FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

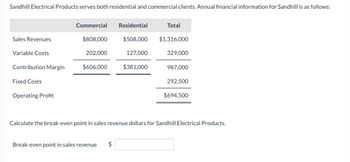

Transcribed Image Text:Sandhill Electrical Products serves both residential and commercial clients. Annual financial information for Sandhill is as follows:

Commercial

Residential

Total

Sales Revenues

$808,000

$508,000 $1,316,000

Variable Costs

202,000

127,000

329,000

Contribution Margin

$606,000

$381,000

987,000

Fixed Costs

292,500

Operating Profit

$694,500

Calculate the break-even point in sales revenue dollars for Sandhill Electrical Products.

Break-even point in sales revenue

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- The contribution format income statement for Huerra Company for last year is given below: Total Unit Sales $ 992,000 $ 49.60 Variable expenses 595,200 29.76 Contribution margin 396,800 19.84 Fixed expenses 316,800 15.84 Net operating income 80,000 4.00 Income taxes @ 40% 32,000 1.60 Net income $ 48,000 $ 2.40 The company had average operating assets of $500,000 during the year. Required: 1. Compute the company’s margin, turnover, and return on investment (ROI) for the period. For each of the following questions, indicate whether the margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI figure. Consider each question separately, starting in each case from the data used to compute the original ROI in (1) above. 2. Using Lean Production, the company is able to reduce the average level of inventory by $96,000. 3. The company achieves a cost savings of $6,000 per year by using less…arrow_forwardSjostrom Corporation has provided the following contribution format income statement. Assume that the following information is within the relevant range. Sales (7,000 units) $ 280,000 Variable expenses 182,000 Contribution margin 98,000 Fixed expenses 84,000 Net operating income $ 14,000 If the variable cost per unit increases by $10, spending on advertising increases by $1,500, and unit sales increase by 15,800 units, the net operating income would be closest to: a/ 12,500 b/ 114,100 c/ 91,200 d/ 5,700arrow_forwardData concerning Wislocki Corporation's single product appear below: Selling price Variable expenses Contribution margin Per Unit Percent of Change in net operating income 25% Fixed expenses are $1,051,000 per month. The company is currently selling 9,700 units per month. Required: The marketing manager would like to introduce sales commissions as an Incentive for the sales staff. The marketing manager has proposed a commission of $11 per unit. In exchange, the sales staff would accept an overall decrease in their salaries of $103,000 per month. The marketing manager predicts that Introducing this sales Incentive would Increase monthly sales by 470 units. What should be the overall effect on the company's monthly net operating Income of this change?arrow_forward

- The following annual information is for Dexter Corporation: Product A Revenue per unit: $20.00 Variable cost per unit: $15.00 Total fixed costs: $100,000 How many units does the company have to sell to achieve an after tax income of $75,000 if the income tax rate is 25%?arrow_forwardWhirly Corporation's contribution format income statement for the most recent month is shown below: Total Per Unit Sales (7,700 units) $ 246, 400 $ 32.00 Variable expenses 138, 600 18.00 Contribution margin 107,800 $ 14.00 Fixed expenses 54, 500 Net operating income $ 53,300 Required: (Consider each case independently): What would be the revised net operating income per month if the sales volume increases by 60 units? What would be the revised net operating income per month if the sales volume decreases by 60 units? What would be the revised net operating income per month if the sales volume is 6, 700 units?arrow_forwardLast year’s contribution format income statement for Huerra Company is given below: Total Unit Sales $ 1,002,000 $ 50.10 Variable expenses 601,200 30.06 Contribution margin 400,800 20.04 Fixed expenses 316,800 15.84 Net operating income 84,000 4.20 Income taxes @ 40% 33,600 1.68 Net income $ 50,400 $ 2.52 The company had average operating assets of $491,000 during the year. Required: Compute last year’s margin, turnover, and return on investment (ROI). For each of the following questions, indicate whether last year’s margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI. Consider each question separately. Using Lean Production, the company is able to reduce the average level of inventory by $100,000. The company achieves a cost savings of $10,000 per year by using less costly materials. The company purchases machinery and equipment that increase average operating assets by $125,000.…arrow_forward

- McGrath electric is a service firm with current service sales of 4,794,549 and a 57% contribution margin. It’s fixed costs are 1,217,297. If there is a 13% in sales, compute the percentage of net increase in operating income for McGrath. Round to the nearest hundred, two decimals.arrow_forwardThe following CVP income statements are available for Sunland Company and Carla Vista Company: Sunland Company Carla Vista Company Sales revenue $370,000 $370,000 Variable costs 222,000 74,000 Contribution margin 148,000 296,000 Fixed costs 98,000 246,000 Operating income $50,000 $50,000 (a) Calculate the break-even point in dollars and the margin of safety ratio for each company. (Round break-even point to the nearest whole dollar, e.g. 5,275 and margin of safety ratio to 2 decimal places, e.g. 15.25%.) Sunland Company Carla Vista Company Break-even point $ $ Margin of safety ratio de % %arrow_forwardSkywalker Corporation reported the following on their contribution format income statement: Sales (12,000 units) $175,000 Less: Variable expenses 100,000 Contribution margin 75,000 Less: Fixed expenses 62,500 Net operating income $ 12,500 What is the contribution margin ratio?arrow_forward

- Drake Company produces a single product. Last year's income statement is as follows: Sales (21,000 units) $1,278,900 Less: Variable costs 879,900 Contribution margin $399,000 Less: Fixed costs 259,800 Operating income $139,200 Required: Question Content Area 1. Compute the break-even point in units and sales revenue. In your computations, round the contribution margin per unit to the nearest cent and round the contribution margin ratio to four decimal places. Round your final answers to the nearest whole unit or dollar. Break-even units units Break-even dollars 2. What was the margin of safety in dollars for Drake Company last year? Round your final answer to the nearest whole dollar.arrow_forwardFarrow Company reports the following annual results. Contribution Margin Income Statement Sales (460,000 units) Variable costs Direct materials Direct labor Overhead Contribution margin Fixed costs Fixed overhead Fixed general and administrative Income (a) Compute the income or loss for the special offer. (b) Should the company accept or reject the special offer? Required A Required B Per Unit $15.00 The company receives a special offer for 46,000 units at $13 per unit. The additional sales would not affect its normal sales. Variable costs per unit would be the same for the special offer as they are for the normal units. The special offer would require incremental fixed overhead of $184,000 and incremental fixed general and administrative costs of $198,000. SPECIAL OFFER ANALYSIS Contribution margin Income (loss) 2.00 4.00 2.50 6.50 2.00 1.50 $ 3.00 Complete this question by entering your answers in the tabs below. Required A Annual Total $ 6,900,000 Compute the income or loss for the…arrow_forwardDhapaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education