FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

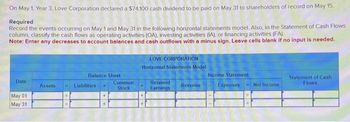

Transcribed Image Text:On May 1, Year 3, Love Corporation declared a $74,100 cash dividend to be paid on May 31 to shareholders of record on May 15.

Required

Record the events occurring on May 1 and May 31 in the following horizontal statements model. Also, in the Statement of Cash Flows

column, classify the cash flows as operating activities (OA), investing activities (IA), or financing activities (FA).

Note: Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed.

Date

May 01

May 31

Assets

Balance Sheet

Liabilities

Common

Stock

LOVE CORPORATION

Horizontal Statements Model

Retained

Earnings

Revenue

Income Statement

Expenses

Net Income

Statement of Cash

Flows

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Label the following headings, line items, and notes with the numbers 1 through 13 according to their sequential order in preparing a statement of cash flows. a. "Cash flows from investing activities" title b. "For period Ended date" heading 3 C. "Cash flows from operating activities" title 2 d. Company name 1 Schedule or note disclosure of noncash investing and financing transactions e. 2 f. "Statement of Cash Flows" heading 2 g. Net increase (decrease) in cash $ 2 h. Net cash provided (used) by operating activities $ i. Cash (and equivalents) balance at prior period-end $ 4 4 j. Net cash provided (used) by financing activities $ k. "Cash flows from financing activities" title 1. Net cash provided (used) by investing activities $ 14 4 13 m. Cash (and equivalents) balance at current period-end $ 13arrow_forwardThe following information for the year ended December 31, 2021, was reported by Nice Bite, Incorporated Accounts Payable Accounts Receivable Cash (balance on January 1, 2021) Cash (balance on December 31, 2021) Common Stock Dividends Equipment Income Tax Expense Interest Expense Inventory Notes Payable Office Expense Prepaid Rent Retained Earnings (beginning) Salaries and Wages Expense Service Revenue Utilities Expense Salaries and Wages Payable Other cash flow information: Cash from issuing common stock Cash paid to reacquire common stock Cash paid for income taxes Cash paid to purchase long-term assets Cash paid to suppliers and employees Cash received from customers $ 52,000 29,800 104,400 89,000 148,000 0 143,700 10,800 30, 200 17,900 29,700 15,000 7,700 9,800 36,400 151,800 25,800 15,000 $ 28,000 31,700 11,700 59,400 91,600 151,000 PLEASE PREPARE INCOME STATEMENT, STATEMENT OF RETAINED EARNINGS, AND BALANCE SHEET. Warrow_forwardAccounts payable pertain to operating expenses. Prepare the operating activities section of the statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a-sign e.g. -15,000 or in parenthesis e.g. (15,000).) SHERIDAN COMPANY Partial Statement of Cash Flows Adjustments to reconcile net income to $ $arrow_forward

- vishu Subject-Accountingarrow_forwardOn which of the four major financial statements (balance sheet, income statement, statement of cash flows, or statement of retained earnings) would you find the following items? earnings before taxes net plant and equipment increase in fixed assets gross profits balance of retained earnings, December 31, 20xx common stock and paid-in surplus net cash flow from investing activities accrued wages and taxes increase in inventoryarrow_forwardAshvinnarrow_forward

- please answer do not image formatarrow_forwardOn May 1, Year 3, Love Corporation declared a $94,200 cash dividend to be paid on May 31 to shareholders of record on May 15. Required Record the events occurring on May 1 and May 31 in a horizontal statements model. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If an element was not affected by the event, leave the cell blank. (Enter any decreases to account balances with a minus sign.) Date May 1 May 31 Balance Sheet Assets = Liabilities Common Stock LOVE CORPORATION Horizontal Statements Model Retained: Earnings Revenue: Income Statement Expense Net Income Statement of Cash Flowarrow_forwardHought Office Machines, Inc.'s accountants assembled the following selected data for the year ended December 31, 2018: E (Click the icon to view the current accounts.) E (Click the icon to view the transaction data.) Requirement 1. Prepare Hought Office Machines, Inc.'s statement of cash flows using the indirect method to report operating activities. List noncash investing and financing activities on an accompanying schedule. Complete the statement one section at a time, beginning with the cash flows from operating activities. (Use parentheses or a minus sign for numbers to be subtracted.) Hought Office Machines, Inc. Data Table Statement of Cash Flows Year Ended December 31, 2018 Cash flows from operating activities: Transaction Data for 2018: Net income Net income..... $ 60,000 Adjustments to reconcile net income to net cash Purchase of treasury stock. 14,300 provided by (used for) operating activities: Issuance of common stock for cash. 36,600 Loss on sale of equipment. 6,000…arrow_forward

- a) Prepare a statement of cash flows using the direct method for the year ended 31 December 2020.arrow_forwardcompany purchases stock for $40,000 cash. This transaction should be shown on the statement of cash flows under Select one: a. Investing activities b. Noncash investing and financing activities c. Financing activities d. Operating activitiesarrow_forwardFollowing is selected financial information of Kia Company for the current year ended December 31. $ (1,500) 850 Cash used by investing activities Net increase in cash Cash used by financing activities Cash from operating activities Cash, December 31, prior year (2,300) 4,650 4,200 Required: Prepare the statement of cash flows for Kia Company for the current year ended December 31. (Cash outflows should be indi with a minus sign.) KIA COMPANY Statement of Cash Flows For Current Year Ended December 31 2$ Mc Graw MacBook * FS FB F9 F10 23 %24 & 4 9. Q W E T Y U G H. C V mand * co Barrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education