FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

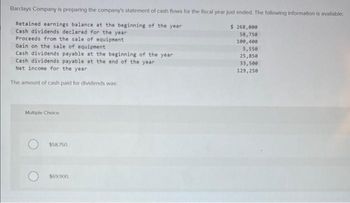

Transcribed Image Text:Barclays Company is preparing the company's statement of cash flows for the fiscal year just ended. The following information is available:

Retained earnings balance at the beginning of the year

Cash dividends declared for the year

Proceeds from the sale of equipment

Gain on the sale of equipment

Cash dividends payable at the beginning of the year

Cash dividends payable at the end of the year

Net income for the year

The amount of cash paid for dividends was:

Multiple Choice

$58,750

$69,900.

$ 268,000

58,750

100,400

5,550

25,850

33,500

129,250.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Statement of Cash Flows The comparative balance sheet of Orange Angel Enterprises Inc. at December 31, 20Y8 and 20Y7, is as follows: Dec. 31, Dec. 31, 20Y8 20Y7 Cash Accounts receivable (net) Merchandise inventory Assets Prepaid expenses Equipment Accumulated depreciation-equipment Total assets Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) Mortgage note payable Common stock, $1 par Excess of paid-in capital over par Retained earnings Total liabilities and stockholders' equity $53,650 $66,100 82,440 89,100 117,780 110,440 4,800 3,350 239,920 197,870 (62,380) (48,530) $436,210 $418,330 $91,600 0 14,000 203,000 127,610 $436,210 $87,430 125,500 9,000 118,000 78,400 $418,330 Additional data obtained from the income statement and from an examination of the accounts in the ledger for 20Y8 are as follows: a. Net income, $125,980. b. Depreciation reported on the income statement, $30,270. c. Equipment was purchased at a cost of $58,470, and fully depreciated…arrow_forwardThe accountant for Sysco Company is preparing the company's statement of cash flows for the fiscal year just ended. The following information is available: Net income for the year 285,000 Cash dividends declared for the year 53,000 Cash dividends payable at the beginning of the year 12, 200 Cash dividends payable at the end of the year 14, 300 What is the amount of cash dividends paid that should be reported in the financing section of the statement of cash flows?arrow_forwardplease do not give images formatarrow_forward

- Compute cash flowarrow_forwardAce Co. issued 1,000 shares of its $10 par value common stock for $15 per share in cash. How should this transaction be reported in Ace's statement of cash flows for the year of issuance? A. $15,000 cash inflow from financing activities. B. $10,000 cash inflow from financing activities and $5,000 adjustment to arrive at cash flows from operating activities. C. $15,000 cash flow from investing activities. D. $10,000 cash flow from investing activities and $5,000 adjustment to arrive at cash flows from operating activitiesarrow_forwardThe accountant for Robinson Company is preparing the company's statement of cash flows for the fiscal year just ended. The following information is available: RETAINED EARNINGS BALANCE AT BEGINNING OF YEAR $156,000 CAHS DIVIDENS DECLARED FOR THE YEAR $46,000 PROCEEDS FROM SALE OF EQUIPMENT $81,000 GAIN ON SALE OF EQUIPMENT $7,000 CASH DIVIDENDS PAYABLE BEGINNING OF YEAR $18,000 CASH DIVIDENDS PAYABLE ENDING OF YEAR $40,000 NET INCOME $92,000 The amount of cash dividends paid during the year would be:arrow_forward

- Preparing the Statement of Cash Flows Balance sheet information for Beckwith Products Company is presented below. Jan. 1 Dec. 31 Assets: Cash $25,000 $36,950 Accounts receivable 78,000 75,100 Inventory 36,000 45,300 Property, plant, and equipment 153,000 256,400 Accumulated depreciation 20,000 38,650 Total assets $272,000 $375,100 Liabilities and Equity: Accounts payable $11,000 $13,100 Interest payable 8,000 11,500 Wages payable 9,000 8,100 Notes payable 90,000 105,000 Common stock 50,000 100,000 Retained earnings 104,000 137,400 Total liabilities and equity $272,000 $375,100 Additional Information: Net income for the year was $58,400. Cash dividends of $25,000 were declared and paid during the year. During the year, Beckwith issued $50,000 of notes payable and repaid $35,000 principal relating to notes payable. Common stock was issued for $50,000 cash.…arrow_forwardChanges in Current Operating Assets and Liabilities Blue Circle Corporation's comparative balance sheet for current assets and liabilities was as follows: Dec. 31, Year 2 Dec. 31, Year 1 Accounts receivable $20,300 $25,000 Inventory 85,100 76,000 Accounts payable 18,100 22,100 Dividends payable 24,000 23,000 Adjust net income of $104,000 for changes in operating assets and liabilities to arrive at net cash flows from operating activities.arrow_forwardIn preparation for developing its statement of cash flows for the year just ended, D-Rose Distributors collected the following information: ($ in millions) Purchase of treasury bills (considered a cash equivalent) 6.6 Sale of preferred stock 150.6 Gain on sale of land 4.6 Proceeds from sale of land 25.6 Issuance of bonds payable for cash 140.6 Purchase of equipment for cash 30.6 Purchase of GE stock 35.6 Declaration of cash dividends 134.6 Payment of cash dividends declared in previous year 130.6 Purchase of treasury stock 120.6 Payment for the early extinguishment oflong-term notes (carrying (book) value: $100 million) 110.6 Required:1. Prepare the investing activities section of D-Rose's statement of cash flows.2. Prepare the financing activities section of D-Rose's statement of cash flows.(For all requirements, list any cash outflow with a minus sign. Enter your answer in millions rounded to 1 decimal…arrow_forward

- On May 1, Year 3, Love Corporation declared a $59,700 cash dividend to be paid on May 31 to shareholders of record on May 15. Required Record the events occurring on May 1 and May 31 in the following horizontal statements model. Also, in the Statement of Cash Flows column, classify the cash flows as operating activities (OA), Investing activities (IA), or financing activities (FA). Note: Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed. Date May 01 May 31 Assets Balance Sheet Liabilities + • Common Stock LOVE CORPORATION Horizontal Statements Model Retained Revenus Earnings Income Statement Expenses Net Income Flowsarrow_forwardOn May 1, Year 3, Love Corporation declared a $74,100 cash dividend to be paid on May 31 to shareholders of record on May 15. Required Record the events occurring on May 1 and May 31 in the following horizontal statements model. Also, in the Statement of Cash Flows column, classify the cash flows as operating activities (OA), investing activities (IA), or financing activities (FA). Note: Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed. Date May 01 May 31 Assets Balance Sheet Liabilities Common Stock LOVE CORPORATION Horizontal Statements Model Retained Earnings Revenue Income Statement Expenses Net Income Statement of Cash Flowsarrow_forwardWeatarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education