000 Beginning Finished Goods Inventory 1,100 Ending Finished Goods Inventory 2,200 Selling Expenses 15,000 Administrative Expenses 3,900 What is the gross profit? A. $22,100 B. $38,100 C. $19,200 D.arrow_forwardRoyall Sales Company uses the retail inventory method to value its merchandise inventory. The following information is available for the current year: Cost Retail Beginning inventory $30,000 $45,000 Purchases 190,000 260,000 Freight-in 2,500 — Net markups — 8,500 Net markdowns — 10,000 Employee discounts — 1,000 Sales revenue — 205,000 The ending inventory under Conventional Retail Inventory Method is = The ending inventory under Cost Method of Retail Inventory Method is =arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education