FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

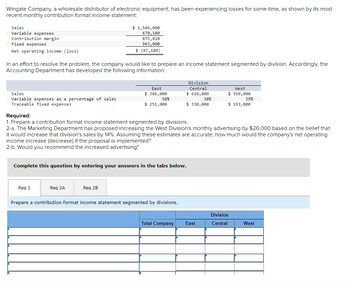

Transcribed Image Text:Wingate Company, a wholesale distributor of electronic equipment, has been experiencing losses for some time, as shown by its most

recent monthly contribution format income statement:

Sales

Variable expenses

Contribution margin

Fixed expenses

Net operating income (loss)

In an effort to resolve the problem, the company would like to prepare an income statement segmented by division. Accordingly, the

Accounting Department has developed the following information:

Sales

Variable expenses as a percentage of sales

Traceable fixed expenses

$ 1,546,000

670, 180

875,820

963,000

$ (87,180)

Req 1

Req 2A

East

$ 386,000

58%

$ 251,000

Required:

1. Prepare a contribution format income statement segmented by divisions.

2-a. The Marketing Department has proposed increasing the West Division's monthly advertising by $26,000 based on the belief that

it would increase that division's sales by 14%. Assuming these estimates are accurate, how much would the company's net operating

income increase (decrease) if the proposal is implemented?

2-b. Would you recommend the increased advertising?

Complete this question by entering your answers in the tabs below.

Req 2B

Division

Central

$ 610,000

38%

$ 330,000

Prepare a contribution format income statement segmented by divisions.

Total Company East

West

$ 550,000

39%

$ 193,000

Division

Central

West

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Wingate Company, a wholesale distributor of electronic equipment, has been experiencing losses as shown by its most recent monthly contribution format income statement: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) $ 1,591, 000 706, 760 884, 240 973,000 $ (88,760) In an effort to resolve the problem, the company wants to prepare an income statement segmented by division. Accordingly, the Accounting Department provided the following information: Sales Variable expenses as a percentage of sales Traceable fixed expenses East $ 351,000 $262,000 56% Division Central $ 660,000 36% $ 335,000 West $ 580,000 47% $206,000 Required: 1. Prepare a contribution format income statement segmented by divisions. 2-a. The Marketing Department believes increasing the West Division's monthly advertising by $25,000 will increase that division's sales by 18%. Assuming these estimates are accurate, how much would the company's net operating income increase (decrease)…arrow_forwardBelow are departmental income statements for a guitar manufacturer. The company classifies advertising, rent, and utilities as indirect expenses. The manufacturer is considering eliminating its Electric Guitar department because it shows a loss. Departmental Income Statements For Year Ended December 31 Acoustic Sales $ 102,900 Electric $ 84,000 Cost of goods sold Gross profit Expenses Advertising Depreciation-Equipment Salaries Supplies used Rent Utilities Total expenses 44,975 47,550 57,925 36,450 4,985 4,320 10,080 8,540 20,100 17,800 2,010 1,780 7,095 5,950 2,995 2,640 47,265 41,030 Income (loss) $ 10,660 $ (4,580) 1. Prepare a departmental contribution to overhead report. 2. Based on contribution to overhead, should the electric guitar department be eliminated?arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Below are departmental income statements for a guitar manufacturer. The company classifies advertising, rent, and utilities as indirect expenses. The manufacturer is considering eliminating its Electric Guitar department because it shows a loss. Departmental Income Statements For Year Ended December 31 Acoustic Electric Sales $ 102,900 $ 83,300 Cost of goods sold 44,175 47,350 Gross profit 58,725 35,950 Expenses Advertising 4,995 4,270 Depreciation—Equipment 10,080 8,560 Salaries 19,800 17,200 Supplies used 2,000 1,700 Rent 7,055 6,030 Utilities 2,965 2,620 Total expenses 46,895 40,380 Income (loss) $ 11,830 $ (4,430) Prepare a departmental contribution to the overhead report. Based on contribution to overhead, should the electric guitar department be eliminated?arrow_forwardaccoutingarrow_forwardMillard Corporation is a wholesale distributor of office products. It purchases office products from manufacturers and distributes them in the West, Central, and East regions. Each of these regions is about the same size and each has its own manager and sales staff. The company has been experiencing losses for many months. In an effort to improve performance, management has requested that the monthly income statement be segmented by sales region. The company's first effort at preparing a segmented income statement for May is given below. Sales Regional expenses (traceable): Cost of goods sold Advertising Salaries Utilities Depreciation Shipping expense Total regional expenses Regional income (loss) before corporate expenses Corporate expenses: Advertising (general) General administrative expense Total corporate expenses Net operating income (loss) Variable expenses: Total variable expenses Traceable fixed expenses: Total traceable fixed expenses Common fixed expenses: Total common…arrow_forward

