FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

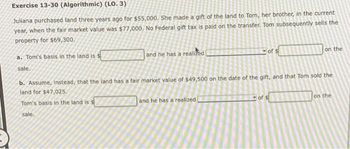

Transcribed Image Text:Exercise 13-30 (Algorithmic) (LO. 3)

Juliana purchased land three years ago for $55,000. She made a gift of the land to Tom, her brother, in the current

year, when the fair market value was $77,000. No Federal gift tax is paid on the transfer. Tom subsequently sells the

property for $69,300.

a. Tom's basis in the land is s

sale.

and he has a realized

of $

and he has a realized

on the

b. Assume, instead, that the land has a fair market value of $49,500 on the date of the gift, and that Tom sold the

land for $47,025.

Tom's basis in the land is s

sale.

on the

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Reese and Jake engage in a like-kind exchange. Reese transfers real estate with a fair market value of $500,000 and an adjusted basis of $200,000 to Jake. Jake transfers real estate worth $700,000 and an adjusted basis of $250,000, plus a $200,000 mortgage on the property, to Reese. What is Jake's potential or deferred gain before and after the transaction? $450,000 potential gain before the transaction; $50,000 potential gain after the transaction. $250,000 potential gain before the transaction; $50,000 potential gain after the transaction. $450,000 potential gain before the transaction; $250,000 potential gain after the transaction. $250,000 potential gain before the transaction; $200,000 potential gain after the transaction. Income Taxarrow_forwardO Sebastian originally sold his home in an installment sale for $300,000. At the time, his adjusted basis in the home was $220,000. He qualified for the Section 121 principal residence exclusion, so his gain was not included in his taxable income for the year of sale. Three years later, he repossessed the home from the buyer when the balance of the note was $275,000. He spent $8,000 on improvements and resold it within the year for $320,000. What is Sebastian's recomputed adjusted basis in the property? $228,000 $258,000 $278,000 $308,000arrow_forwardDuring the current year, Jeff sells a tract of land for $700,000. The property was received as a gift from Corina on March 10, 1995, when the property had a $240,000 FMV. The taxable gift was $230,000 because the annual exclusion was $10,000 in 1995. Corina purchased the property on April 12, 1980, for $56,000. At the time of the gift, Corina paid a gift tax of $10,000. In order to sell the property, Jeff paid a sales commission of $14,000. Read the requirements. Requirement a. What is Jeff's realized gain on the sale? Select the formula, then calculate Jeff's realized gain on the sale. (Do not round intermediary calculations. Only round the amounts you input in the cells to the nearest dollar.) Minus: Realized gain Requirement b. How would your answer to Part a change, if at all, if the FMV of the gift property was $50,000 as of the date of the gift? If the FMV of the gift property was $50,000 as of the date of the gift, Stan would have realized a gain on the sale ofarrow_forward

- Jacob owns a modest house on a large, ocean-front lot in a region where development is booming. Seeking to cap his estate-tax exposure, Jacob sells a remainder interest in the property to Alice — Jacob’s committed partner to whom he is not married — for its actuarial value. Jacob continues to reside in the property pursuant to his retained life estate for the remainder of his lifetime. At the time of the sale of the remainder, the fee interest was valued at $3 million, and the remainder was valued at $1 million. Upon Jacob’s death five years later, the value of the property had increased to $5 million. Discuss the estate tax consequences to Jacob’s estate.arrow_forwardThis year, Leron and Sheena sold their home for $750,000 after all selling costs. Under the following scenarios, how much taxable gain does the home sale generate for Leron and Sheena? Assume that the couple is married filing jointly. Leron and Sheena bought the home one year ago for $600,000 and lived in the home until it sold. What's the taxable gain?arrow_forwardDetermine the taxable gift in each of the following unrelated scenarios:Abram is single and gives $35,000 to each one of his eight grandchildren.Jacob is married and gives $35,000 to each one of his eight grandchildren. He and his wife gift split.In January, Curt sells YTM stock (FMV = $30,000) to Martina for $20,000.David sells a $500,000 real estate property to Joe for $100,000.In the ordinary course of business, Joe sells a diamond ring valued at $30,000 for $15,000 to a customer named Donna.Determine the items exempt from gift tax that were paid by Yancey:College expenses for his son paid directly to the institutionTuition = $20,000Room and Board = $10,000Transfer to Throw Them All Out political party = $3,000College expenses for his daughter paid directly to herTuition = $35,000Room and Board = $10,000Medical expenses for his son = $20,000Medical expenses for his son’s friend Sergio = $5,000Determine the annual exclusion in each of the following unrelated…arrow_forward

- Theresa Perry exchanged her investment-use real property for a larger piece of investment-use property. At the time of the exchange, the fair market value (FMV) of the property she traded was $55,000, and her adjusted basis in this property was $27,000. She also provided $11,000 cash. In the exchange, she received investment-use property with an FMV of $66,000.What is Theresa's gain realized and the gain recognized on the exchange? $0 and $28,000 $11,000 and $38,000 $28,000 and $0 $38,000 and $11,000arrow_forwardBob owned a duplex used as rental property. The duplex had an adjusted basis to Bob of $86,000 and a fair market value of $300,000. Bob transferred the duplex to his brother, Carl, in exchange for a triplex that Carl owned. The triplex had an adjusted basis to Carl of $279,000 and a fair market value of $300,000. Two months after the exchange, Carl sold the duplex to his business associate to whom he was not related for $312,000. What is Bob's bases in the triplex? Select one of the answers below and show your work: a. $86,000 b. $279,000 c. $300,000 d. $312,000arrow_forwardBarbara sold land she purchased three months earlier for use in her business. Her cost and adjusted basis in the land prior to the sale were $80,000. She also incurred $10,000 in expenses related to the sale. The buyer paid $80,000 cash and assumed barbarous 20,000 mortgage on the property. What is the amount of Barbara's gain, and where on form 4797 will she report the sale?arrow_forward

- Carlos and Connie own a farm as tenancy by the entirety (TBE). The farm is currently valued at $2 million. All of the following statements are correct except A)if Connie dies, $1 million is included in her gross estate for estate tax purposes. B)if Carlos dies, Connie receives a stepped-up basis in 100% of the farm. C)if Carlos dies, Connie becomes full owner of the farm by right of survivorship. D)Carlos and Connie are spouses.arrow_forwardDerek purchases a small business from Art on August 30, 2022. He paid the following amounts for the business: Fixed assets Goodwill Covenant not to compete Total $256,600 51,320 64,150 $372,070 a. How much of the $372,070 purchase price is for Section 197 intangible assets? b. What amount can Derek deduct on his 2022 tax return as Section 197 intangible amortization? If required, round the final answer to the nearest dollar. Use months, not days, in your computations.arrow_forwardMany years ago James and Sergio purchased property for $945,000. Although they are listed as equal co-owners, Sergio was able to provide only $420,000 of the purchase price. James treated the additional $52,500 of his contribution to the purchase price as a gift to Sergio. Required: If the property is worth $1,134,000 at Sergio's death, what amount would be included in Sergio's estate if the title to the property was tenants in common? What if the title was joint tenancy with right of survivorship? (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) Amount to be included in Sergio's estate if: Title to the property was tenants in common Title to the property were joint tenancy with right of survivorshiparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education