FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

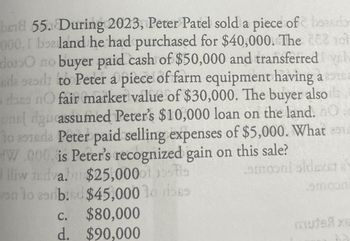

Transcribed Image Text:bed 55. During 2023, Peter Patel sold a piece of beasdor

000, I bealand he had purchased for $40,000. The 28210

do10 no buyer paid cash of $50,000 and transferred yel

eda saad to Peter a piece of farm equipment having a s

dons nO fair market value of $30,000. The buyer also

unel dgu assumed Peter's $10,000 loan on the land. O

To aside Peter paid selling expenses of $5,000. What

W.000. is Peter's recognized gain on this sale?

lliw

dva. $25,000

on lo srb.d $45,000 19

moni oldest a

amoon

C.

$80,000

d. $90,000

เสมาe

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A7arrow_forwardJack and Jill exchange like-kind real estate assets as listed below: Jack's old asset: FMV $50,000; Adjusted Taxable Basis $23,000 Jill's old asset: FMV $70,000; Basis $55,000 If Jack pays Jill cash of $20,000 plus Jack's old asset, how much gain must Jill recognize on this transaction? $5,000 $10,000 $15,000 $20,000arrow_forwardKk62.arrow_forward

- 1) Kristine sold one asset on March 20th of 2023. It was a computer with an original basis of $10,000, purchased in May of 2021 and depreciated under the half-year convention. What is Kristine's depreciation deduction for 2023? Note: Round final answer to the nearest whole number. Blank] Blank 1 Add your answerarrow_forwardProblem 13-84 (LO. 8, 9) Karl purchased his residence on January 2, 2019, for $260,000, after having lived in it during 2018 as a tenant under a lease with an option to buy clause. On August 1, 2020, Karl sells the residence for $315,000. On June 13, 2020, Karl purchases a new residence for $367,000. If an amount is zero, enter "0". a. What is Karl's recognized gain? His basis for the new residence?Karl's recognized gain is $fill in the blank aa8a5403c02a012_1, and his basis for the new residence is $fill in the blank aa8a5403c02a012_2. b. Assume that Karl purchased his original residence on January 2, 2018 (rather than January 2, 2019). What is Karl's recognized gain? His basis for the new residence? Karl's recognized gain is $fill in the blank f8cfe3ffcff0ffc_1, and his basis for the new residence is $fill in the blank f8cfe3ffcff0ffc_2. c. In part (a), what could Karl do to minimize his recognized gain?To minimize his recognized gain, he can continue to…arrow_forwardAngela exchanges a rental house at the beach with an adjusted basis of $180,000 and a fair market value of $160,000 for a rental house at the mountains with a fair market value of $148,000 and cash of $12,000. What is Angela’s recognized gain or loss? Group of answer choices $148,000 ($20,000) $12,000 $0arrow_forward

- LO.2 During the year, Eugene had the four property transactions summarized below. Eugene is a collector of antique glassware and occasionally sells a piece to get funds to buy another. What are the amount and nature of the gain or loss from each of these transactions? Property Antique vase Date Date Adjusted Sales Acquired Sold Basis Price 06/18/12 05/23/23 $37,000 $42,000 Blue Growth Fund 12/23/14 11/22/23 22,000 38,000 (100 shares) Orange bonds 02/12/15 04/11/23 34,000 42,000 Green stock (100 02/14/23 11/23/23 11,000 13,000 shares)arrow_forwardam. 110.arrow_forwardPlease dont provide solution image based thanksarrow_forward

- Hrd.1 In a like-kind exchange, Tucker gave up his fully depreciated rental condominium (FMV $90,000, adjusted basis $80,000) and $10,000 for an office building (FMV $100,000). What is the gain realized and recognized on the exchange? ______ realized gain; _____ recognized gain.arrow_forwardNonearrow_forwardRight answer pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education