- Buckley Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment A were eliminated. BUCKLEY COMPANY Income Statements for Year 2 Segment A B C Sales $ 330,000 $ 480,000 $ 500,000 Cost of goods sold (242,000 ) (184,000 ) (190,000 ) Sales commissions (30,000 ) (44,000 ) (44,000 ) Contribution margin 58,000 252,000 266,000 General fixed operating expenses (allocation of president’s salary) (92,000 ) (92,000 ) (92,000 ) Advertising expense (specific to individual divisions) (6,000 ) (20,000 ) 0 Net income (loss) $ (40,000 ) $ 140,000 $ 174,000 Required Prepare a schedule of relevant sales and costs for Segment A. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A. Options for required A table are: Advertising…arrow_forwardHancock Company manufactures and sells two lines of furniture, case goods and upholstery, During the most recent accounting period, the Case Goods and Upholstery Divisions sold 17,400 and 2,360 units, respectively. The company's most recent financial statements are shown below. Sales Less cost of goods sold: Unit-level production cost Depreciation, production equipment Gross margin Less operating expenses: Case Goods Upholstery $1,852,000 $472,000 1,156,000 276,000 $420,000 283,200 70,800 $118,000 Unit-level selling and administrative costs Corporate-level facility expenses (fixed) Net income (loss) If unit sales for both divisions increased 10% the company would report which of the following? 69,600 64,000 $286,400 59,000 64,000 $(5,000)arrow_forwardWingate Company, a wholesale distributor of electronic equipment, has been experiencing losses for some time, as shown by its most recent monthly contribution format income statement: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) $ 1,600,000 700,400 899,600 990,000 $ (90,400) In an effort to resolve the problem, the company would like to prepare an income statement segmented by division. Accordingly, the Accounting Department has developed the following information: Sales Variable expenses as a percentage of sales. Traceable fixed expenses East $ 440,000 $ 280,000 52% Division Central $ 620,000 $ 320,000 36% West $ 540,000 46% $ 195,000 Required: 1. Prepare a contribution format income statement segmented by divisions. 2-a. The Marketing Department has proposed increasing the West Division's monthly advertising by $21,000 based on the belief that it would increase that division's sales by 15%. Assuming these estimates are accurate, how much…arrow_forward

- Studemeir Paint & Floors (SPF) has experienced net operating losses in its Other Flooring Products line during the last few periods. SPF’s management team thinks that the store will improve its profitability if it discontinues the Other Flooring Products line. The operating results from the most recent period are: Paint and Paint Supplies Carpet Other Flooring Products Sales $ 375,500 $ 201,000 $ 152,000 Cost of goods sold 151,000 128,000 117,000 SPF estimates that store support expenses are approximately 24% of revenues. Harish Rana, SPF’s controller, states that while every sale has one purchase order, not every sales dollar requires or uses the same amount of store support activities. He conducts a preliminary investigation and his results and analysis are as follows: Activity (cost driver) Paint and Paint Supplies Carpet Other Flooring Products Order processing (number of purchase orders) 360 157 120 Receiving…arrow_forwardWingate Company, a wholesale distributor of electronic equipment, has been experiencing losses for some time, as shown by its most recent monthly contribution format Income statement: sales variable expenses Contribution margin Fixed expenses $ 1,610,000 551,400 Net operating income (loss) 1,058,600 1,164,000 $ (105,400) In an effort to resolve the problem, the company would like to prepare an income statement segmented by division. Accordingly, the Accounting Department has developed the following Information: Sales East $410,000 Division Central $ 670,000 West $530,000 Variable expenses as a percentage of sales Traceable fixed expenses 52% 22% 36% $ 278,000 $ 326,000 $ 200,000 Required: 1. Prepare a contribution format Income statement segmented by divisions. 2-8. The Marketing Department has proposed increasing the West Division's monthly advertising by $27,000 based on the belief that it would increase that division's sales by 13%. Assuming these estimates are accurate, how much…arrow_forwardi am confused for this question please provide correct answerarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education